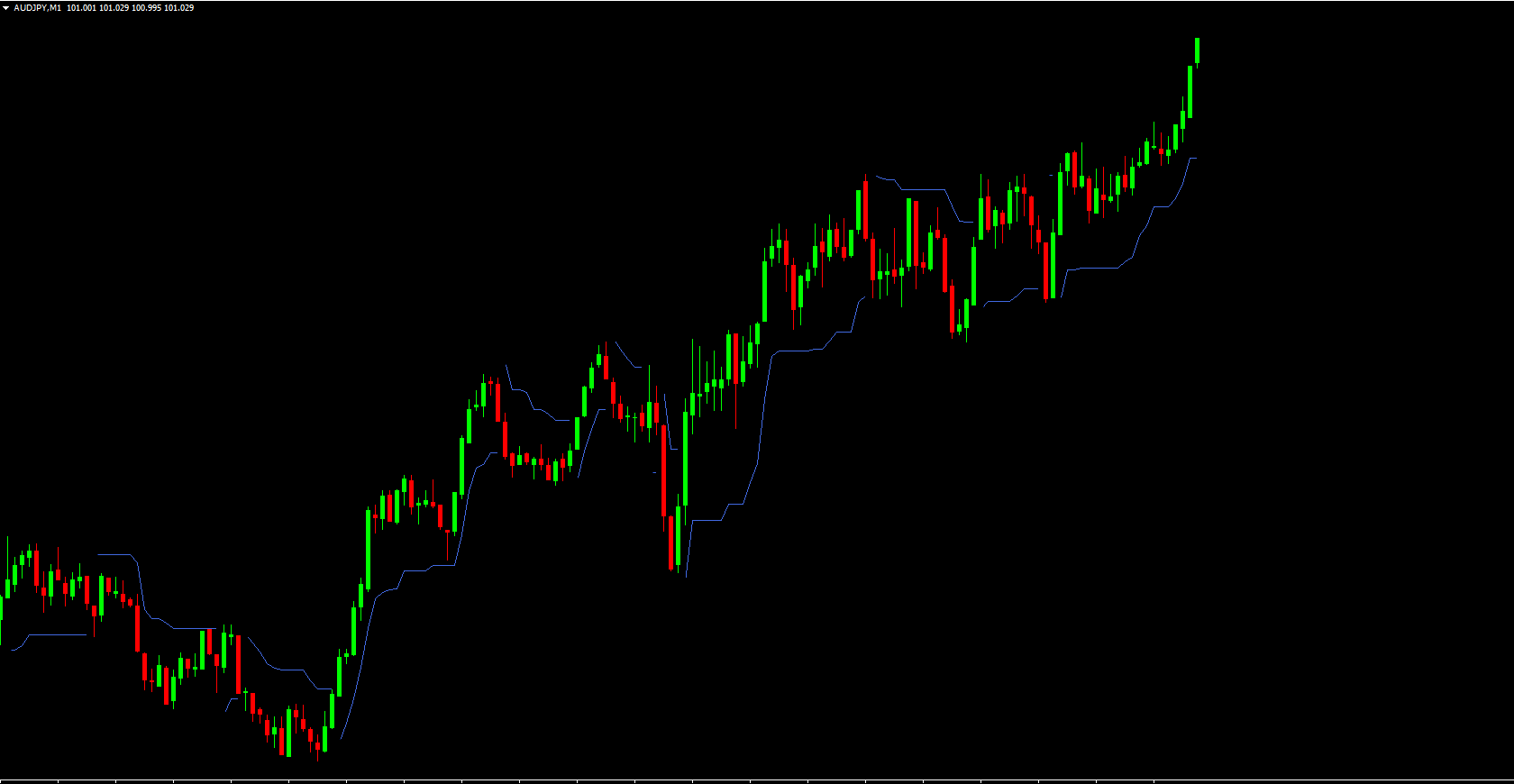

The ATR Stop Indicator is a powerful stop-loss management tool designed for MetaTrader 4 (MT4). Built on the foundation of the traditional Average True Range (ATR) indicator, it identifies stop-loss levels based on market volatility instead of arbitrary pip distances. This makes the ATR Stop Indicator a highly reliable risk-management utility for traders who prefer dynamic protection over fixed stop placements.

The indicator combines two main components: the ATR value, which measures current volatility, and a multiplier, which determines how far the stop-loss should be placed from the active price. When volatility increases, stop levels automatically widen, and when volatility decreases, stops tighten—ensuring both flexibility and safety.

Although the ATR Stop Indicator works on all MT4 timeframes, applying it on higher timeframes—such as H4 or Daily—typically produces cleaner, more stable results due to reduced market noise.

The ATR value measures the average range of price movement over a specific period. Higher ATR readings indicate volatile market conditions, while lower readings suggest calmer environments.

The multiplier determines how far away your stop will be placed relative to the ATR value.

For example:

Stop-Loss Distance = ATR x Multiplier

A larger multiplier produces a wider stop, while a smaller one tightens your stop.

The ATR Stop Indicator’s main purpose is determining safe stop-loss levels, not generating buy or sell signals. It helps traders avoid placing stops too close (leading to premature exits) or too far (risking excessive loss).

Many traders use the indicator to set:

Initial stop-loss levels when opening a trade

Trailing stops as the market moves in their favor

As market volatility changes, the ATR Stop Indicator adjusts, helping protect profits while allowing trends to develop naturally.

To improve accuracy, traders often combine the ATR Stop Indicator with other technical tools such as:

RSI – for identifying overbought or oversold conditions

MACD – for spotting trend direction and momentum

Moving averages – for confirming trend alignment

For example, if MACD confirms a bullish trend and the ATR stop places a safe stop-loss below a key support level, the trader gains a strong confluence for placing a buy trade.

On a EUR/USD H4 chart, the ATR Stop Indicator plots dynamic stop levels that move as market volatility changes. Suppose a trader opens a long position during a bullish trend. The ATR Stop Indicator will place the stop-loss below current price based on the ATR multiplier.

As the price continues upward:

ATR values may increase or decrease

Stop-loss levels trail the price accordingly

The trader locks in profits without manually adjusting the stop

This approach provides volatility-based risk control, greatly reducing emotional decision-making.

Adapts stops automatically to market volatility

Avoids stop-loss hunting caused by tight stops

Works on all MT4 timeframes

Ideal for swing, intraday, and trend-following strategies

Simple, visual risk-management tool

Enhances disciplined trading through consistent stop placement

Using ATR stops helps traders maintain structured risk management—one of the most crucial elements of long-term success.

The ATR Stop Indicator for MT4 gives traders an adaptive and highly effective method for placing stop-loss levels. By taking volatility into account, it produces realistic stops that adjust with market conditions. Whether used for initial stop placement or for trailing profits, this indicator brings clarity and precision to your risk management strategy.

To download more powerful MT4 tools and explore premium trading indicators, visit IndicatorForest.com.

Published:

Nov 14, 2025 10:57 AM

Category: