The Stochastic Bollinger Bands Indicator for MT4 combines two of the most popular technical analysis tools—Stochastic Oscillator and Bollinger Bands—to help traders identify high-probability setups in both overbought and oversold zones. By blending momentum signals with volatility bands, the indicator provides a clearer picture of price exhaustion, making it valuable for scalpers, intraday traders, and swing traders. The focus keyword appears naturally throughout this guide to ensure proper SEO optimization.

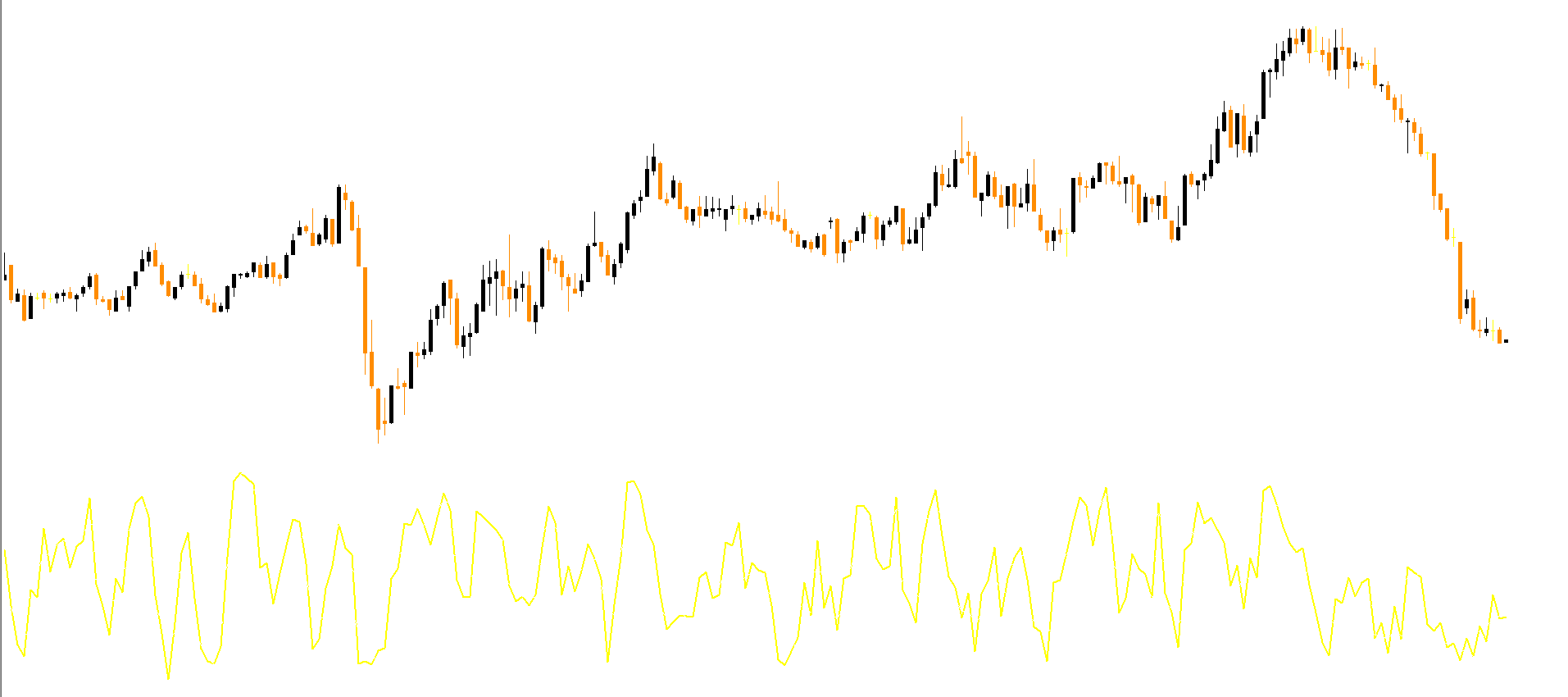

This hybrid indicator plots the Stochastic line alongside the upper, middle, and lower Bollinger Bands. The result is a more refined confirmation tool that enhances trade accuracy by aligning momentum with volatility behavior. Whether you are a beginner or an experienced trader, the Stochastic Bollinger Bands Indicator offers deep insights into market structure without cluttering the main chart.

The Stochastic Oscillator measures momentum and shows when price is overbought or oversold.

Above 80 = Overbought

Below 20 = Oversold

Bollinger Bands measure volatility by plotting standard deviations around a moving average.

Upper band = Overbought zone

Lower band = Oversold zone

By merging both tools, the indicator provides stronger signals because momentum and volatility confirm one another.

The indicator filters weak signals by requiring both Stochastic and Bollinger Bands to align in the same zone.

Scalping (1M/5M charts)

Day trading (15M/30M charts)

Swing trading (H4/Daily charts)

Both novice and experienced traders benefit from its simplicity and reliability.

The indicator displays the Stochastic line in YELLOW, while the Bollinger Bands appear as three WHITE lines. This combination offers a clear visual representation of upcoming reversals.

Follow this sequence for high-probability long entries:

Stochastic and Bollinger Bands meet at the Oversold zone.

Price should be near or touching the lower Bollinger Band.

Wait for a bullish reversal candlestick pattern, such as:

Bullish engulfing

Hammer

Pin bar

Enter a BUY / LONG position once confirmation occurs.

For short entries, reverse the logic:

Stochastic and Bollinger Bands meet at the Overbought zone.

Price should be near or touching the upper Bollinger Band.

Wait for a bearish reversal candlestick pattern, such as:

Bearish engulfing

Inverted hammer

Bearish pin bar

Enter a SELL / SHORT position after confirmation.

The indicator is powerful, but combining it with candlestick psychology and support/resistance levels increases accuracy significantly.

Using trend filters such as the 50 EMA, 200 EMA, or a trendline helps avoid false reversal signals during strong directional markets.

Always use stop-losses at logical price structures, such as above recent highs or below recent lows.

The Stochastic Bollinger Bands Indicator for MT4 is one of the best tools for trading overbought and oversold market conditions. It offers clean visual signals, works for all trading styles, and helps traders avoid weak reversal attempts. Since the indicator appears in a separate window, it does not interfere with your main chart’s technical analysis.

You can download this powerful tool for free on IndicatorForest.com and start improving your strategy today.

Published:

Nov 18, 2025 11:06 AM

Category: