The Ease of Movement Indicator for MT4, developed by Richard W. Arms, is a unique momentum oscillator that measures the relationship between price movement and volume. Unlike traditional oscillators that rely solely on price, this tool integrates volume data to show how easily prices are moving in a particular direction.

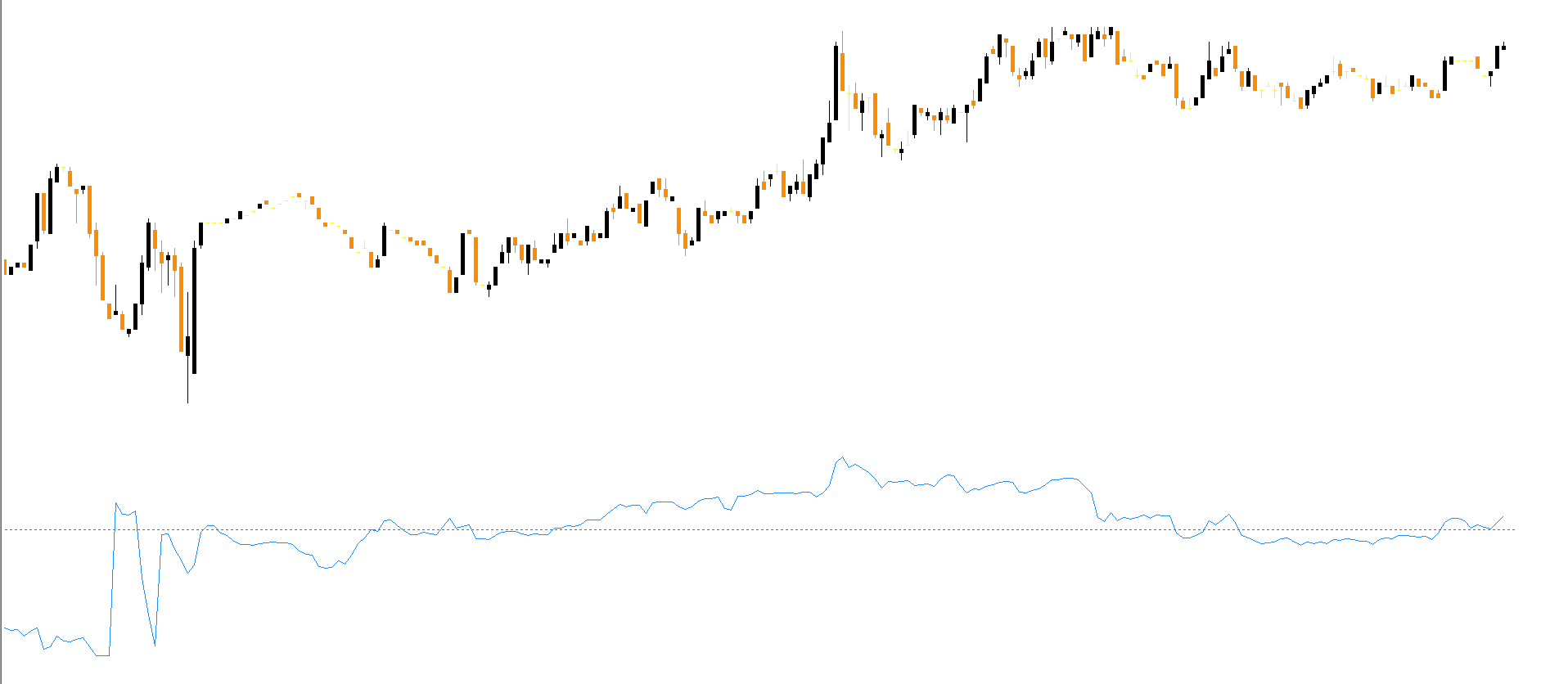

The indicator is plotted as a smooth signal line that fluctuates above and below the zero line, helping traders identify whether price movements are supported by strong or weak volume.

Available for free at IndicatorForest.com, this indicator is a valuable addition to any trader’s technical toolkit, especially for those interested in volume-based strategies.

The Ease of Movement (EOM) indicator combines price and volume to identify whether a price change is occurring with ease or resistance. In simple terms, it shows whether the market is moving up or down efficiently based on trading volume.

When the indicator rises above zero, it indicates that prices are moving upward easily with relatively low volume — suggesting a possible bullish bias but also potential exhaustion if volume is too weak.

When the indicator falls below zero, it implies that prices are declining with light volume, reflecting a bearish trend but possibly lacking strong selling pressure.

The zero line acts as the critical pivot point. Crosses above or below this line are often used as buy or sell signals.

Here’s how to interpret the signals effectively:

BUY Signal:

When the indicator moves below the zero line, it suggests a lower downside volume — meaning sellers are losing strength.

This can be a signal to enter long positions or prepare for an upcoming bullish reversal.

SELL Signal:

When the indicator moves above the zero line, it indicates a lower upside volume, signaling that buyers are weakening.

This can be a good opportunity to enter short positions or exit existing longs.

Confirmation:

For better accuracy, combine EOM signals with a Moving Average or trend filter indicator (such as EMA 50 or RSI) to confirm the market direction before executing trades.

💡 Pro Tip: Avoid trading solely on EOM zero-line crosses during high-volatility news periods, as volume distortions may cause false readings.

Advantages:

Highlights the link between price and volume.

Provides early insights into trend weakness or strength.

Useful for spotting divergences between volume and price.

Works on all currency pairs and timeframes.

Disadvantages:

May generate false signals during low-volume sessions.

Should not be used alone — best combined with trend indicators.

Apply it on Daily or H4 charts for cleaner signals.

Combine with Moving Average or MACD for confirmation.

Use it to filter out false breakouts by analyzing volume pressure.

Avoid trading when the EOM line is flat, as it indicates low momentum.

The Ease of Movement Indicator for MT4 is a highly insightful momentum oscillator that links price action with trading volume to reveal the underlying market strength. By observing the zero line and tracking how easily prices move up or down, traders can make smarter decisions about when to enter or exit trades.

You can download the Ease of Movement Indicator for free from IndicatorForest.com and add a professional-grade volume analysis tool to your trading strategy today.

For traders interested in exploring more indicators based on momentum and volume, check out our post on the Best Volume Indicators for MT4.

Published:

Nov 11, 2025 21:46 PM

Category: