The forex market spends a significant portion of the time ranging, moving sideways before resuming a trend. Trading during these consolidation periods can be tricky, but it also provides ideal opportunities for price breakouts. The Consolidation Indicator for MT4 is a powerful tool for trading ranging markets and spotting key levels. It is a free indicator that combines Ichimoku Kinko Hyo concepts with Fibonacci-based channels.

How the Consolidation Indicator Works

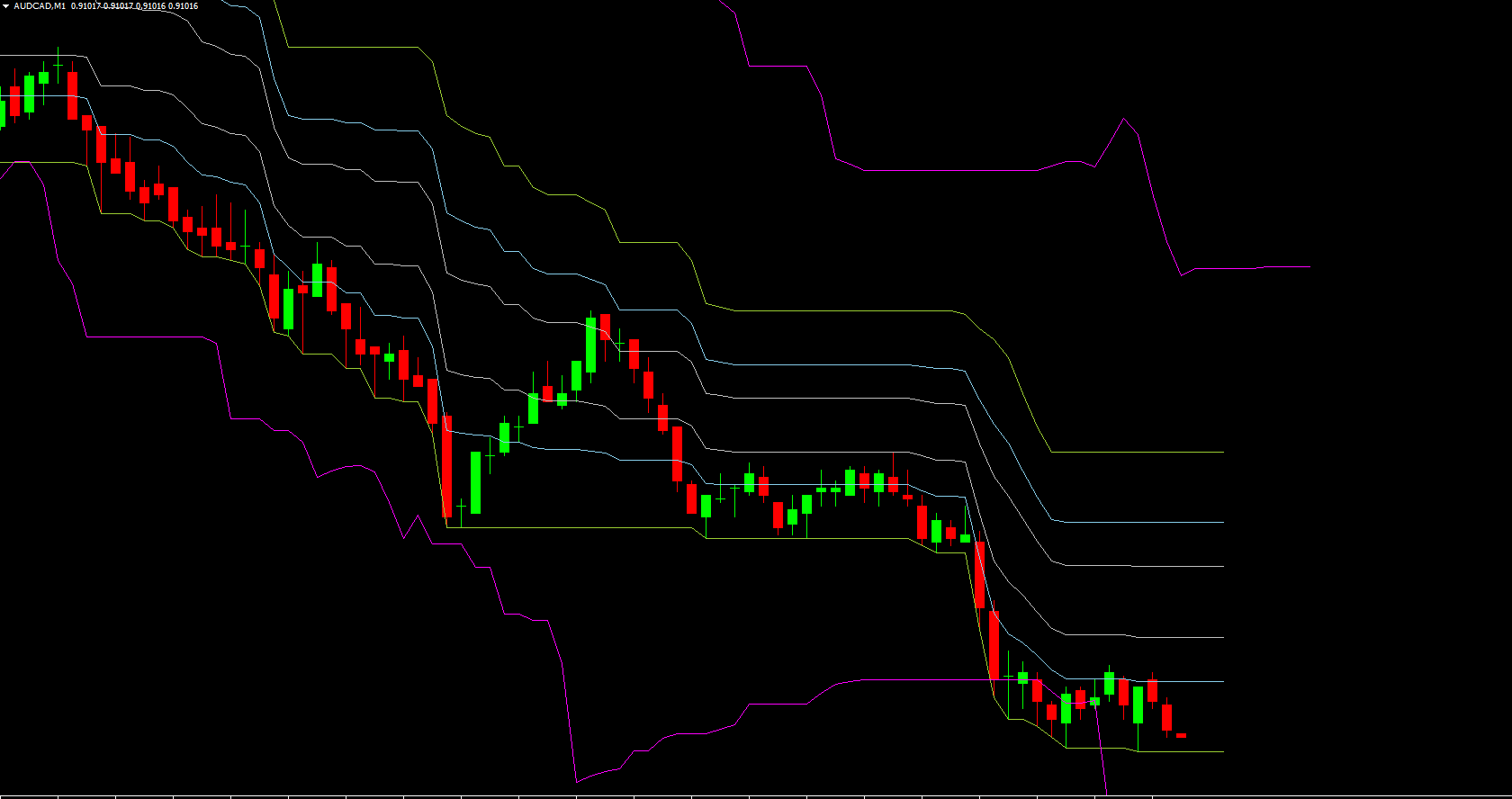

The indicator displays eight lines forming four channels that help traders identify support, resistance, and potential breakout levels. Each line is calculated using Fibonacci coefficients, which can be customized as needed.

Silver Channel: The tightest channel, ideal for spotting short-term trend movements.

Sky Channel: Confined within sky blue colors, useful for intermediate support and resistance.

Zen Channel: Marked in green, serves as the main channel for observing market consolidation.

Future Channel High: Shown in magenta, highlights potential breakout levels.

Traders do not receive direct buy or sell signals from the indicator. Instead, trade opportunities are derived by interpreting the channels similar to Ichimoku Kinko Hyo strategies. Narrow channels indicate trend continuation, while wider channels act as dynamic support and resistance zones.

How to Trade Using the Consolidation Indicator

Observe the Zen channel to determine the current market range.

Buy Opportunities: Enter long positions when price touches the lower bound of the Zen channel.

Sell Opportunities: Enter short positions when price touches the upper bound of the Zen channel.

Monitor potential breakouts using the Future Channel High (magenta line) as a guide.

For example, on the GBP/USD chart, if the price trades within the green Zen channel, waiting for the price to reach the upper or lower boundary can provide strategic entry points. The indicator is compatible with any currency pair and suits both beginner and experienced traders.

Advantages of the Consolidation Indicator

Trade Ranging Markets: Designed for sideways price movement, which makes up most of the forex market.

Fibonacci-Based Channels: Provides natural support and resistance zones.

Ichimoku-Like Analysis: Combines familiar Ichimoku concepts with channel trading.

Multi-Currency Use: Works with any forex pair or timeframe.

Free Download: Available at IndicatorForest.com for all traders.

Tips for Trading with the Consolidation Indicator

Focus on the main channels (Zen and Future Channel High) for higher probability trades.

Use the narrow channels for detecting short-term trends or momentum.

Combine with other technical tools like RSI, MACD, or moving averages to confirm trades.

Be patient and wait for price to reach channel boundaries before entering trades.

Conclusion

The Consolidation Indicator for MT4 is an ideal tool for trading ranging markets and spotting breakout opportunities. By interpreting the Fibonacci-based channels, traders can identify optimal buy and sell zones or wait for breakout moves. Although it may seem complex initially, the indicator becomes intuitive with experience. You can download the Consolidation Indicator for free from IndicatorForest.com and start trading consolidations effectively today.

Published:

Nov 17, 2025 23:09 PM

Category: