The WD Gann Box Indicator for MT4 is a powerful trend-analysis tool designed to identify market structure using geometric angles and price levels. Gann trading concepts are widely used by professional traders to forecast price action, determine reversals, and identify trend strength. This MT4 indicator simplifies the complex Gann methodology by automatically scanning the chart and plotting the required horizontal, vertical, and diagonal lines.

The indicator works across intraday, daily, weekly, and monthly charts, making it suitable for short-term and long-term market analysis. Both beginners and advanced traders can use it. New traders benefit from clearly marked support-resistance levels, while advanced traders can apply more sophisticated multi-timeframe Gann-based strategies. For best results, the focus keyword—WD Gann Box Indicator for MT4—should always be paired with price action for confirmation.

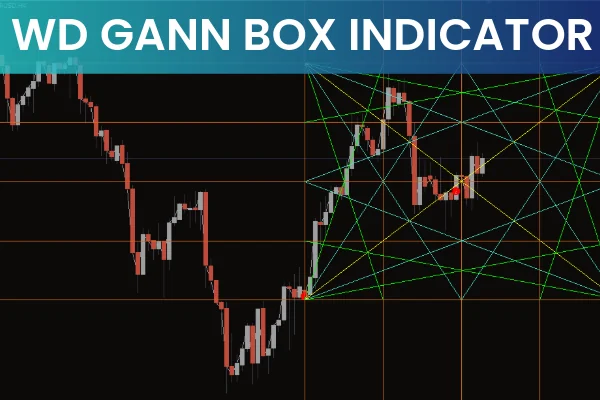

The indicator plots several types of lines automatically:

Vertical and horizontal red lines

45-degree Level 1 blue diagonal lines

Level 2 green angled lines

Level 3 gray angled lines

These levels collectively form the Gann Box structure.

The 45-degree line is the core element of the Gann system. It helps determine whether the market is:

Bullish (price above the 45-degree blue line)

Bearish (price below the 45-degree blue line)

This angle acts as a natural balance point between price and time. Traders use it to understand the true trend and anticipate reversals.

A bullish trend occurs when:

Price stays above the 45-degree blue Gann line

Structure continues to form higher highs and higher lows

Red horizontals or green/gray diagonals create supportive zones

Trade plan:

Enter BUY above the blue Gann line.

Place a stop loss below the previous swing low.

Take profit when:

The price breaks below the 45-degree line, or

A major resistance level (horizontal red line) is hit, or

You achieve a strong risk-reward ratio.

A bearish trend is confirmed when:

Price remains below the 45-degree blue line

Gann structure indicates lower highs and lower lows

Green and gray diagonal levels provide resistance

Trade plan:

Enter SELL as long as price stays below the 45-degree line.

Place stop loss above the previous swing high.

Book profit when price breaks above the descending 45-degree line or reaches a significant support level.

Every line in the Gann Box—horizontal, vertical, or angled—acts as:

A support zone during down moves

A resistance zone during up moves

However, the 45-degree angled lines remain the primary trend determinant, while other levels help refine entries and exits.

Traders should also use:

Candlestick patterns

Breakout confirmations

Volume strength

Market structure

These additions help validate trend reversals and reduce false signals.

The WD Gann Box Indicator for MT4 combines the power of geometry, angles, and support-resistance mapping to reveal genuine market trends and reversal zones. While it automatically draws the Gann structure, traders should confirm signals using price action for more accuracy. This indicator is easy to install and works well for both beginner and advanced traders on any timeframe.

For more premium and free indicators, visit IndicatorForest.com.

Published:

Nov 23, 2025 12:40 PM

Category: