The Chande Kroll Stop Indicator for MT4 is a smart and reliable trading tool designed to help forex traders calculate dynamic protective stop-loss levels. Created by Tushar Chande and Stanley Kroll, this indicator is based on volatility and directional movement, ensuring that stop losses are adaptive and market-responsive.

Unlike static stop losses that can easily be hit by short-term price fluctuations, the Chande Kroll Stop automatically adjusts with market volatility, helping traders lock in profits and protect positions even during unpredictable conditions.

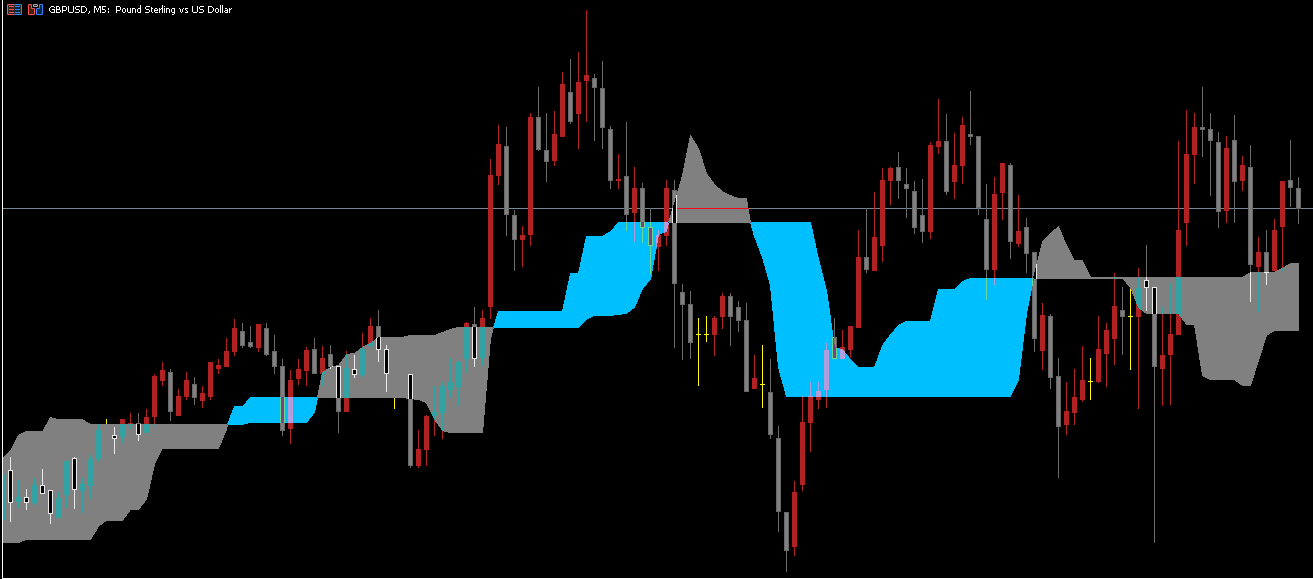

The Chande Kroll Stop Indicator calculates its values using the Average True Range (ATR) and directional movement of price. The indicator displays two main lines on the chart — the long stop line and the short stop line — which create a colored zone (either blue or gray) depending on market direction.

Here’s how it works:

In bullish markets, the blue zone represents the long stop area.

In bearish markets, the gray zone acts as the short stop area.

These zones serve as visual guides for stop-loss placement, helping traders manage risk effectively and avoid premature exits caused by short-term volatility.

Using the Chande Kroll Stop on MT4 is straightforward:

Attach the indicator to your trading chart.

Observe the two plotted lines — one representing the long stop, and the other the short stop.

The colored zone (blue or gray) indicates which line is active:

Blue Zone: Market is trending upward (buy setup).

Gray Zone: Market is trending downward (sell setup).

Set your stop-loss level just beyond the active stop line to protect your trade.

The indicator automatically adjusts as volatility changes, meaning your stop loss will trail price effectively without manual recalculation.

The Chande Kroll Stop Indicator is not just for setting stop losses — it also generates buy and sell signals based on color changes in the indicator zone.

When the zone color changes from gray to blue, it indicates a potential uptrend.

Traders can open a buy trade and place the stop loss near the lower boundary of the blue zone.

As the price rises, the blue zone will trail the movement, protecting accumulated profit.

When the zone color changes from blue to gray, it signals a downtrend.

Traders can enter a sell trade with the stop loss placed above the upper boundary of the gray zone.

As the price declines, the gray zone trails the movement, ensuring your trade remains protected.

This color-based visual system makes the indicator easy to interpret, even for beginner traders.

A simple and effective exit strategy can be applied using the indicator’s zone behavior:

For long trades: Exit when the price drops into the blue zone.

For short trades: Exit when the price rises into the gray zone.

This method prevents you from holding losing positions for too long and helps secure profits when market conditions change direction.

Let’s look at a typical GBP/USD example on an H1 chart:

When the gray zone turned blue, it generated a buy signal. Shortly after, the price rallied upward.

The blue zone acted as a dynamic trailing stop, keeping the position safe during temporary retracements.

When the uptrend ended, the indicator flattened and eventually changed color to gray, signaling a sell setup.

The following decline confirmed the signal’s reliability, with the gray zone serving as a new trailing stop.

This example illustrates how the indicator not only helps identify entries but also manages exits with precision.

Dynamic Stop Loss: Automatically adjusts based on volatility and price movement.

Works on All Timeframes: From M1 to monthly charts.

Simple Color System: Easy-to-read zones for quick decision-making.

Protects Profits: Trails price action effectively to secure gains.

Versatile Use: Can be applied to forex, commodities, indices, and crypto trading.

To get the most out of this indicator:

Combine it with trend confirmation tools like Moving Averages or ADX.

Avoid using it in extremely low-volatility markets, as signals may lag.

Always respect your stop loss and follow sound risk management principles.

Test settings on a demo account before applying them to live trading.

The Chande Kroll Stop Indicator for MT4 is a powerful tool for traders who want to manage risk intelligently and maintain consistent profits. Its ability to adapt to volatility and track stop losses dynamically makes it one of the most practical and reliable indicators for trade management.

Whether you’re a day trader, swing trader, or long-term investor, the Chande Kroll Stop can help you stay disciplined, avoid emotional exits, and protect your capital effectively. Download it today and take your trade management strategy to the next level.

Published:

Nov 05, 2025 11:40 AM

Category: