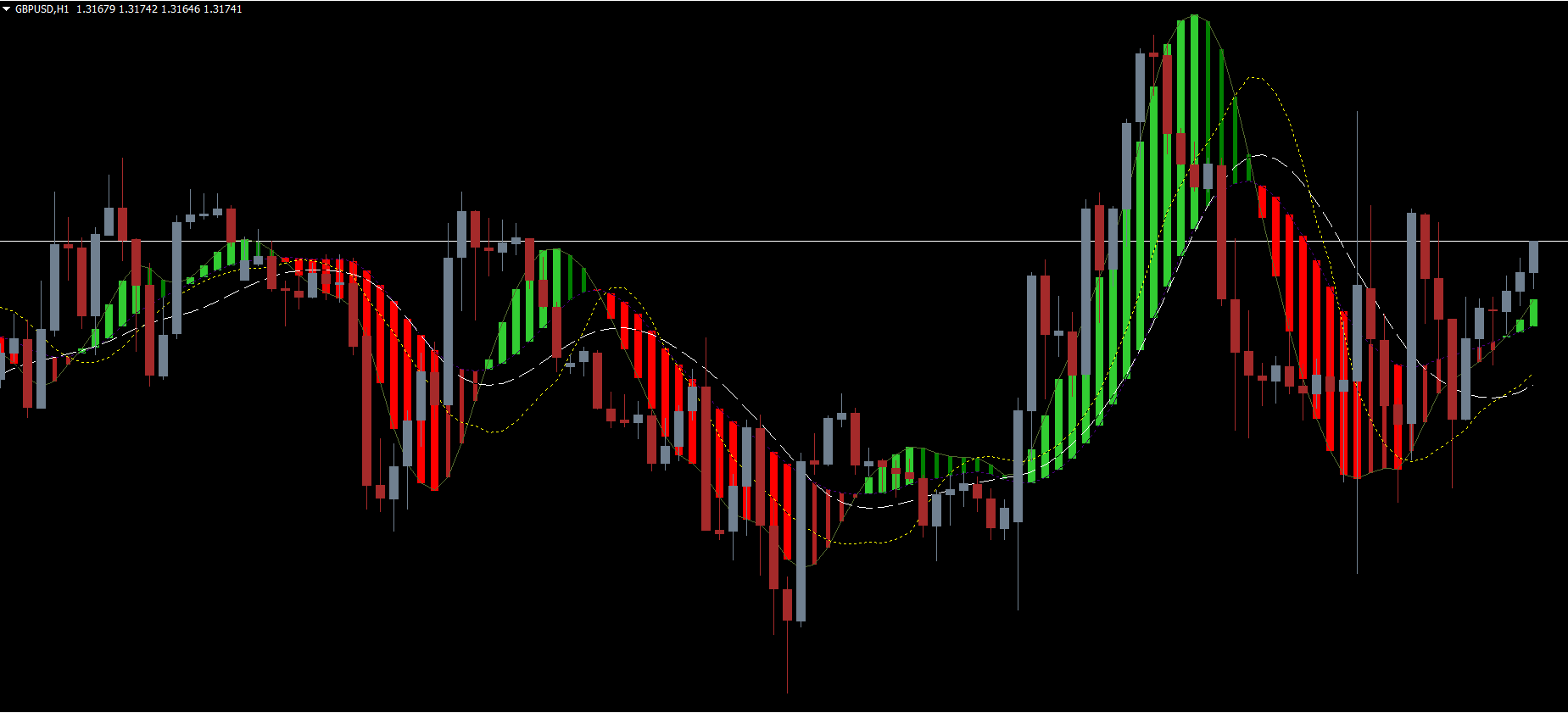

The All MACD Adaptive MTF Indicator for MT4 is an advanced technical analysis tool that enhances traditional MACD signals by combining three powerful moving averages: VWMA, T3 fast MA, and T3 slow MA. This multi-timeframe (MTF) indicator offers a more accurate reading of market conditions by adapting to volatility and providing dynamic support and resistance zones.

Unlike the classic MACD, this adaptive version modifies its calculations based on price behavior across different timeframes, resulting in more reliable signals. With color-shifting MACD bars, crossover logic, and built-in MA structure, the All MACD Adaptive MTF Indicator helps traders confirm trend direction, detect momentum shifts, and identify high-probability entry and exit points.

The red Volume-Weighted Moving Average (VWMA) acts as the signal line of the indicator. Because VWMA incorporates volume into its calculation, it reacts more sensitively to significant price moves.

When the VWMA rises above the MACD cloud, it indicates bullish bias.

When it falls below the cloud, bearish momentum may be developing.

This simple relationship between VWMA and the MACD cloud is one of the core signals traders use to confirm trend direction.

The Adaptive MACD cloud dynamically adjusts with price fluctuations. As the market momentum shifts, the indicator changes the MACD bar colors:

Green bars signal bullish pressure

Red bars signal bearish pressure

This visual behavior makes it easier to recognize early trend reversals or momentum weakening, particularly when combined with multi-timeframe readings.

The indicator applies T3 fast-MA and T3 slow-MA, working together as a trend-confirmation system.

When the fast-T3 MA crosses above the slow-T3, it signals a bullish trend shift.

When the fast-T3 MA crosses below the slow-T3, it suggests bearish continuation.

The T3 moving average is smoother than traditional MAs, reducing noise and helping traders focus on genuine trend changes.

A bullish trading signal forms when:

The VWMA (signal MA) moves above the adaptive MACD cloud

The fast-T3 MA crosses above the slow-T3 MA

MACD bars turn green, showing rising momentum

This combination provides confluence, allowing traders to capture trend continuation moves with higher accuracy.

A bearish signal appears when:

The VWMA drops below the MACD cloud

The fast-T3 MA moves below the slow-T3 MA

MACD bars turn red, signaling bearish momentum

Traders can use the dynamic MA zones as support/resistance areas to refine entries and place stop-loss levels.

The indicator adapts to different timeframes, allowing traders to align lower-timeframe entries with higher-timeframe trends. This reduces false signals and increases precision.

The moving averages act as dynamic zones, making it easier to identify retracement entries and potential reversal zones.

This indicator is suitable for scalpers, day traders, and swing traders alike due to its flexibility and adaptive calculations.

With adjustable settings for MACD, T3, and VWMA, traders can tailor the indicator to match their trading style and preferred timeframe.

The All MACD Adaptive MTF Indicator for MT4 is a highly effective technical tool for traders who rely on trend structure, momentum shifts, and multi-timeframe confirmation. With VWMA signals, color-coded MACD bars, and T3 crossover logic, it provides a complete and visually intuitive trading system.

Its adaptability makes it suitable for traders of all experience levels, but it should always be used alongside broader analysis and risk management tools.

For more premium MT4 & MT5 indicators, visit IndicatorForest.com and explore our complete library of smart trading tools.

Published:

Nov 16, 2025 09:53 AM

Category: