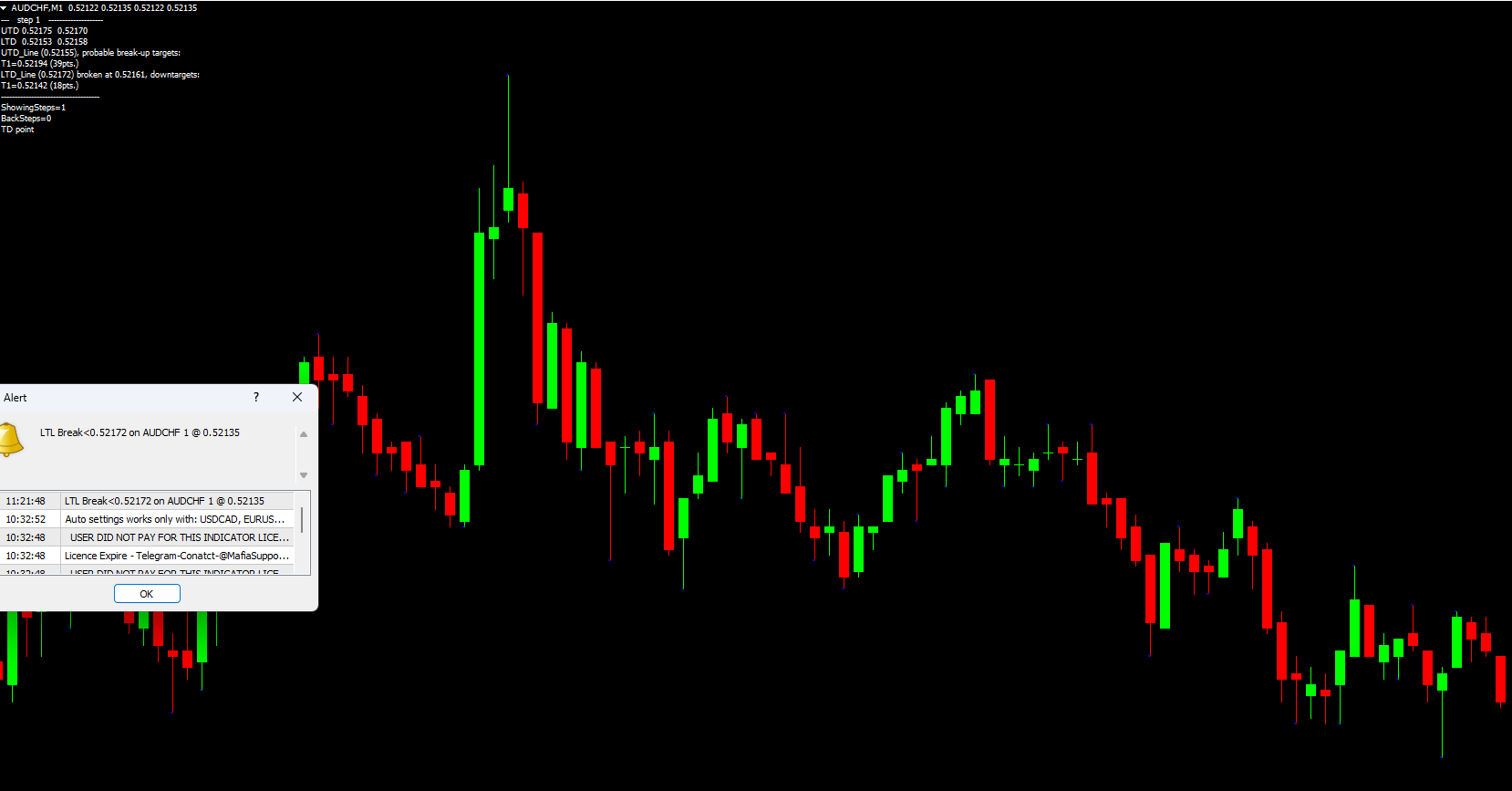

The DeMark Trendline Trader Indicator for MT4 is a powerful charting tool that automatically plots diagonal and horizontal trendlines to highlight the market’s trend direction. These trendlines act as dynamic support and resistance levels, helping traders identify breakouts, reversals, and trend continuation opportunities. The DeMark Trendline Trader Indicator simplifies market structure, making it easier to understand price reactions and potential trading zones right from the first glance.

The DeMark Trendline Trader Indicator is built to detect market structure using Tom DeMark’s trendline methodology. It draws two diagonal and two horizontal levels on the chart, each color-coded for clarity:

Red Line (HL1): Identifies support levels

Lime Green Line (LL1): Identifies resistance levels

These angled lines show the directional trend based on recent swing highs and lows, helping traders visualize trend progression.

Green Line (HC1): Represents resistance

Crimson Red Line (LC1): Represents support

These horizontal levels reveal key price areas where the market has historically reacted or paused.

The indicator also displays text information in the upper-left portion of the chart. This includes price levels, support and resistance zones, and potential breakout targets, giving traders an instant understanding of market conditions.

In addition to lines and text, the indicator plots dots above candlesticks that highlight relevant swing points. These markers support trendline formation and help traders confirm structure.

The DeMark Trendline Trader Indicator is especially useful for traders who prefer structured market analysis without manually drawing trendlines.

Automatic trendline detection eliminates manual plotting

Support/resistance visualization helps identify breakout zones

Color-coded clarity makes chart reading easier

Superior on higher timeframes like H4, Daily, and Weekly

Works across forex pairs, indices, and metals

Because Tom DeMark’s methodology focuses on price exhaustion and structural shifts, the indicator offers insights that many standard MT4 tools cannot.

To use the indicator effectively, traders must pay attention to the diagonal trendlines, as they provide the primary signal direction.

A red diagonal line (HL1) appears, indicating a support level.

Traders can consider entering long positions when:

Price reacts upward from the red support line

Dots confirm swing points

Horizontal lines show space for an upward breakout

Stop-loss placement is typically set below the support line or the previous swing low.

A lime green diagonal line (LL1) indicates resistance.

A sell opportunity arises when:

Price rejects or breaks downward from the lime green resistance line

Trendline and dot structure align with bearish conditions

Crimson horizontal support is below, offering profit target zones

Stop-loss can be placed above the resistance swing.

The horizontal crimson (LC1) and green (HC1) lines represent potential breakout zones. If one of these lines is missing, traders rely primarily on the diagonal lines for direction.

Breakouts gain more reliability when combined with confirmation tools such as the RSI or MACD, which can signal momentum strength or potential trend exhaustion.

The DeMark Trendline Trader Indicator performs best on longer timeframes including:

H4

Daily

Weekly

Short-term charts may generate more false signals due to noise and rapid price fluctuations.

The DeMark Trendline Trader Indicator provides a structured method to identify diagonal and horizontal support and resistance levels. It highlights breakout potential, displays useful price levels, and helps traders understand directional bias. Whether you're analyzing trends or spotting breakout setups, this indicator enhances chart clarity.

For more free MT4 indicators and trading tools, visit IndicatorForest.com today.

Published:

Nov 23, 2025 01:27 AM

Category: