The Turtle Channel Indicator is a powerful trend-following system for MetaTrader 4 (MT4) that uses historical price highs and lows to form dynamic breakout channels. Built on the principle that past highs and lows act as future support and resistance zones, the indicator helps traders identify market structure, trend direction, reversal points, and potential breakout opportunities.

By plotting colored channel lines, the Turtle Channel Indicator makes it easy for scalpers, day traders, and swing traders to follow price action and improve timing for entries and exits. Whether you're a beginner or an advanced trader, this indicator adds clarity and precision to your technical analysis.

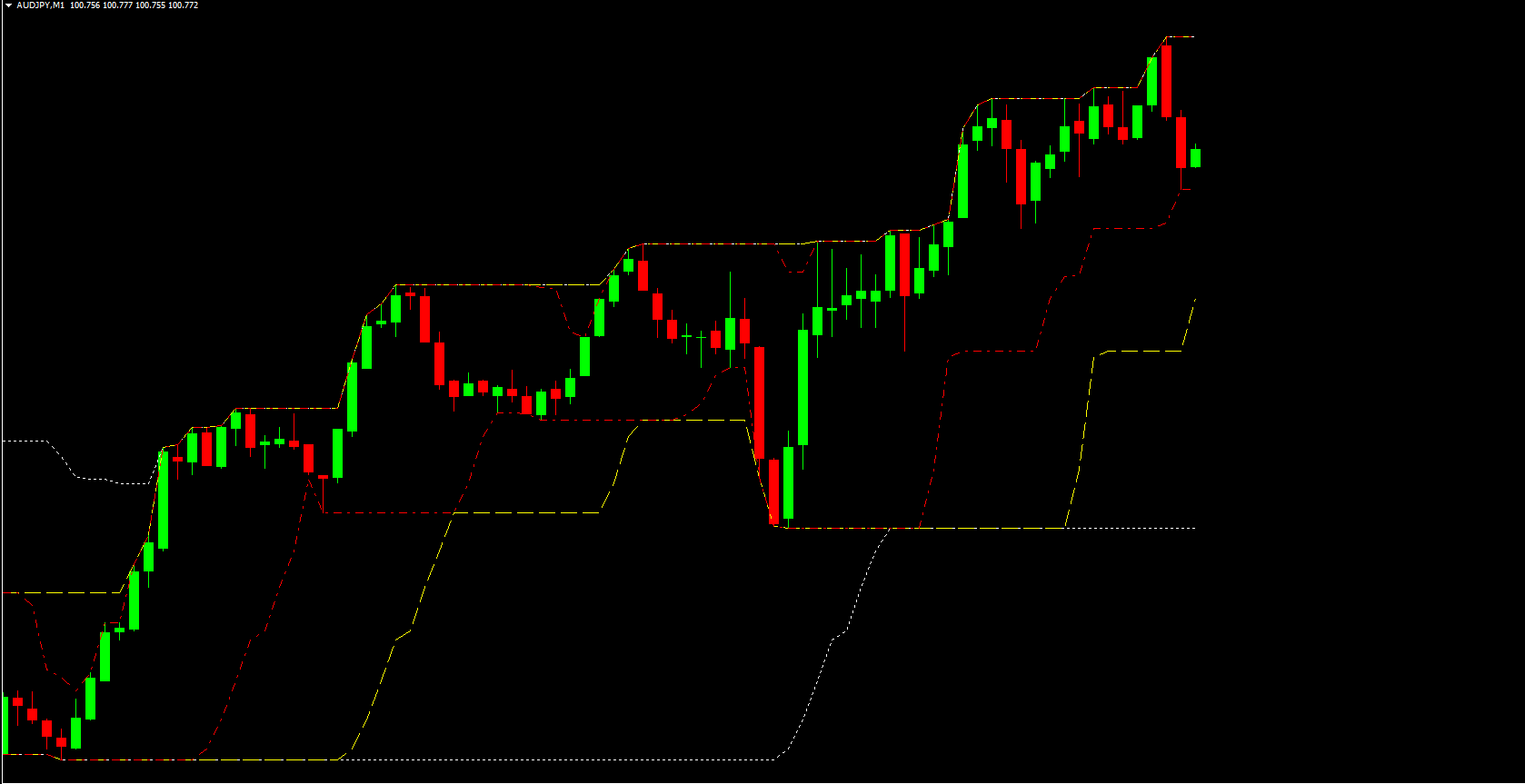

The indicator forms a channel based on:

Red Line – upper breakout level

Yellow Line – lower breakout level

White Line – optimal trade exit or mid-channel zone

These lines update dynamically as new price highs and lows are formed, giving traders a real-time view of trend strength and potential reversal zones.

Because historical highs often turn into resistance and historical lows turn into support, the Turtle Channel Indicator provides a reliable framework for predicting market reactions at key levels.

Traders typically look for buy or sell signals when the red and yellow lines align at the upper or lower channel. However, not every channel touch is a valid trade. It is essential to combine the indicator with:

Price action patterns

Trend confirmation indicators

Candlestick confirmation

Momentum tools (RSI, MACD, Stochastics)

This synergy increases accuracy and reduces false entries.

Consider the EURUSD pair on the M15 timeframe. The indicator provides multiple high-probability trade setups once price interacts with the channel lines.

Price forms a bullish engulfing candlestick pattern on the lower channel (yellow line). This indicates strong buying pressure and potential trend continuation or reversal to the upside.

Later, price forms a bearish engulfing pattern on the upper channel (red line). This signals potential weakness and a possible reversal downward.

These examples show the importance of price action confluence when using the Turtle Channel Indicator. The most reliable setups occur when channel interaction is supported by strong candlestick signals.

Excellent for identifying trend reversals

Works on all timeframes

Ideal for scalpers, intraday traders, and swing traders

Suitable for beginners, intermediate, and advanced traders

Helps identify breakout levels and exit points

Simple and visual representation of trend behavior

The Turtle Channel Indicator for MT4 is a reliable tool for trend-following and reversal trading strategies. By basing its channel on past highs and lows, it provides accurate forecasting of support, resistance, and breakout zones. Traders who combine the indicator with price action gain a significant advantage in spotting profitable setups.

To download more forex tools and explore hundreds of premium trading indicators, visit IndicatorForest.com.

Published:

Nov 14, 2025 10:13 AM

Category: