The Dual Ulcer Index Indicator is a unique technical analysis tool developed in 1987 by Peter Marin and Bryon McCann. Originally known as the Ulcer Index, it was designed to measure downside risk — or the “pain” of price drawdowns — in trading instruments. Unlike volatility-based indicators that consider both upward and downward movements, the Dual Ulcer Index focuses solely on downside volatility, which makes it ideal for risk-conscious traders.

In Forex and other financial markets, where prices never reach zero, the Dual Ulcer Index can be used to analyze both bullish and bearish trends. This makes it a versatile tool for traders seeking to optimize entries and exits based on risk exposure.

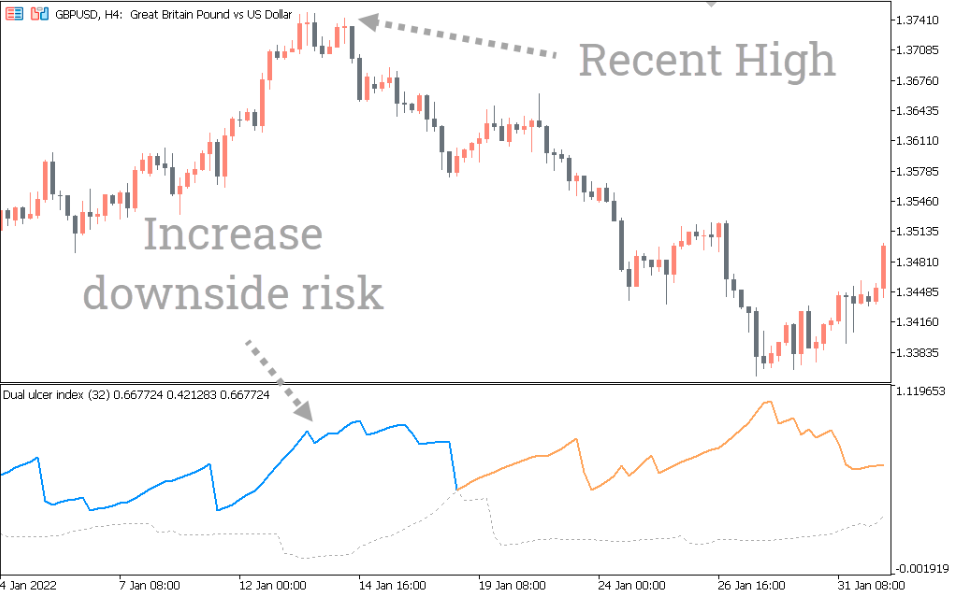

The Dual Ulcer Index Indicator measures both the depth and duration of price drawdowns from previous highs. When the market experiences a decline, the index value increases, reflecting greater downside risk. Conversely, as the market recovers and prices move toward new highs, the index decreases.

When the indicator approaches zero, it signifies a strong bullish condition where prices are consistently hitting higher highs. On the other hand, a sharp rise in the Dual Ulcer Index signals a period of increased risk and potential price correction.

Suppose the Dual Ulcer Index is flat near zero — this indicates that the market is stable or trending upward. If the index starts to rise rapidly, it may be time for traders to tighten stop-loss levels or take profit, as this could signal an upcoming drawdown.

The Dual Ulcer Index Indicator can be applied to any trading instrument or timeframe. Here’s how traders can incorporate it into their strategy:

Identify Downside Risk:

When the index rises sharply, it indicates increasing drawdown. Traders holding long positions should consider risk management or partial exits.

Confirm Uptrend Strength:

A low or falling index suggests that prices are making consistent new highs, signaling a healthy uptrend. This can be a good time to add to long positions or trail stops higher.

Avoid Emotional Trading:

The Dual Ulcer Index provides a rational measure of risk exposure, helping traders stay objective rather than reacting emotionally to market fluctuations.

Combine with Other Indicators:

For best results, use it alongside momentum indicators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to confirm entries and exits.

Focuses specifically on downside risk, not total volatility.

Works across multiple markets including Forex, stocks, and commodities.

Helps traders identify low-risk periods for entries.

Easy to interpret: low readings = stable uptrend, high readings = elevated risk.

By focusing on drawdown duration and depth, the indicator gives traders a clearer sense of the market’s emotional “pain level,” helping to prevent poor decisions during volatile times.

The Dual Ulcer Index Indicator is an excellent tool for traders who want to track downside risk and maintain discipline during volatile market phases. By keeping an eye on the index value, traders can make more informed decisions about when to hold, exit, or add to positions.

To explore more advanced Forex tools like this, visit IndicatorForest.com — your trusted source for premium Forex indicators bundles and expert trading insights.

Published:

Oct 12, 2025 13:48 PM

Category: