The Murrey Math Lines Indicator is a powerful MT4 tool that helps traders identify clear support and resistance levels using an algorithm based on Murrey Math and principles drawn from W.D. Gann’s famous technical methodologies. By dividing price action into eight mathematically calculated levels, the indicator allows traders to better understand market structure, anticipate reversals, and identify high-probability entry and exit points.

Gann was known for creating some of the most accurate market forecasting methods, including Gann Angles. The Murrey Math concept expands on these ideas by applying consistent mathematical calculations to any chart, timeframe, or asset—making it a versatile tool for forex, indices, stocks, and commodities.

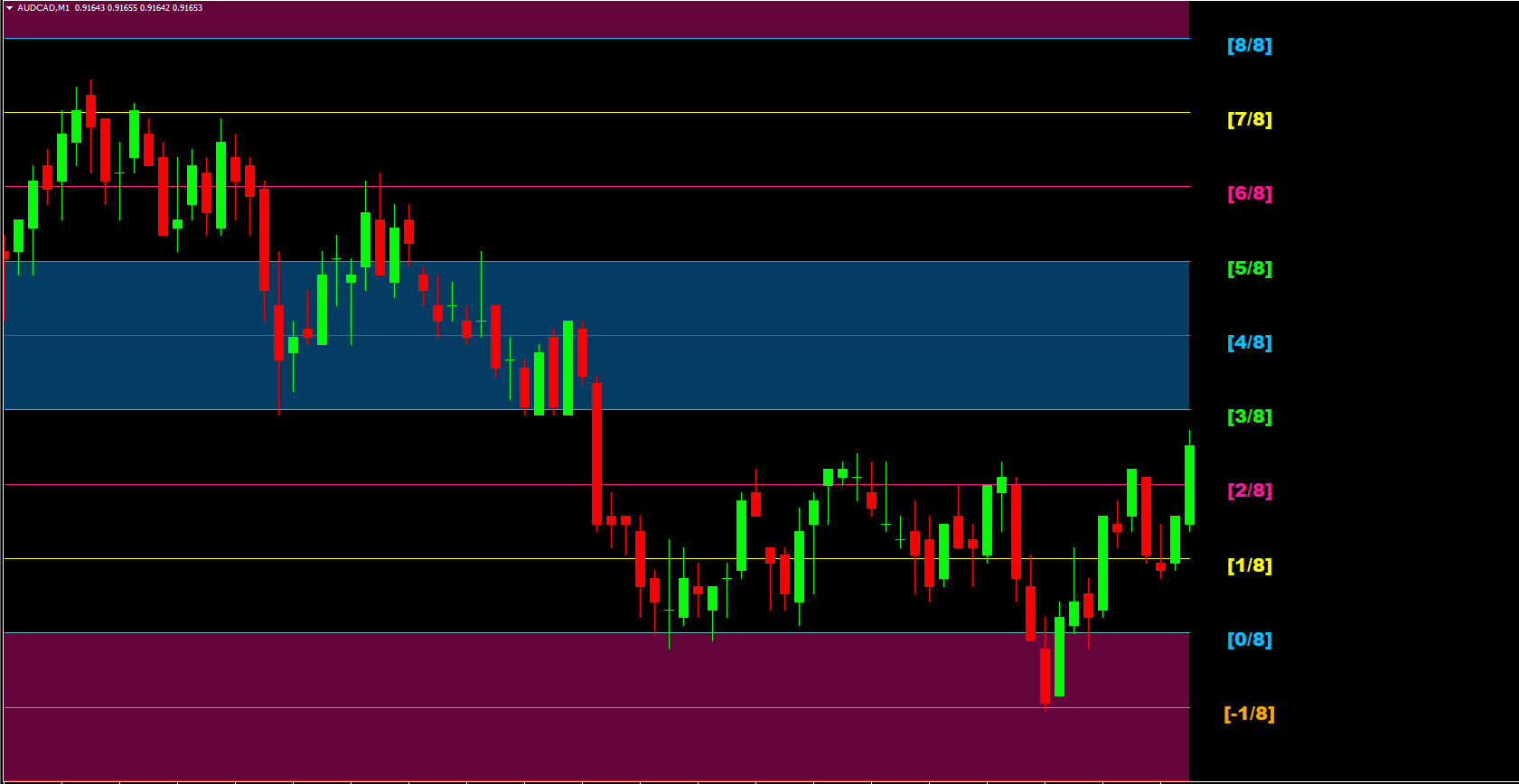

The indicator plots eight horizontal levels, each representing a different type of support or resistance. These levels are displayed on the chart as color-coded areas, typically with blue and red zones that visually highlight strong market barriers.

The eight lines include:

0/8 Level – Ultimate Resistance Zone

1/8 Level – Weak Resistance

2/8 Level – Reversal Level

3/8 Level – Top of Trading Range

4/8 Level – Major Support/Resistance (Key Level)

5/8 Level – Bottom of Trading Range

6/8 Level – Reversal Level

7/8 Level – Weak Support

8/8 Level – Ultimate Support Zone

The three most important Murrey Math levels are:

0/8 – Extreme Resistance

4/8 – Strongest Support/Resistance Line

8/8 – Extreme Support

These levels help traders identify market extremes, fair value zones, and likely turning points.

The indicator provides clear BUY and SELL opportunities based on how price interacts with the eight levels.

A BUY signal may occur when:

Price touches the 8/8 level, showing extreme support

Price moves above 4/8, confirming bullish pressure

Price reverses upward from the 6/8 level

A breakout happens above 2/8, indicating a strong continuation

In the GBP/USD H4 example, BUY signals trigger when price bounces from strong support zones or breaks key Murrey levels confirming upward momentum.

A SELL signal may occur when:

Price touches the 0/8 level, showing extreme resistance

Price breaks below 4/8, indicating bearish control

Price reverses downward from 2/8 or 6/8 levels

The market drops below 7/8, confirming weakness

Levels 2/8 and 6/8 are specifically known for signaling market reversals, making them high-probability zones for trade setups.

0/8 and 8/8 → Strongest reversal zones

1/8 and 7/8 → Weak zones, often temporary

2/8 and 6/8 → Potential reversal levels

4/8 → Central pivot zone (best entry/exit level)

When price crosses above 8/8 or below 0/8, it often indicates market uncertainty, meaning traders should avoid low-quality setups until price stabilizes.

This indicator is especially useful for:

Spotting major support and resistance

Determining potential reversal zones

Timing entries and exits more accurately

Filtering trades according to market structure

Understanding the “fair value” zone of price

It performs well on all timeframes but is particularly effective on H1, H4, and Daily charts.

For maximum accuracy, combine the Murrey Math Lines Indicator with:

Trendlines

Moving averages

Price action patterns (pin bars, engulfing candles, breakouts)

Fibonacci levels

Volume indicators

Multiple confirmations increase signal strength and reduce false entries.

The Murrey Math Lines Indicator for MT4 is an excellent tool for identifying support, resistance, and reversal points using eight mathematically calculated levels. Its structure helps traders determine optimal entry and exit zones with confidence. You can download the indicator for free from IndicatorForest.com and start improving your market analysis today.

Published:

Nov 15, 2025 01:07 AM

Category: