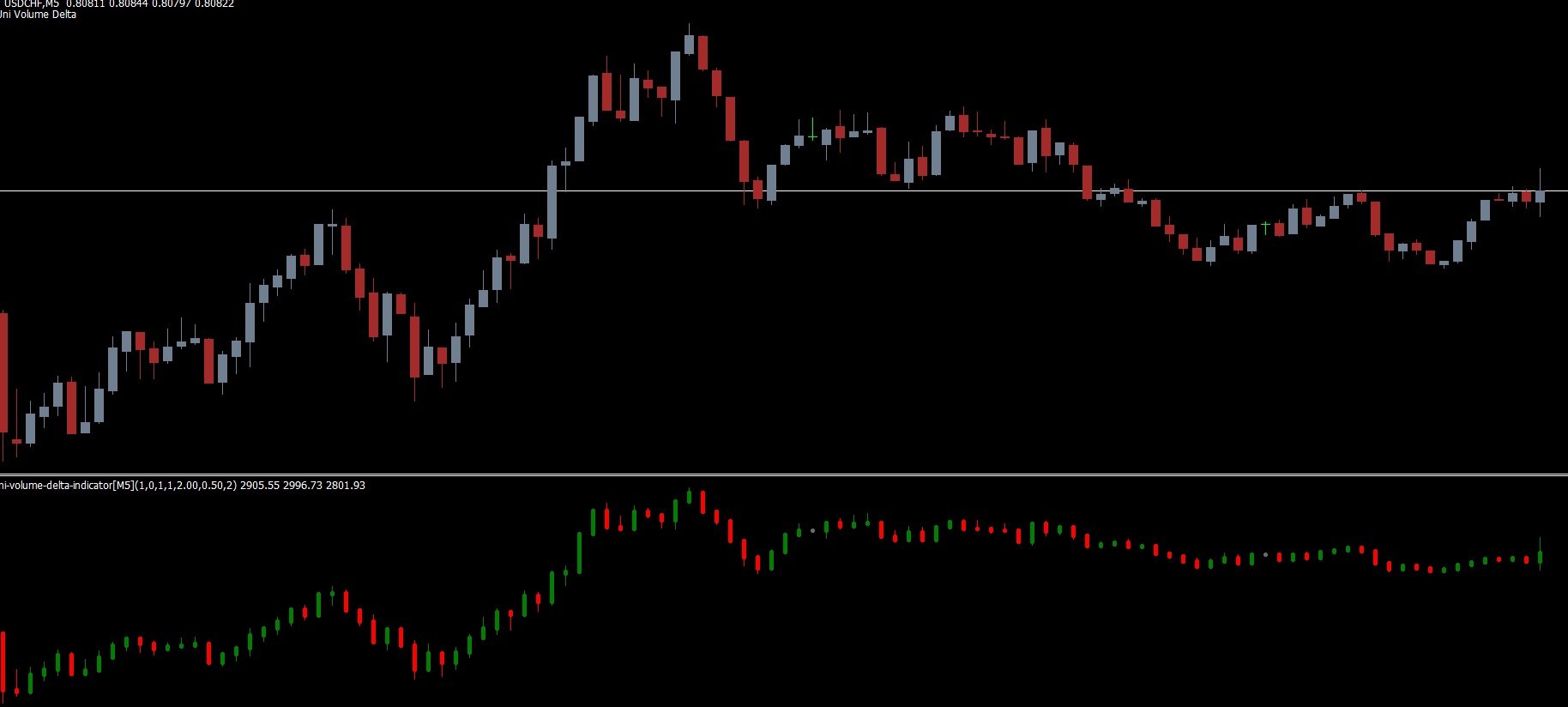

The Uni Volume Delta Indicator for MT4 is a simple yet highly informative technical tool designed to visualize market volume directly on the price chart. Instead of using a separate indicator window, it displays colored bars—similar to candlesticks—to reveal bullish, bearish, and neutral volume conditions. This makes it easy for forex traders to interpret market pressure, momentum, and potential trend reversals at a glance.

Whether you are a beginner or an intermediate trader, the Uni Volume Delta indicator helps you see how market participants are acting behind each candle. By combining price action with volume delta information, traders can gain insight into the strength behind each move.

The Uni Volume Delta indicator plots three types of bars based on trading volume:

A green bar indicates that bullish pressure is dominating, meaning buyers are more active in the market.

A red bar signals bearish volume, implying sellers are controlling the market.

A neutral bar appears when volume is weak or indecisive, often indicating consolidation or a potential pause before a reversal.

Because these bars visually resemble candlesticks, traders can interpret volume behavior naturally, just as they analyze standard price candles.

The indicator measures buy and sell volume and then displays it as a bar on the price chart. Since it aligns visually with existing candlesticks, traders can easily recognize patterns such as:

Volume spikes during breakouts

Weak volume during consolidation

Divergence between price action and volume delta

Trend continuation or trend exhaustion signals

This makes the Uni Volume Delta indicator valuable when combined with other tools, such as RSI, Stochastic, Moving Averages, or support/resistance zones.

Although useful on all timeframes, the Uni Volume Delta indicator is especially effective for short-term strategies, such as scalping and day trading. This is because shorter timeframes rely heavily on volume dynamics and momentum.

Below are detailed buy and sell setups:

Locate a green bar indicating bullish volume dominance.

Wait for price direction confirmation, such as a higher low or bullish candle formation.

Enter a buy trade at the appearance of a stable green bar.

Set stop-loss near the low of the signal bar or nearest support zone.

Exit the trade when a red bar or bearish volume appears, signaling a potential reversal.

This approach works best when combined with other indicators or price patterns such as bullish engulfing, RSI oversold conditions, or moving average crossovers.

Locate a red bar representing strong bearish volume.

Wait for price confirmation, such as a lower high or bearish candle.

Enter a sell trade once a clear red bar forms.

Place stop-loss near the high of the signal bar or nearest resistance.

Exit the trade when a green bar appears, suggesting buyers are returning.

Using this method helps avoid false signals and improves accuracy when combined with RSI, MACD, or a trendline break.

Works best on M1, M5, M15 for scalping

Use on H1 or H4 for confirmation but expect fewer signals

Avoid trading during low-volume sessions (Asian session for many pairs)

Always use a stop-loss to protect against unexpected volatility

Combine Uni Volume Delta with trend indicators for stronger setups

The Uni Volume Delta Indicator for MT4 is a powerful tool for understanding price strength and market sentiment. By visualizing bullish, bearish, and neutral volume directly on the chart, traders can make more informed decisions regarding entries and exits. While it works on all timeframes, it’s particularly effective for short-term trading strategies such as scalping and day trading.

To explore more free trading indicators and powerful MT4 tools, visit IndicatorForest.com today.

Published:

Nov 22, 2025 12:00 PM

Category: