The Aroon Oscillator is an automatic trend signal generator designed for trend-following traders in forex and stock markets. Available for the MetaTrader 5 (MT5) platform, it helps traders identify the strength and direction of a trend with remarkable precision.

By analyzing market dynamics and price movements, the Aroon Oscillator determines whether a market is entering a bullish or bearish phase, offering valuable insights for technical analysis. Traders at all levels can use it to forecast potential buy or sell opportunities with greater accuracy.

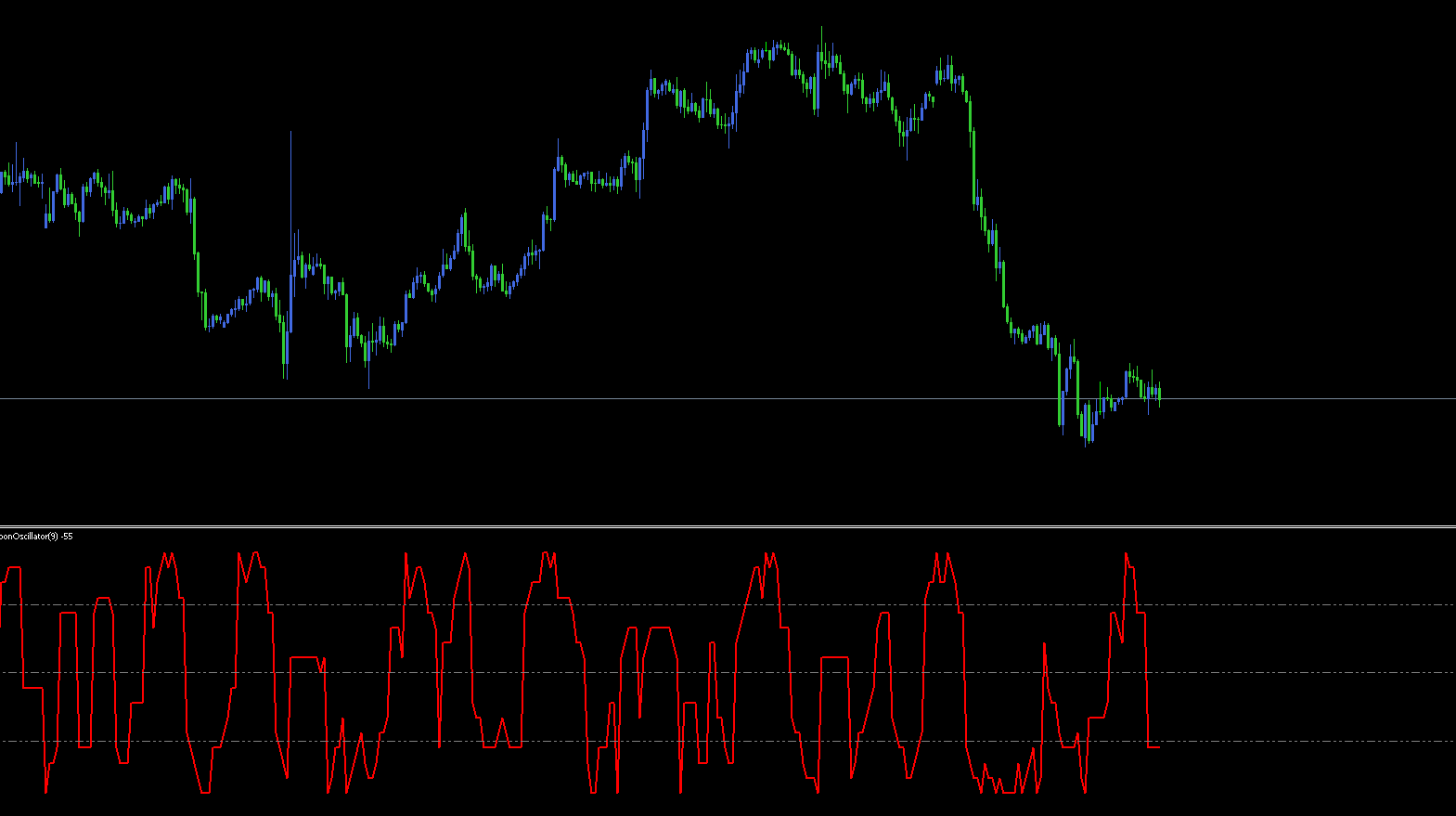

The Aroon Oscillator indicator measures the time between recent highs and lows over a specific period. It is derived from two components: Aroon Up and Aroon Down.

Aroon Up measures how long it has been since the last high.

Aroon Down measures how long it has been since the last low.

The oscillator value fluctuates between +100 and -100, helping traders identify:

Uptrends when the value rises above zero.

Downtrends when it falls below zero.

This clear visualization of market strength allows traders to make informed trading decisions.

When using the Aroon Oscillator in MT5, traders can combine it with other indicators to refine their strategy. Here’s how you can apply it effectively:

Integrating moving averages can help confirm Aroon-based signals. For instance:

Buy signals occur when the Aroon Oscillator crosses above zero while the price remains above the moving average.

Sell signals occur when the oscillator drops below zero and the price stays under the moving average.

Another effective method is to align the Aroon Oscillator signals with support and resistance zones. When the indicator confirms a breakout above resistance with a positive oscillator reading, it suggests a potential bullish continuation. Conversely, a fall below support with a negative oscillator signals a bearish trend.

The Aroon Oscillator supports MTF charts, allowing traders to monitor signals across multiple timeframes. For example, if both the 1-hour and 4-hour oscillators show bullish readings, the probability of a successful long trade increases significantly.

In an hourly GBP/USD chart, suppose the Aroon Oscillator line moves above zero after a pullback. This indicates that the market is regaining bullish momentum. Traders can enter a long position when the price breaks the short-term resistance, confirmed by the oscillator’s upward move.

Conversely, when the oscillator line dips below zero, it may signal that bears are taking control—an opportunity to consider short trades.

Simple yet powerful: Ideal for beginners and professionals alike.

Accurate forecasts: Provides reliable insights into market trends.

Flexible strategy support: Works well with trend-following and multi-indicator systems.

MT5 compatibility: Fully optimized for MetaTrader 5 platforms.

These features make it an indispensable tool for anyone trading forex, stocks, or indices.

From a technical perspective, the Aroon Oscillator is one of the most efficient trend indicators for MT5 users. Its ability to deliver early and accurate trend signals makes it perfect for building profitable trading strategies.

Start mastering market trends with the Aroon Oscillator and explore more expert trading tools at IndicatorForest.com.

Published:

Nov 02, 2025 13:29 PM

Category: