The Ehlers Fisher Transform Indicator for MT4 is a cutting-edge technical tool developed by John F. Ehlers, a renowned market analyst and engineer. This indicator is designed to identify potential trend reversal zones by transforming price data into a Gaussian normal distribution. The key advantage of this transformation is that it enhances the visibility of turning points, making it easier for traders to spot early trend reversals in the forex market.

Ehlers’ algorithm is known for its sensitivity to price fluctuations, allowing traders to detect changes in market momentum before they are visible on standard oscillators or moving averages. Whether you trade forex, commodities, or indices, the Ehlers Fisher Transform Indicator can help refine your entry and exit timing.

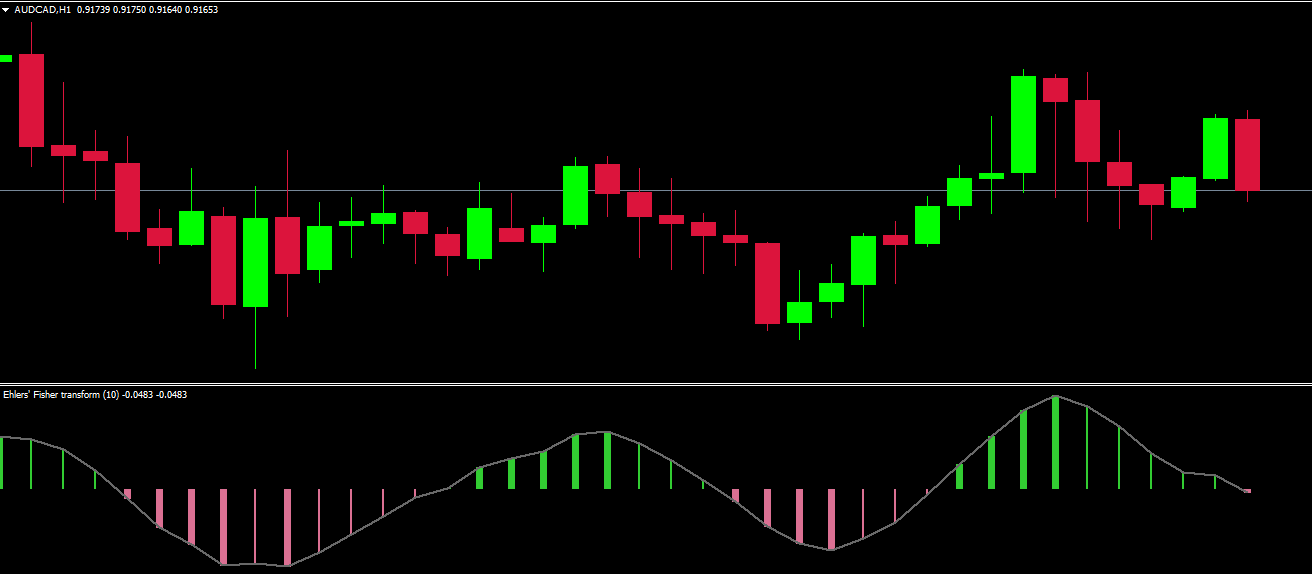

The Ehlers Fisher trading strategy revolves around identifying the bell-shaped curve pattern that typically occurs when a market approaches a potential reversal. The indicator plots a Fisher Transform line and histogram bars that together signal overbought and oversold conditions.

Fisher Transform Line: Represents the strength and direction of the current market trend.

Histogram Bars: Show whether the trend is bullish or bearish.

Color Cues: Lime green bars indicate bullish momentum (buy signals), while pale violet red bars represent bearish momentum (sell signals).

The synergy between these two components helps traders anticipate trend exhaustion and reversal zones with improved accuracy compared to traditional oscillators like the RSI or MACD.

The Ehlers Fisher Transform Indicator divides market conditions around the 0.00 centerline:

Above 0.00: Bullish bias — the market is likely in an uptrend.

Below 0.00: Bearish bias — the market is likely in a downtrend.

When the histogram bars are shaded, it indicates active buy or sell momentum. Conversely, unshaded bars suggest declining momentum and an early warning of a potential trend reversal.

Entry Signals: Enter long trades when histogram bars turn lime green and cross above the zero line.

Exit or Reverse: Consider selling when the bars turn pale violet red and drop below the centerline.

Avoid Choppy Markets: The indicator performs best in trending conditions — avoid trading during consolidation.

By combining the Ehlers Fisher Transform with trend confirmation tools like moving averages or the ADX, traders can improve signal reliability and reduce false entries.

Early Reversal Detection: Ideal for spotting turning points before they fully develop.

Clear Visual Representation: The color-coded histogram simplifies market interpretation.

Versatile Application: Works across multiple timeframes and asset classes.

Customizable Settings: Traders can adjust sensitivity according to their strategy or volatility preference.

The Ehlers Fisher Transform Indicator for MT4 is a robust and precise technical indicator that leverages J.F. Ehlers’ mathematical approach to trend analysis. Its ability to detect early reversals makes it an essential tool for traders who value timely market entries and exits.

To enhance your trading strategy and download the Ehlers Fisher Transform Indicator for MetaTrader 4, visit IndicatorForest.com — your trusted source for professional forex indicators and expert advisors.

Published:

Nov 02, 2025 03:36 AM

Category: