The ADX Directional Movement Indicator is one of the most reliable tools in technical analysis, used by traders to measure the strength of a market trend. This indicator focuses on trend intensity rather than direction. Unlike other momentum tools that highlight price direction, the ADX (Average Directional Index) evaluates how strong or weak a trend is—helping traders decide whether to follow it or wait for clearer signals.

At IndicatorForest.com, traders can explore detailed guides, indicator downloads, and strategies to enhance their market performance using the ADX and other professional-grade tools.

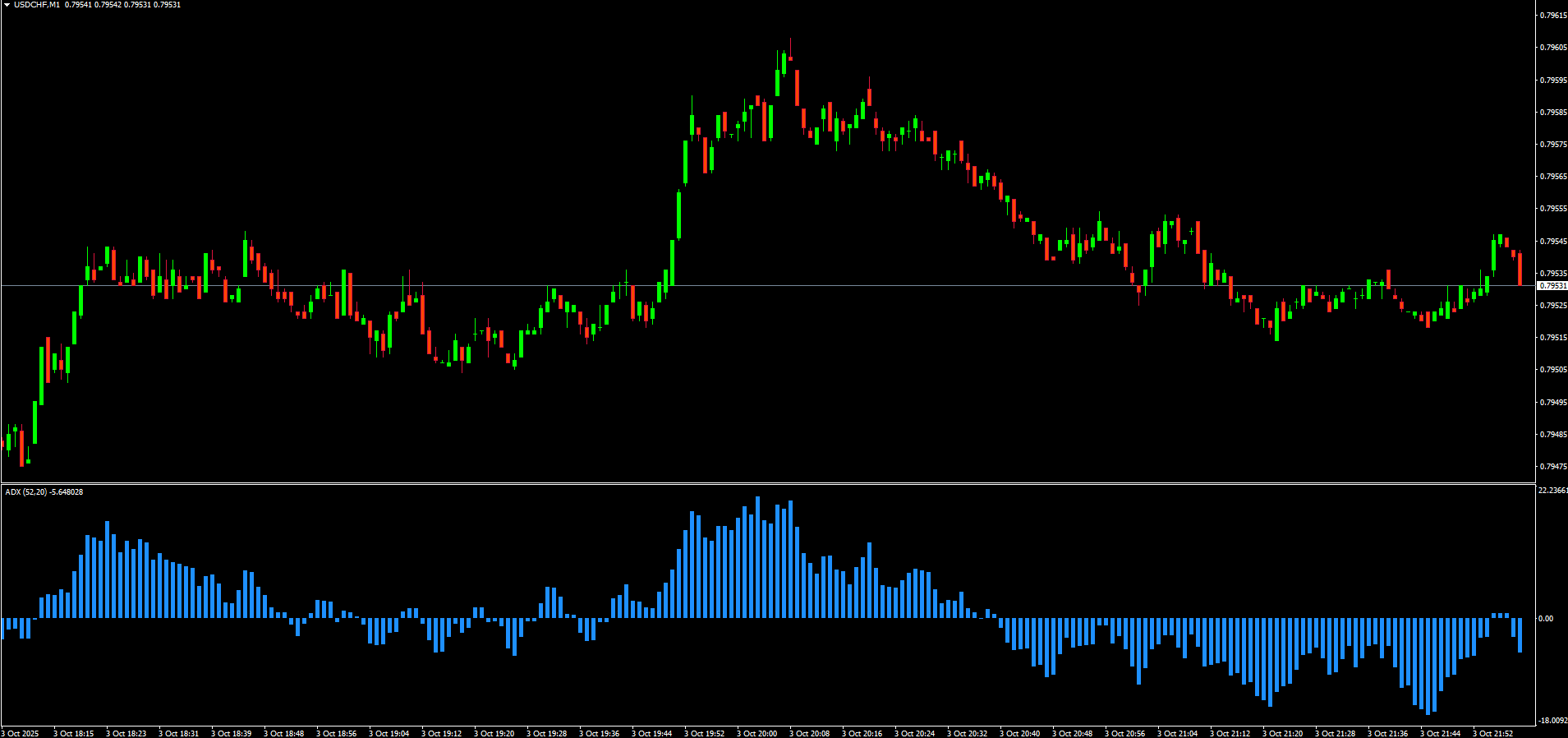

The ADX Directional Movement system consists of three components:

ADX line – measures overall trend strength.

+DI (Positive Directional Indicator) – measures upward movement.

–DI (Negative Directional Indicator) – measures downward movement.

When the ADX value rises above 20 or 25, it signals a strong trend—regardless of whether the market is bullish or bearish.

If +DI crosses above –DI, it indicates a potential buy signal.

If –DI crosses above +DI, it signals a sell opportunity.

Flat or declining ADX values suggest sideways or weak market conditions, where trend-following systems tend to underperform. Traders can use these readings to avoid low-probability setups and wait for stronger trends to emerge.

The ADX is excellent for spotting when the market is transitioning from a range-bound phase to a trending phase. For example, when ADX rises from below 20 to above 25, it often confirms that a new, strong trend has begun.

False breakouts can mislead even experienced traders. By checking whether the ADX line is rising, traders can confirm whether a breakout is supported by increasing momentum or not.

Many traders combine the ADX Directional Movement Indicator with oscillators like RSI or MACD for more robust setups. While RSI detects overbought or oversold conditions, ADX validates whether a trend is strong enough to continue.

You can explore more indicator combinations and ready-to-use templates on IndicatorForest.com, where professional traders share custom trading tools and strategies.

ADX Trend-Following Strategy:

Wait for ADX to cross above 20.

Enter long when +DI > –DI, or short when –DI > +DI.

Set stop-loss below/above the recent swing level.

ADX and Moving Average Strategy:

Combine a 50-period moving average with ADX. Trade in the direction of the moving average only when ADX confirms trend strength.

ADX Pullback Strategy:

When the trend is strong (ADX > 25) and price retraces temporarily, use pullbacks as opportunities to re-enter in the trend direction.

Helps avoid weak markets and false signals.

Works across all timeframes (intraday, swing, long-term).

Can be applied to stocks, forex, crypto, and commodities.

Provides quantifiable trend strength, unlike subjective chart analysis.

The ADX Directional Movement Indicator is suitable for both beginners and seasoned traders looking to improve their decision-making and trade timing.

The ADX Directional Movement Indicator is more than just a line on a chart—it’s a powerful decision-support tool. By focusing on trend strength, traders can avoid low-quality setups, maximize profits in trending markets, and improve overall consistency.

To learn more about ADX strategies, templates, and other professional tools, visit IndicatorForest.com today and explore our growing library of free and premium trading indicators.

Published:

Oct 05, 2025 02:52 AM

Category: