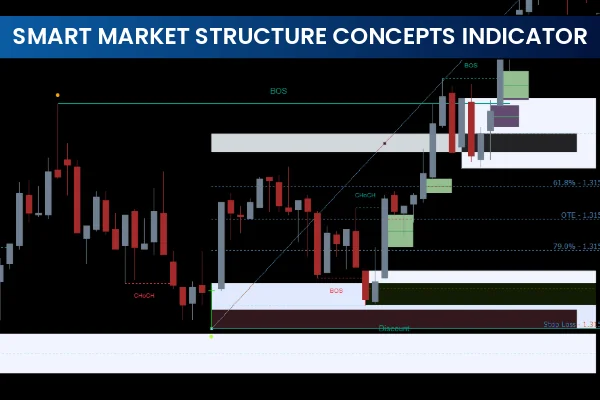

The Smart Market Structure Concepts Indicator for MT4 is an advanced visual trading tool built for traders who follow ICT trading methodology, Smart Money Concepts (SMC), and institutional market logic. It automatically scans the market in real time and plots essential structure elements such as CHoCH (Change of Character), BOS (Break of Structure), Fair Value Gaps (FVGs), strong/weak highs and lows, order blocks, liquidity zones, equilibrium levels, and killzones.

Instead of manually drawing levels and waiting for structure confirmation, this indicator simplifies your chart by automatically identifying critical market structure shifts and institutional price points. Whether you trade forex, indices, or commodities, it gives you a clearer narrative of where smart money may react.

The indicator instantly marks CHoCH to signal potential trend reversals and BOS to confirm continuation setups. These automatic annotations eliminate guesswork and help traders stay aligned with the true market structure.

Bullish and bearish fair value gaps are drawn in real time, helping traders identify imbalance zones and potential mitigation points—essential elements of ICT’s price delivery algorithm.

The indicator highlights:

Buy-side liquidity (BSL)

Sell-side liquidity (SSL)

Liquidity pools

Liquidity sweeps

Internal/external liquidity

This helps traders pinpoint areas where price is likely to move before reversing.

It plots:

Previous Day High

Previous Day Low

Previous Day Open

Previous Day Close

These daily reference points are crucial for session traders and ICT-style scalping.

The indicator marks high-probability trading windows such as:

Asian Killzone

London Open Killzone

New York Killzone

New York Reversal Window

Traders who rely on session volatility benefit greatly from these automated zones.

Based on displacement and liquidity behavior, the indicator identifies:

Strong Highs (likely to hold)

Weak Highs (likely to be taken)

Strong Lows

Weak Lows

This helps traders predict where liquidity hunts may occur.

The indicator provides a rich set of visual signals based on institutional order flow:

These are the backbone of SMC trading.

CHoCH indicates potential trend reversal after liquidity is taken.

BOS confirms continuation in the current direction.

The indicator identifies potential reaction points such as:

Liquidity grabs

Swing highs/lows

Buy/sell-side liquidity

Equal highs/lows

Internal range liquidity

A liquidity sweep followed by CHoCH often leads to high-probability setups.

When price enters an FVG zone and reacts, traders can look for:

Reversal entries

Mitigation plays

OTE setups

Continuation trades

Killzones create windows of volatility where institutional traders participate.

Combining killzones with structure signals greatly increases accuracy.

The indicator also outlines 79–61.8% retracement zones, ideal for ICT-style continuation entries.

Removes the need to draw levels manually

Helps avoid chart clutter

Perfect for ICT/SMC training and real trading

Works on all timeframes

Great for scalping, day trading, and swing trading

Creates full market narrative from structure → liquidity → imbalance

Whether you're a beginner learning SMC or an advanced trader refining institutional entries, this indicator delivers unmatched clarity.

The Smart Market Structure Concepts Indicator for MT4 is more than a market structure tool—it’s a complete ecosystem for ICT and Smart Money traders. With automated CHoCH/BOS detection, liquidity mapping, fair value gaps, killzones, and daily reference levels, it transforms your chart into a professional institutional framework.

For traders wanting to evolve beyond simple support and resistance and understand the deeper logic behind market movement, this indicator is a must-have.

Visit IndicatorForest.com to download more premium and free MT4 indicators designed for advanced trading strategies.

Published:

Nov 18, 2025 10:37 AM

Category: