The Gann Fan and Fibonacci Indicator is a powerful technical analysis tool that merges two classic trading techniques—Gann angles and Fibonacci retracement levels—to help traders anticipate price movements. This unique combination allows traders to pinpoint potential support and resistance zones, identify market reversals, and align with the overall trend direction.

By using the Gann Fan and Fibonacci Indicator on IndicatorForest.com, traders can gain a deeper understanding of market dynamics and make more informed decisions.

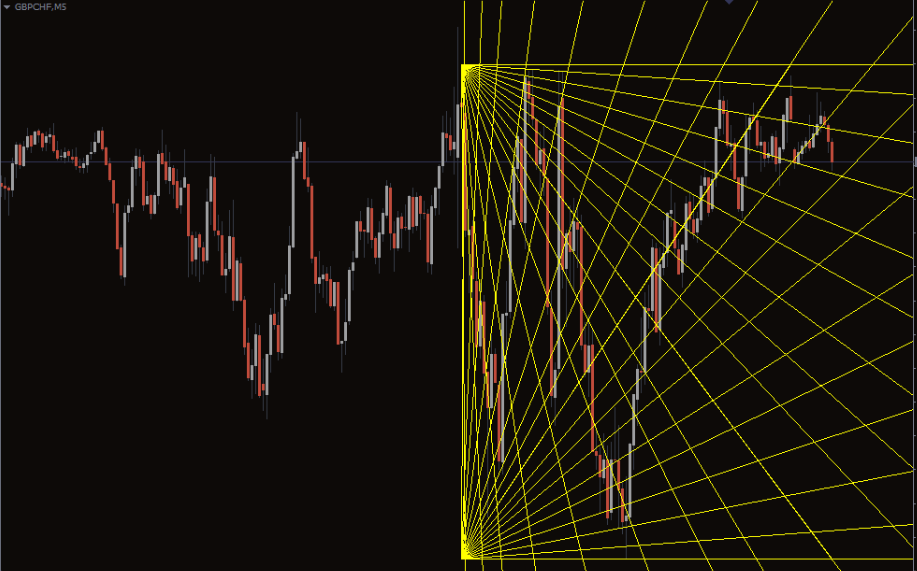

The Gann Fan consists of diagonal lines (Gann angles) drawn from a central price point at specific geometric angles. These lines represent time-price relationships that show how price might move over time.

The Fibonacci retracement tool, on the other hand, uses horizontal levels based on the Fibonacci sequence (23.6%, 38.2%, 50%, 61.8%, etc.) to indicate potential retracement or extension levels in price action.

When combined, the Gann Fan and Fibonacci Indicator provides a multi-dimensional view of the market. The intersection points of Gann angles and Fibonacci levels create strong zones where trend reversals or breakouts often occur.

When price approaches a Gann angle that coincides with a Fibonacci retracement level, it forms a confluence zone—an area where buyers and sellers are likely to react strongly.

Bullish Signal: If the price finds support at a lower Gann angle and aligns with a Fibonacci retracement level (like 61.8%), this often indicates a potential reversal upward. Traders may look for confirmation before entering a buy position.

Bearish Signal: When the price struggles to break above an upper Gann angle and a Fibonacci level, it signals resistance, suggesting a possible short opportunity.

Traders can also apply additional confirmation tools, such as volume indicators or momentum oscillators, to validate these trading signals.

Align with the trend: Use higher-timeframe Gann Fans and Fibonacci levels to identify the dominant trend direction.

Look for confluences: The more overlap between Gann angles and Fibonacci levels, the stronger the support or resistance zone.

Wait for confirmation: Don’t enter trades immediately; wait for candlestick patterns or volume surges to confirm signals.

Combine with other tools: The indicator works best when combined with moving averages or RSI for trend confirmation.

Precision: Helps locate exact price zones where reversals are likely.

Versatility: Suitable for forex, stocks, commodities, and crypto markets.

Confidence in Entries/Exits: Reduces emotional trading by providing data-driven levels.

Trend Clarity: Highlights both short-term retracements and long-term trend continuations.

With its dual-layered analysis, this indicator enhances both swing trading and day trading strategies.

Even powerful tools can be misused. Here are key pitfalls to avoid:

Ignoring the dominant trend: Don’t trade counter to the overall direction indicated by higher-timeframe Gann Fans.

Over-plotting indicators: Too many tools can clutter your chart and create confusion.

Forgetting risk management: Always use stop-loss orders, even when signals appear strong.

The Gann Fan and Fibonacci Indicator is more than just a technical tool—it’s a strategic framework that merges time, price, and geometry for unparalleled market insight.

By combining Gann angles and Fibonacci ratios, traders can identify key turning points and make precise entries and exits. Whether you’re a beginner exploring market structure or an experienced trader seeking advanced confluence techniques, this indicator can elevate your performance.

👉 Start improving your trades today—download the Gann Fan and Fibonacci Indicator at IndicatorForest.com.

Published:

Oct 15, 2025 07:13 AM

Category: