The Advanced Fractals Indicator is a powerful swing-trading tool designed to identify repetitive price action patterns on MT5 charts. In fast-moving financial markets, price rarely moves in a straight line—even during a strong trend. Instead, markets produce frequent fluctuations caused by shifts in supply and demand. Traders rely on fractal patterns to make sense of these movements and pinpoint key reversal areas.

Identifying real reversal points is one of the greatest challenges for technical traders. When traders can spot genuine swing highs and lows, they gain an advantage in timing entries, managing risk, and capturing profitable opportunities across trending or corrective markets.

Market sentiment changes rapidly, often creating short-term pullbacks within long-term trends. For example, after a strong bullish move, the price typically corrects downward before continuing higher. Traders confident in the overall trend often wait for a bullish reversal pattern to form before placing a buy order. This is where the Advanced Fractals Indicator becomes a valuable tool.

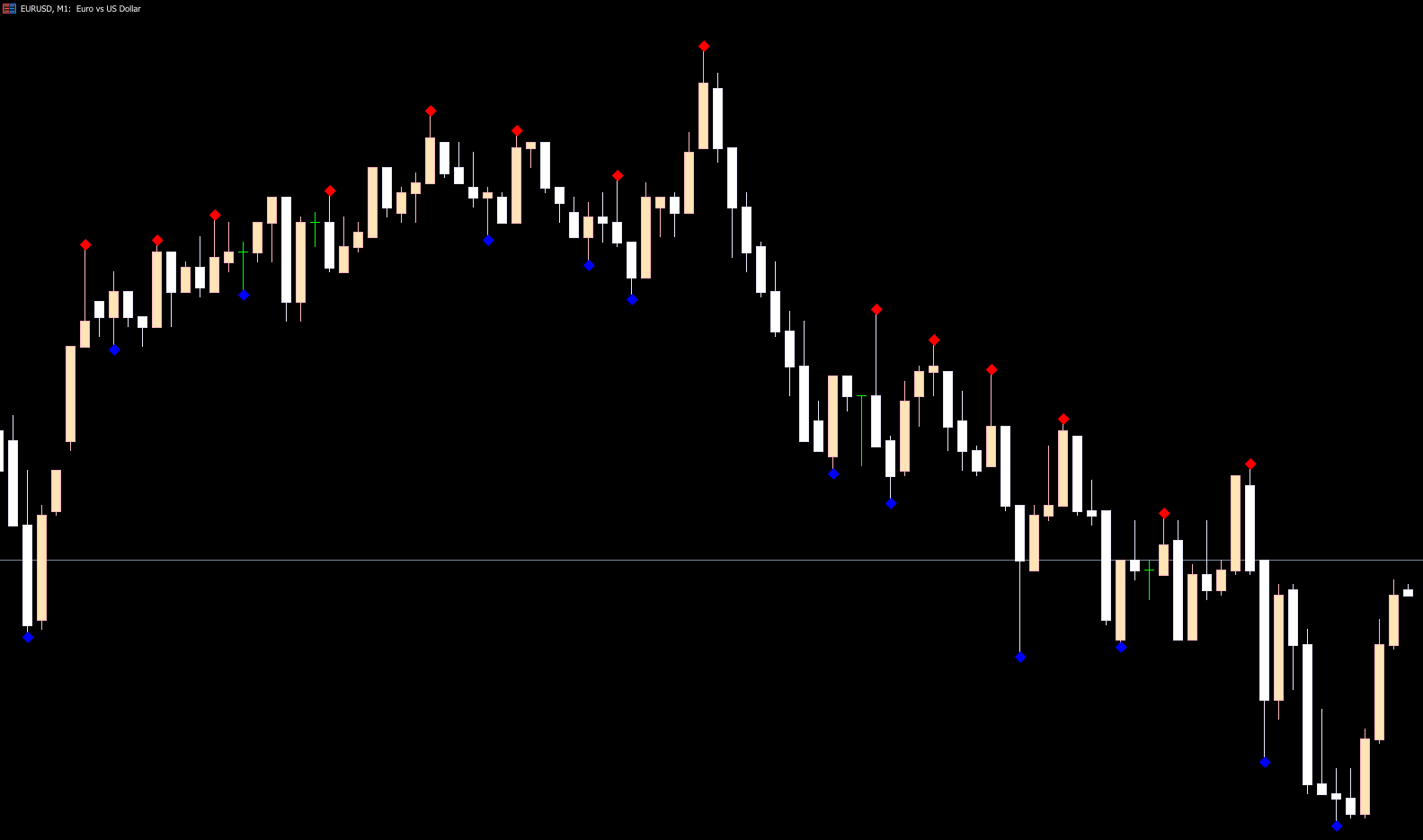

Fractals provide an extremely simple yet effective way to locate these reversal zones. By plotting small dots above or below candles, the indicator warns traders of potential turning points. Because of its visual clarity and straightforward interpretation, fractals have become popular among both beginner swing traders and experienced professionals.

The Basic fractal structure consists of tiny dots marking potential trend reversals:

Blue dots below candles = bullish reversal signal

Red dots above candles = bearish reversal signal

These signals highlight areas where the market may change direction after a temporary correction or consolidation phase. Unlike lagging indicators that confirm moves after they occur, fractals help traders anticipate shifts early.

The Advanced Fractals Indicator improves upon the default fractals in MT5 by reacting more quickly to price swings and providing clearer visual cues. It monitors random price movements closely and prints reversal signals whenever the market shows an opportunity to change direction.

Fractal signals appear frequently on shorter timeframes (such as M1, M5, or M15). This makes the indicator especially popular among scalpers and intraday traders who need steady opportunities throughout the trading session.

On higher timeframes (H4, Daily, Weekly), the number of signals decreases—but each signal becomes more reliable. Longer-term fractals often mark major swing highs and lows that can define significant market structure levels.

Because the indicator prints a high number of signals on fast charts, traders should avoid blindly following every dot. Instead, combining fractals with key price action tools creates stronger confirmation.

Fractal signals are most powerful when supported by additional technical factors. Examples include:

Horizontal support and resistance

Moving averages (for trend direction)

Trend lines and channels

Candle patterns such as pin bars or engulfing setups

In the example described, fractal dots appear near support and resistance levels, producing more reliable buy and sell setups. Signals in the middle of a choppy or unstable market carry more risk and should typically be avoided.

Here is a simple, effective approach:

Look for a blue fractal dot below the candle near a support level

Confirm the market is in an uptrend or forming a higher low

Enter buy positions once price rejects the level

Place stop-loss below the swing low

Look for a red fractal dot above the candle near resistance

Confirm downward momentum or a lower-high structure

Enter sell positions as price rejects resistance

Place stop-loss above the swing high

This structured method filters out many false reversal points.

The Advanced Fractals Indicator offers one of the simplest and most effective ways to identify meaningful price reversals in Forex trading. By combining fractal signals with important market structure levels—such as support, resistance, moving averages, and trend lines—traders can significantly improve their swing-trading accuracy. According to our assessment, the indicator performs exceptionally well for scalping and day-trading strategies, although it remains a valuable tool for higher-timeframe traders as well.

For more powerful MT5/MT4 indicators, visit IndicatorForest.com.

Published:

Nov 23, 2025 12:00 PM

Category: