The Darvas Boxes Indicator for MetaTrader 5 (MT5) is built upon the legendary Nicholas Darvas trading strategy, which famously transformed a few thousand dollars into over $2 million in just 19 months. This indicator visualizes Darvas’s momentum-based breakout method, allowing traders to spot potential trend continuation or reversal points with high accuracy.

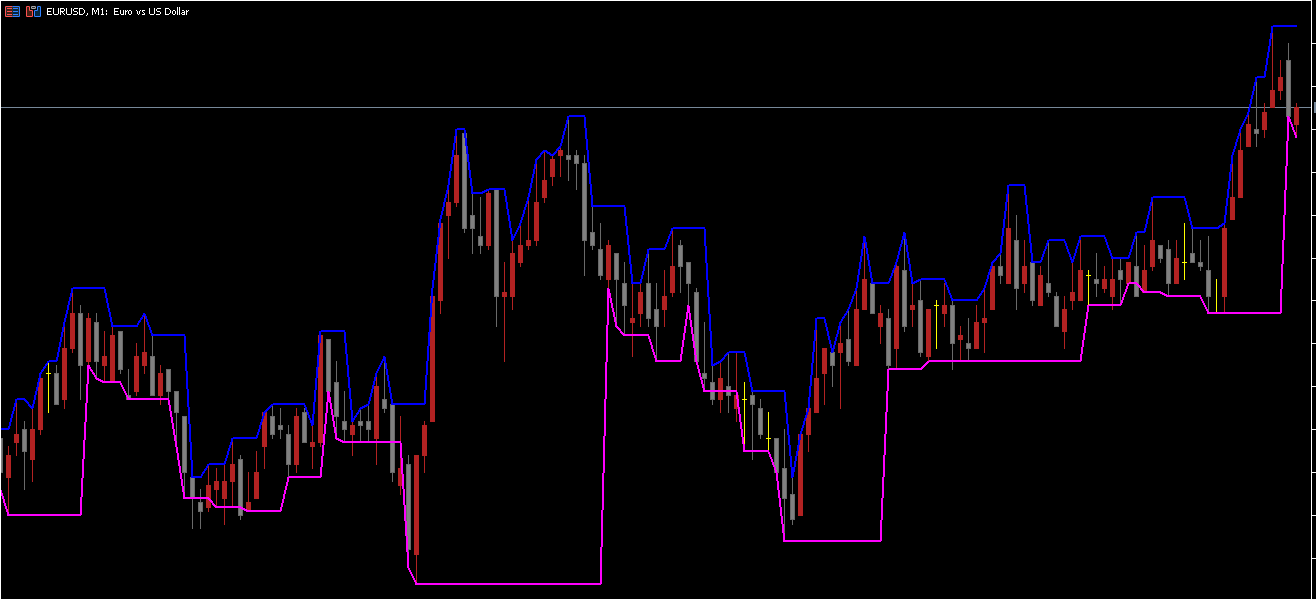

Unlike predictive systems, the Darvas Boxes Indicator reacts to real market movement—a practical advantage since markets often behave irrationally. It draws dynamic boxes on the chart, representing price consolidation zones, and generates BUY/SELL signals when price breaks out of these zones.

The Darvas Boxes Indicator identifies market structure by drawing rectangular boxes around price ranges. These boxes adjust dynamically based on price action, showing areas of accumulation or consolidation.

The upper boundary of each box represents resistance or the high of a range.

The lower boundary represents support or the low of a range.

When price breaks out above or below these levels, it signals potential momentum continuation.

This makes it a perfect trend-following tool that reacts to momentum rather than predicting it.

The Darvas Boxes Indicator works well on higher timeframes such as H1, H4, or Daily, though scalpers can also use it on shorter timeframes for smaller pip targets.

Wait for the price to break above the upper boundary of the current box.

Enter a BUY (LONG) position after the breakout confirmation.

Place your Stop Loss a few pips below the upper boundary of the previous box.

For Take Profit, use a 1:1 risk-to-reward ratio or manage the trade manually as new boxes form above.

The logic is to ride the momentum as price continues to form higher boxes, indicating a strong bullish trend.

Wait for the price to break below the lower boundary of the current box.

Enter a SELL (SHORT) position once the breakout is confirmed.

Place your Stop Loss a few pips above the upper band of the broken box.

Take profit at the next support level or apply a 1:1 risk-to-reward ratio.

This setup works best when the market transitions from consolidation to a strong downward trend.

Traders appreciate the Darvas Boxes Indicator for its simplicity, objectivity, and effectiveness in momentum trading. Key advantages include:

Trend Confirmation: Helps identify valid breakouts and trend continuations.

Visual Clarity: Boxes make it easy to see support, resistance, and consolidation zones.

Multi-Timeframe Compatibility: Works efficiently across all timeframes, especially H1 and above.

Momentum-Based Entries: Ensures traders follow the trend rather than fight it.

Beginner-Friendly: Minimal setup required—just attach it to your chart and trade the breakout.

To get the most reliable signals from the Darvas Boxes Indicator:

Combine it with price action tools such as candlestick patterns or trendlines.

Use confirmation from other indicators like MACD, ADX, or Moving Averages.

Avoid trading breakouts during low-volatility sessions.

Test your strategy on a demo account before applying it live.

This ensures better accuracy and helps filter out false breakouts that can occur in choppy markets.

The Darvas Boxes Indicator for MT5 is a versatile tool that helps traders capitalize on momentum breakouts and trend continuations. Inspired by Nicholas Darvas’s proven trading method, it offers both simplicity and precision for modern traders.

Whether you’re an intraday trader or a swing trader, the indicator provides a clear structure for identifying profitable trading opportunities.

👉 Download the Darvas Boxes Indicator for MT5 today and experience the power of momentum-based trading in your MetaTrader platform.

Published:

Nov 07, 2025 05:00 AM

Category: