The Liquidity Swings Indicator MT4 is an advanced market-structure tool designed by LuxAlgo to help traders detect crucial swing highs and lows where liquidity accumulates. These liquidity pockets often serve as magnets for price, making them essential for identifying potential reversals, breakouts, and order-flow reactions.

By using wick extremities and swing-volume calculations, the indicator gives traders a clear visual map of where institutional interest may exist. This makes it ideal for traders who use price action, supply and demand zones, order-flow concepts, smart money techniques, or sniper-entry strategies.

Whether you trade forex, indices, commodities, or crypto, the Liquidity Swings Indicator provides a reliable framework for detecting market turning points with precision.

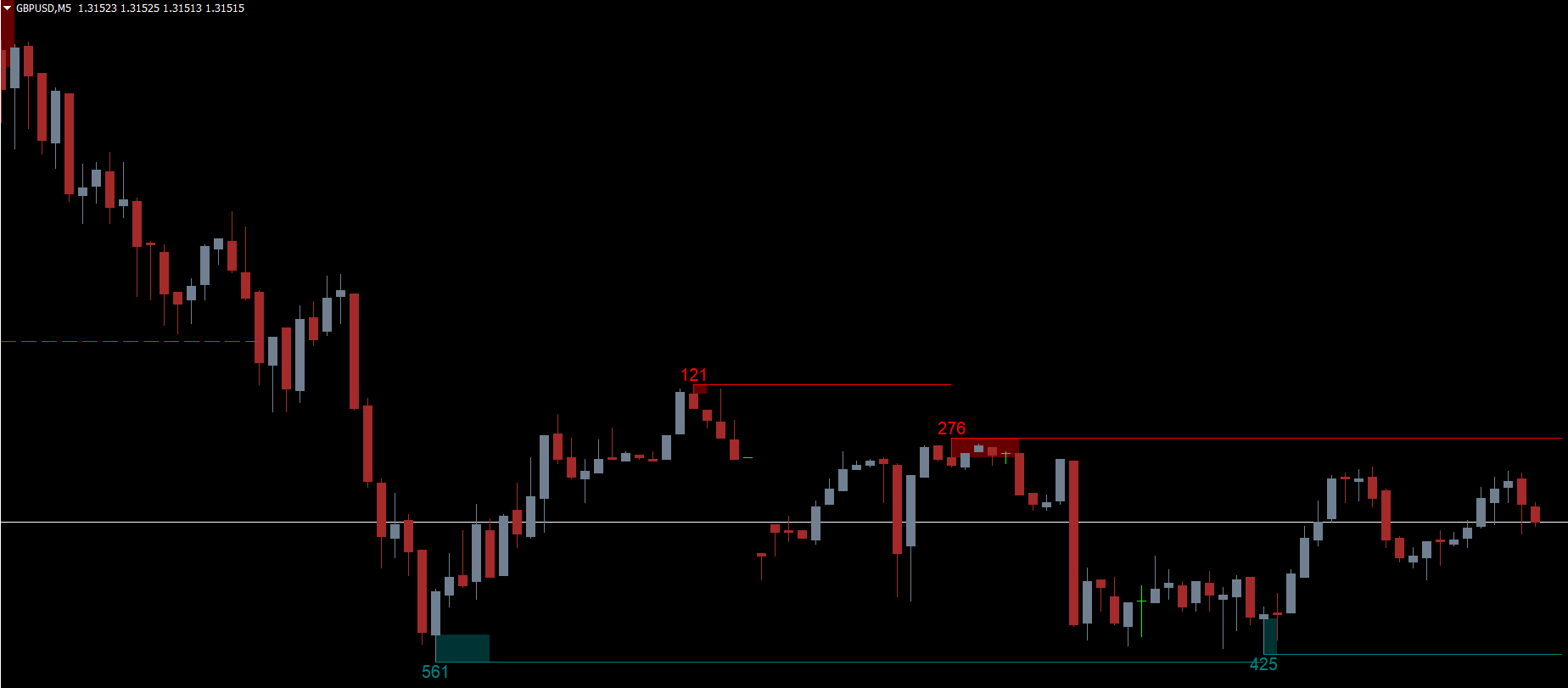

The indicator plots two main elements:

Red swing highs – areas where sell-side liquidity may sit

Teal swing lows – areas where buy-side liquidity is clustered

Each swing point includes a volume value that represents the strength and significance of that liquidity pool. The higher the value, the more likely institutions will target that level.

Identifies major and minor liquidity zones

Shows where price may react sharply

Helps forecast reversals and continuation moves

Supports sniper-style entries

Works with any timeframe on MT4

A rejection at a red swing high suggests bearish pressure. This may indicate:

Ideal short entries

Potential trend reversal

Institutional liquidity grabs

A bounce from a teal swing low signals possible bullishness:

Buy opportunities

Demand reactions

SMC-style displacement zones

When price breaks above a red swing high:

Liquidity is consumed

A continuation move is likely

Trade the retest for confirmation

When price breaks below a teal swing low:

Bearish momentum increases

The zone becomes resistance

If multiple swing levels appear close together, the area becomes a high-interest liquidity cluster, often leading to:

Strong reversals

Rapid continuation moves

Institutional-level manipulation or accumulation

These clusters are excellent for:

Mapping support/resistance

Identifying high-probability entry areas

Planning take-profit zones

Using the Liquidity Swings Indicator with basic structure helps you:

Identify trend direction

Confirm structural breaks

Validate liquidity grabs

For improved accuracy:

Add volume indicators

Use delta-style oscillators

Combine with supply/demand mapping

The indicator works especially well for:

Identifying inducements

Spotting liquidity sweeps

Confirming BOS/CHOCH signals

Marking premium/discount zones

The Liquidity Swings Indicator MT4 is a powerful liquidity-mapping tool that helps traders pinpoint where price may react due to institutional orders. By highlighting swing highs, swing lows, and significant liquidity clusters, it allows traders to anticipate market moves with accuracy and confidence.

Whether you trade reversals, breakouts, or smart-money setups, this tool enhances your technical analysis and provides a clearer view of market intentions.

👉 Download more premium MT4 and MT5 indicators at IndicatorForest.com and upgrade your trading strategy today.

Published:

Nov 17, 2025 21:54 PM

Category: