The TEMA Indicator for MT5 (Triple Exponential Moving Average) is a powerful trend-following indicator designed to deliver faster and smoother market signals. Unlike the traditional moving average indicators, TEMA reacts quickly to recent price changes, making it a preferred tool for traders who rely on real-time trend analysis.

This guide will walk you through how the TEMA MT5 indicator works, how to interpret its signals, and how to use it effectively in Forex, stock, and cryptocurrency trading.

The TEMA indicator is based on a triple-layer exponential moving average calculation. This unique design reduces lag, making it more responsive to price fluctuations than traditional EMAs or SMAs.

By analyzing the most recent market data, the indicator helps traders detect early trend reversals and potential entry or exit points. It is particularly effective for short- to medium-term trading strategies where timing is crucial.

Key Features of the TEMA Indicator for MT5:

Fast reaction to price movements

Reduced lag compared to other moving averages

Accurate buy/sell signals in trending markets

Works across all MT5 timeframes, especially M30 to H4

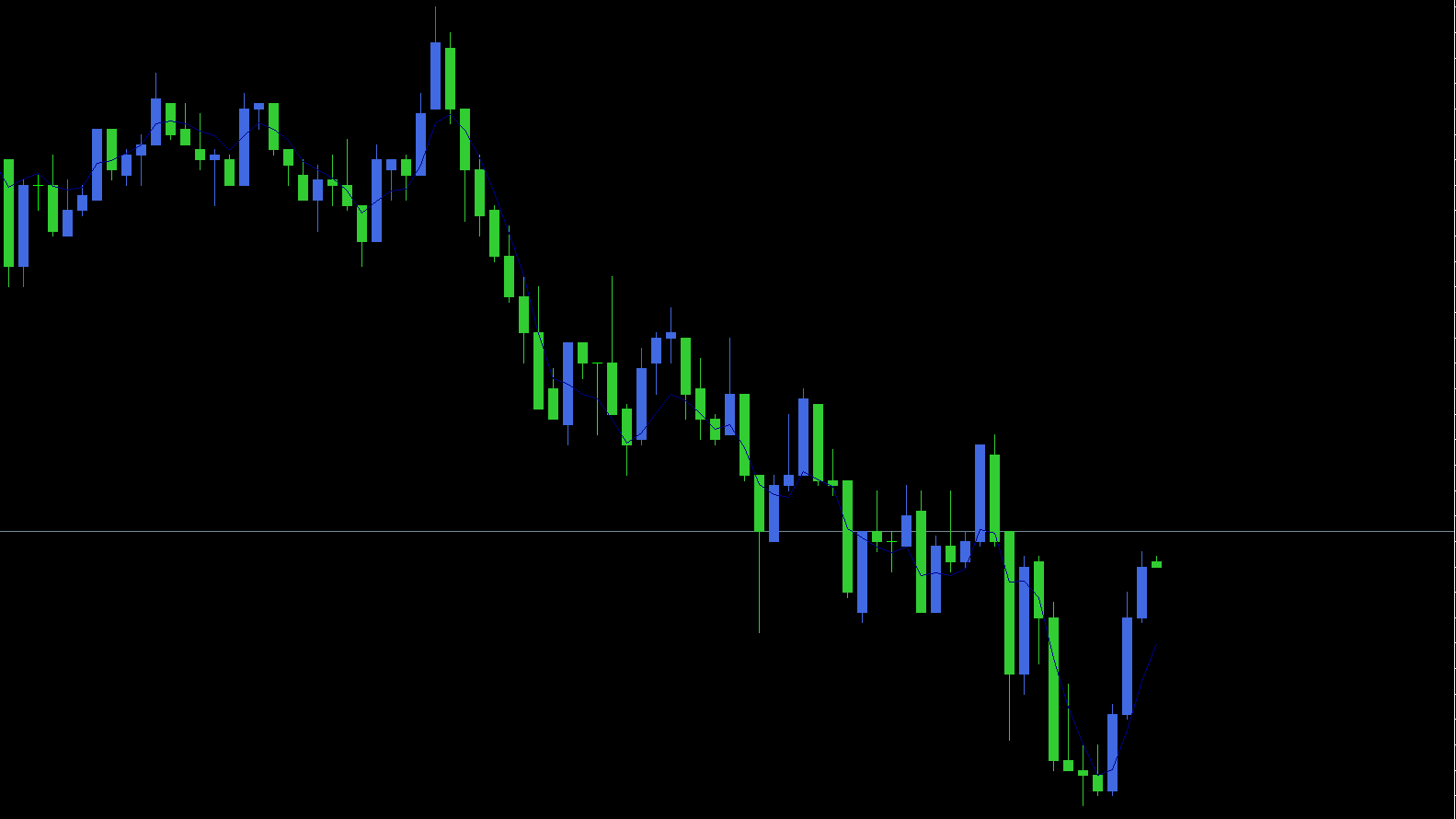

Using the TEMA MT5 indicator is simple and efficient. When the price stays above the TEMA line, the market is in a bullish trend. Conversely, when the price remains below the TEMA line, it indicates a bearish trend.

During an uptrend, price movements tend to respect the TEMA line as a dynamic support level. Traders can look for pullbacks near the TEMA line to open new long positions. When the price rebounds off this support, it often signals strong bullish continuation.

In a downtrend, the TEMA line acts as a resistance level. Price rejection from this level often signals opportunities to enter short trades. For example, on the GBP/USD chart, if the price fails to break above the TEMA line several times, it confirms a strong bearish move.

The TEMA indicator is also helpful for determining exit points and trailing stop losses. As long as the price stays aligned with the trend, traders can follow the TEMA line to manage positions efficiently.

The multi-timeframe (MTF) functionality of the TEMA MT5 indicator enables traders to monitor trends across multiple chart periods. For instance, a trader can confirm a long-term trend on the H4 chart and use M30 or H1 charts to pinpoint precise entry signals.

This approach is excellent for both pullback and breakout trading strategies, helping traders stay aligned with the dominant trend while optimizing entry and exit precision.

Highly responsive and ideal for day trading and swing trading

Compatible with all MetaTrader 5 instruments (Forex, stocks, crypto, commodities)

Simple yet powerful tool suitable for beginners and experienced traders alike

If you’re looking for a fast and efficient trend-following indicator, the TEMA Indicator for MT5 is one of the best tools to add to your trading toolkit.

The TEMA MT5 Indicator offers one of the most efficient methods to identify market trends and generate accurate buy/sell signals. Its speed and precision make it a standout choice among modern moving average indicators.

Whether you trade Forex, stocks, or crypto, using TEMA on the M30 to H4 timeframes can help you catch profitable market moves early.

👉 Explore and download the TEMA Indicator for MT5 now at IndicatorForest.com and enhance your trading strategy today!

Published:

Nov 03, 2025 00:49 AM

Category: