The Flag and Pennant Pattern Indicator for MT4 is a powerful chart-pattern recognition tool designed to automatically scan and highlight flag and pennant formations on the price chart. These continuation patterns appear frequently in trending markets, making them ideal for forex traders who seek repeatable, high-probability trading opportunities. Because the indicator identifies these patterns automatically, traders no longer need to spend hours manually scanning charts for valid setups—saving time and improving accuracy.

Flags and pennants are among the most reliable continuation setups in technical analysis. They form after a strong price impulse, followed by a period of consolidation. Once the consolidation ends, the trend usually resumes in the direction of the original move. The Flag and Pennant Pattern Indicator for MT4 helps traders spot these structures early so they can focus on execution instead of manual analysis.

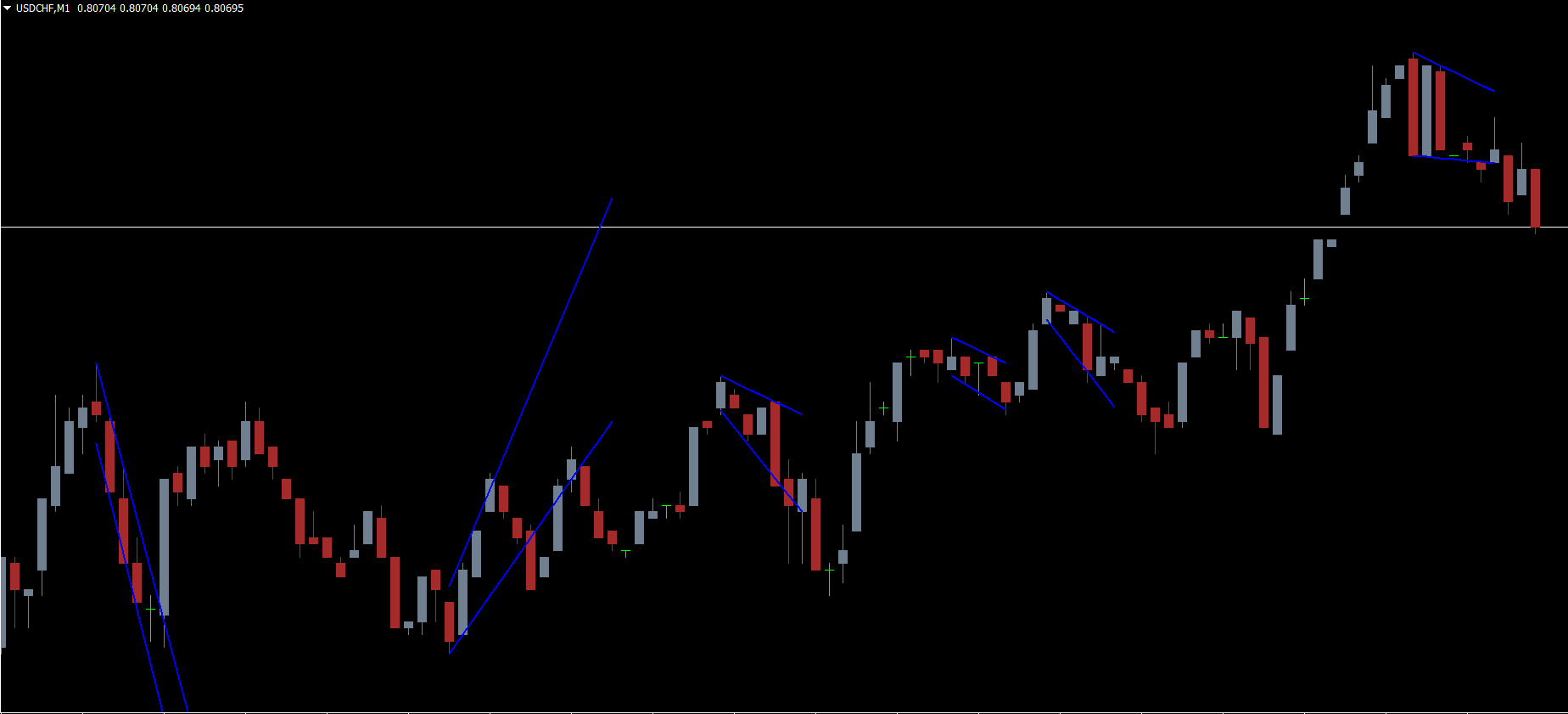

A flag pattern forms when price moves strongly in one direction and then consolidates inside a small parallelogram or rectangular shape. This consolidation usually slopes slightly against the trend.

Bullish Flag: Appears during an uptrend.

Bearish Flag: Appears during a downtrend.

Pennants appear similar to symmetrical triangles but are smaller and follow a strong impulsive wave. Price consolidates into a tight apex, after which a breakout usually follows in the direction of the original trend.

Both patterns signal trend continuation, which is why they are widely used by both swing and intraday traders.

The indicator automatically scans the chart for valid structures and marks them visually:

Flags are drawn in blue

Pennants are drawn in green

This color-coded approach allows quick recognition of potential trading zones. By drawing these formations dynamically, the indicator removes the uncertainty that comes from subjective chart analysis.

Saves time for technical analysis

Reduces subjectivity in pattern recognition

Helps new traders learn chart patterns faster

Provides frequent trade setups in trending markets

Offers better consistency when combined with trend tools

Although the indicator highlights formations automatically, the trader must follow standard pattern trading rules to achieve the best results.

Most traders wait for a breakout above or below the pattern to confirm momentum continuation.

BUY Trade: Breakout above the flag or pennant during an uptrend

SELL Trade: Breakout below the structure during a downtrend

Since these are continuation patterns, counter-trend trades are not recommended and often result in poor performance.

Flag and pennant structures naturally create support and resistance zones. Traders can use these levels to:

Confirm trend direction

Enter breakout trades

Set stop losses below swing lows (for BUY) or above swing highs (for SELL)

To ensure proper risk management:

Stop losses should be placed at the most recent swing high or swing low depending on trade direction.

Take profit levels should target a favorable risk-reward ratio, ideally matching the length of the original impulse move.

Patterns occur frequently in the market

Provides repeated trading opportunities

Ideal for trend continuation strategies

Helps new traders learn pattern behavior

Useful for confirming other indicators such as moving averages, trendlines, and momentum oscillators

Advanced traders can combine the indicator with additional tools such as trend direction indicators, support/resistance levels, or volume analysis to increase accuracy.

The Flag and Pennant Pattern Indicator for MT4 is a valuable tool for forex traders who rely on chart patterns and trend continuation strategies. Since these formations occur often across all currency pairs and timeframes, traders can find multiple high-quality trading signals daily. To improve your trading approach with more premium indicators, visit IndicatorForest.com and download this tool for free.

Published:

Nov 19, 2025 22:57 PM

Category: