The DR IDR Candles Indicator is a powerful session-based analytical tool designed for MetaTrader 5 traders who want clear insights into intraday dynamics. Developed by LuxAlgo, this indicator highlights the Daily Range (DR) and the Initial Daily Range (IDR) zones to help you identify where price may consolidate, reverse, or break out.

In this article, you will learn how this indicator works, its benefits, trading signals, and best practices. Use this knowledge to enhance your intraday strategy — and don’t forget to check out IndicatorForest.com for more premium tools and guides.

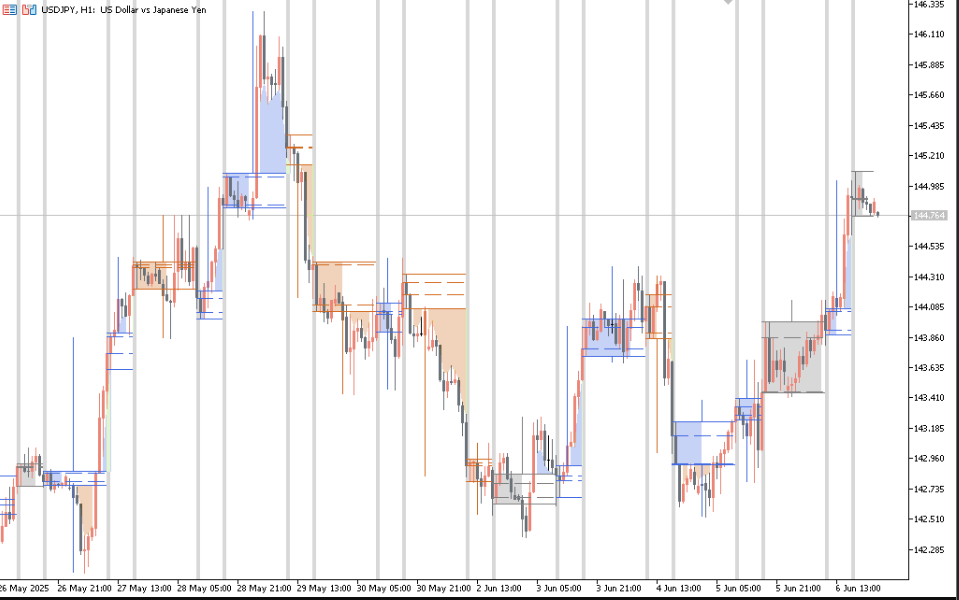

The DR IDR Candles Indicator overlays colored “candles” or zones on your chart to delineate Daily Range (DR) and Initial Daily Range (IDR) sessions.

Daily Range (DR): The full range of price movement during the main trading day.

Initial Daily Range (IDR): The early portion of the trading day (often first 30–60 minutes), which many traders believe sets the tone for intraday momentum.

By visualizing these ranges, traders can spot key supply and demand zones, potential breakout or reversal points, and institutional order flow concentration.

This indicator is especially useful for intraday strategies, session-based approaches, and the ICT (Inner Circle Trader) style of market analysis.

The DR IDR Candles indicator splits the trading day into regular session and overnight session segments. It marks the extremes (high/low) of each session, helping traders see where price may gravitate toward or reject.

The tool visualizes zones where price is more likely to either stall (consolidate), reverse, or break out. Institutional participants often place orders around these zones, giving the zones significance in intraday trading.

Because it’s built for MetaTrader 5, the indicator integrates smoothly with your existing technical tools, overlays, and chart setups. You can often adjust colors, session times, and alert levels to match your preferred trading style.

Clear visual cues for daily and initial trading ranges

Helps confirm reversal or breakout signals

Ideal for intraday traders, scalpers, or swing traders using range strategies

Supports the ICT methodology and session-based systems

Reduces guesswork — price structure and zones become more obvious

Using this indicator alongside other confirmation tools (like order flow, volume, or momentum indicators) can enhance the probability of successful trades.

The DR IDR Candles Indicator gives you signals based on price interaction with the DR/IDR zones.

If price returns to an extreme of the IDR zone and rejects it (with a candlestick rejection pattern), that can be a reversal signal. For example, a wicking candle or engulfing pattern off the IDR high may hint at shorting pressure.

When price decisively breaks above or below the DR boundary with momentum, that may signal continuation. A break through DR with supporting volume or trend strength can be a breakout signal.

Price often consolidates between DR and IDR zones. Traders may look to trade bounces inside that zone until breakout occurs.

As with any indicator, it’s wise to use confirmation tools (e.g. volume, RSI, trend filters) to validate signals.

Always define stop loss and take profit levels

Use proper position sizing

Combine with volumes, trend filters, or structure breaks

Avoid trading during news spikes

Backtest on multiple instruments and timeframes

Over time, you’ll learn which session cues and zones work best for your strategy.

Acquire the indicator from a trusted source (LuxAlgo official or licensed distributor).

Copy the .ex5 or .mq5 file into your MQL5/Indicators folder for MT5.

Restart MT5 or refresh the Navigator window.

Attach the DR IDR Candles indicator on your chart and adjust settings (session times, colors, alerts).

Start observing the DR and IDR zones during live sessions.

Traders of FX, indices, or futures who want clarity in session ranges

ICT-style traders wanting structured zone analysis

Day traders seeking early directional cues

Range and breakout traders looking for institutional zone confluence

Many professionals rely on daily and initial sessions to gauge where institutions might add liquidity.

Ready to take your intraday trading to the next level? Explore more advanced indicators, tutorials, and trading tools at IndicatorForest.com. Dive deeper and elevate your edge in the markets.

Published:

Oct 15, 2025 14:30 PM

Category: