The Gold Stuff Indicator is a powerful and advanced MT4 trading tool designed to identify market trends, momentum shifts, and potential reversal points with high efficiency. This indicator uses a refined algorithm to visually display bullish and bearish market conditions, making it suitable for both beginners and professional traders. By plotting colored bars and directional arrows directly on the chart, the Gold Stuff Indicator helps traders make informed decisions across forex, commodities, and even stock markets.

Whether you prefer trend-following strategies or scalping setups, this indicator gives you a clear advantage by highlighting momentum changes early and accurately. Traders who want reliable visual cues and simple price-action confirmation often choose this tool due to its clarity and ease of use.

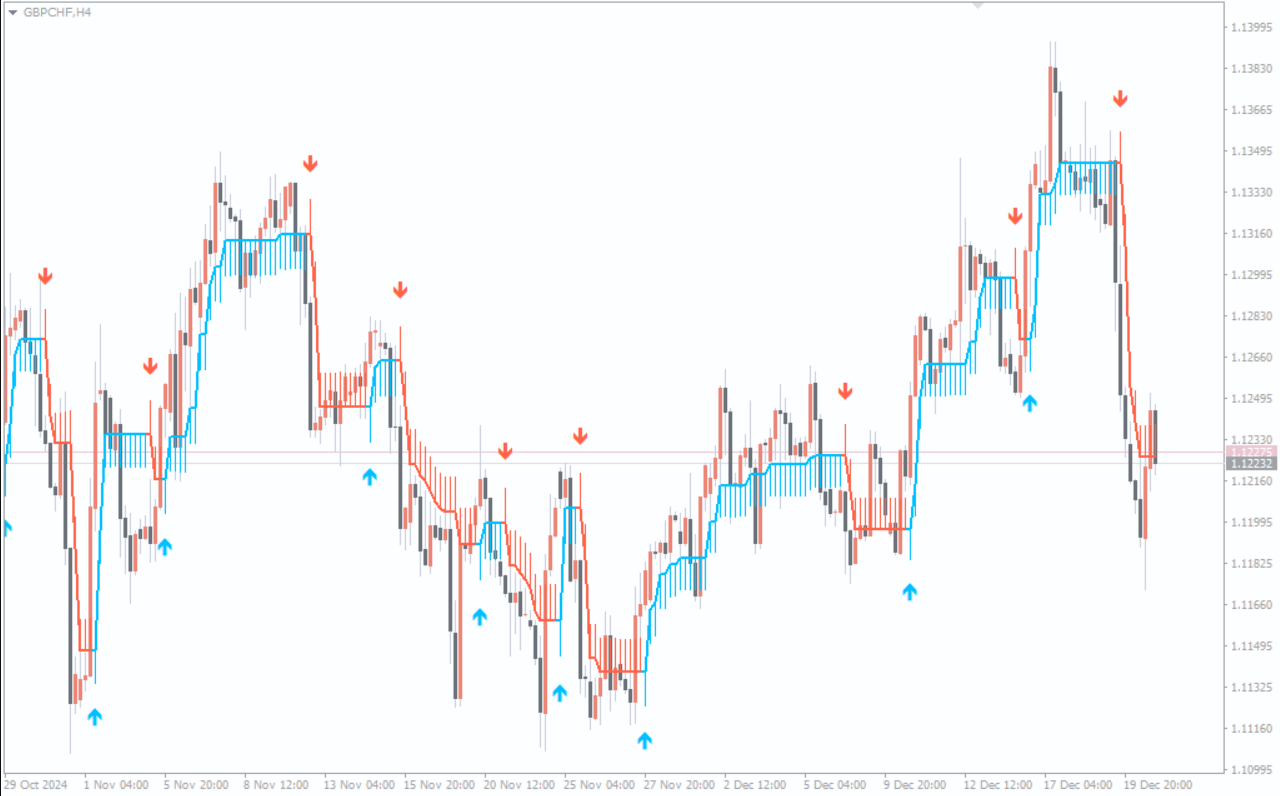

The Gold Stuff Indicator analyzes market momentum and determines whether buyers or sellers are dominating. It uses color-coded bars and arrow signals to communicate market direction instantly.

Blue bars indicate bullish conditions and potential buy opportunities.

Red bars signal bearish market pressure and potential sell opportunities.

The indicator’s algorithm tracks trend strength, volatility shifts, and price dynamics, making its signals more reliable than basic moving average crossovers or lagging oscillators.

The standout feature of the Gold Stuff Indicator is its ability to simplify complex market data. Instead of relying solely on candlestick patterns, traders can quickly understand the prevailing trend through color changes on the chart.

This makes it especially helpful during fast-moving sessions such as London and New York opens, where quick decision-making is essential.

The Gold Stuff Indicator provides clear and actionable buy/sell signals based on momentum and trend direction:

Blue bars begin printing consistently.

A bullish arrow appears near a support zone.

Price starts forming higher highs and higher lows.

Red bars dominate the chart.

A bearish arrow appears at or near a resistance level.

Downtrend structure (lower highs, lower lows) becomes clear.

Traders may choose to combine this indicator with:

Volume indicators

RSI or Stochastic oscillators

These combinations strengthen confirmation and help filter out false signals, especially during low-volatility market conditions.

The Gold Stuff Indicator performs exceptionally well in trending markets. During strong directional movements, the indicator offers early detection of trend continuation or reversal. Thanks to its adjustable amplitude setting, traders can fine-tune sensitivity depending on market type:

High amplitude: Filters noise; ideal for swing trading.

Low amplitude: Detects smaller momentum shifts; excellent for scalping.

Because of this flexibility, the indicator adapts to diverse trading styles:

Day trading

Intraday breakout strategies

Trend continuation methods

Counter-trend reversals (with confluence)

Some benefits include:

Easy visual interpretation

Works across forex, gold, indices, commodities

Helps reduce emotional decision-making

Customizable sensitivity

High accuracy during trending phases

Beginner-friendly and suitable for experts

This indicator gives traders the confidence to enter trades with clarity and exit with precision—crucial in volatile markets.

The Gold Stuff Indicator is a must-have addition to any trader’s technical toolkit, offering reliable trend detection, simplified chart visualization, and enhanced accuracy. Its adaptive algorithm works across various markets and timeframes, helping traders identify profitable opportunities with ease.

To download the Gold Stuff Indicator and explore more powerful trading tools, visit IndicatorForest.com today and elevate your trading strategy.

Published:

Nov 17, 2025 21:31 PM

Category: