The Weighted CCI Indicator for MetaTrader 5 (WCCI) is an advanced version of the traditional Commodity Channel Index (CCI). It helps traders analyze market trends and momentum by identifying overbought and oversold conditions. Unlike the classic CCI, the Weighted CCI uses a weighted period, giving it greater sensitivity and responsiveness to sudden market changes — a crucial advantage for short-term traders and scalpers.

By using the Weighted CCI Indicator on MT5, you can detect potential reversal zones and optimize your entry and exit points. This makes it a powerful addition to your Forex indicator toolkit.

The traditional CCI measures the difference between the current price and its statistical mean over a specific period. Typically, readings above +100 indicate an overbought market, while readings below –100 suggest an oversold condition.

However, the Weighted CCI Indicator for MetaTrader 5 customizes this calculation by using a weighted average, prioritizing recent price movements. This modification improves the indicator’s ability to detect early shifts in market sentiment.

Additionally, this version sets customized limits of +200 and –200, providing more accurate insights for volatile assets like gold, cryptocurrencies, or exotic currency pairs.

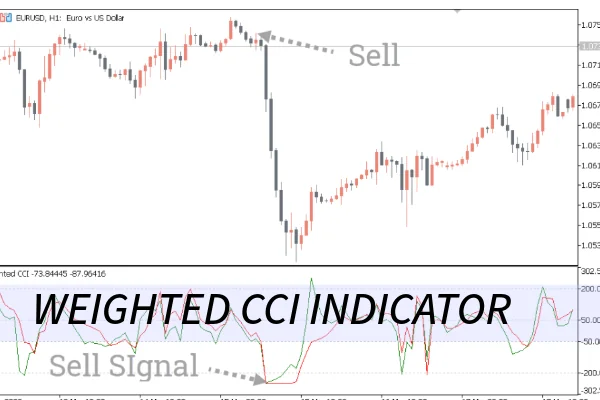

When added to your MetaTrader 5 chart, the Weighted CCI Indicator displays:

Dodger Blue Line – the main signal line showing market momentum.

Red Horizontal Bars – the upper and lower limit zones representing overbought and oversold levels.

When the blue line touches or crosses the upper red line, it signals potential overbought conditions. Conversely, when it touches the lower red line, it signals potential oversold conditions.

Trading with the Weighted CCI Indicator involves recognizing these signal levels and waiting for confirmation signals:

Buy Setup:

Wait for the blue line to dip below the lower red bar (indicating oversold).

When it reverses upward, this may signal a potential buy opportunity.

Sell Setup:

When the blue line rises above the upper red bar (indicating overbought).

A downward reversal suggests a potential sell setup.

For best results, traders should combine the Weighted CCI Indicator with price action strategies, support and resistance analysis, or moving averages to confirm entry points and avoid false signals.

The Weighted CCI Indicator for MetaTrader 5 offers several advantages:

Increased responsiveness to fast market moves

Better accuracy in volatile trading environments

Clear visual representation of trading zones

Easy integration with other MT5 indicators

This makes it an excellent choice for Forex, crypto, and commodity traders seeking a more dynamic view of market conditions.

Avoid trading solely based on indicator signals. Always validate them with other tools.

Adjust the weighted period depending on your trading style. Shorter periods work better for scalping, while longer ones suit swing trading.

Test the indicator on a demo account before using it in live trading.

In conclusion, the Weighted CCI Indicator for MetaTrader 5 is a reliable tool for detecting overbought and oversold levels with improved precision. By incorporating weighted calculations, it enhances your ability to read market momentum and anticipate reversals.

However, like all technical indicators, it’s best used in combination with price action analysis and other Forex indicators. To download and start using the Weighted CCI Indicator, visit IndicatorForest.com and explore more advanced MT5 tools to improve your trading results.

Published:

Oct 12, 2025 13:34 PM

Category: