The RSI Candles Indicator for MT4 is a unique trading tool that automates the display of Relative Strength Index (RSI) values directly on candlesticks. Unlike the traditional RSI indicator, which is plotted in a separate window, this tool shows bullish and bearish sentiment visually on the price chart itself.

Designed specifically to highlight trend direction, the RSI Candles indicator simplifies decision-making for traders by color-coding each candlestick according to its RSI value. It is particularly useful for identifying ongoing bullish or bearish trends without cluttering the chart with extra indicator windows.

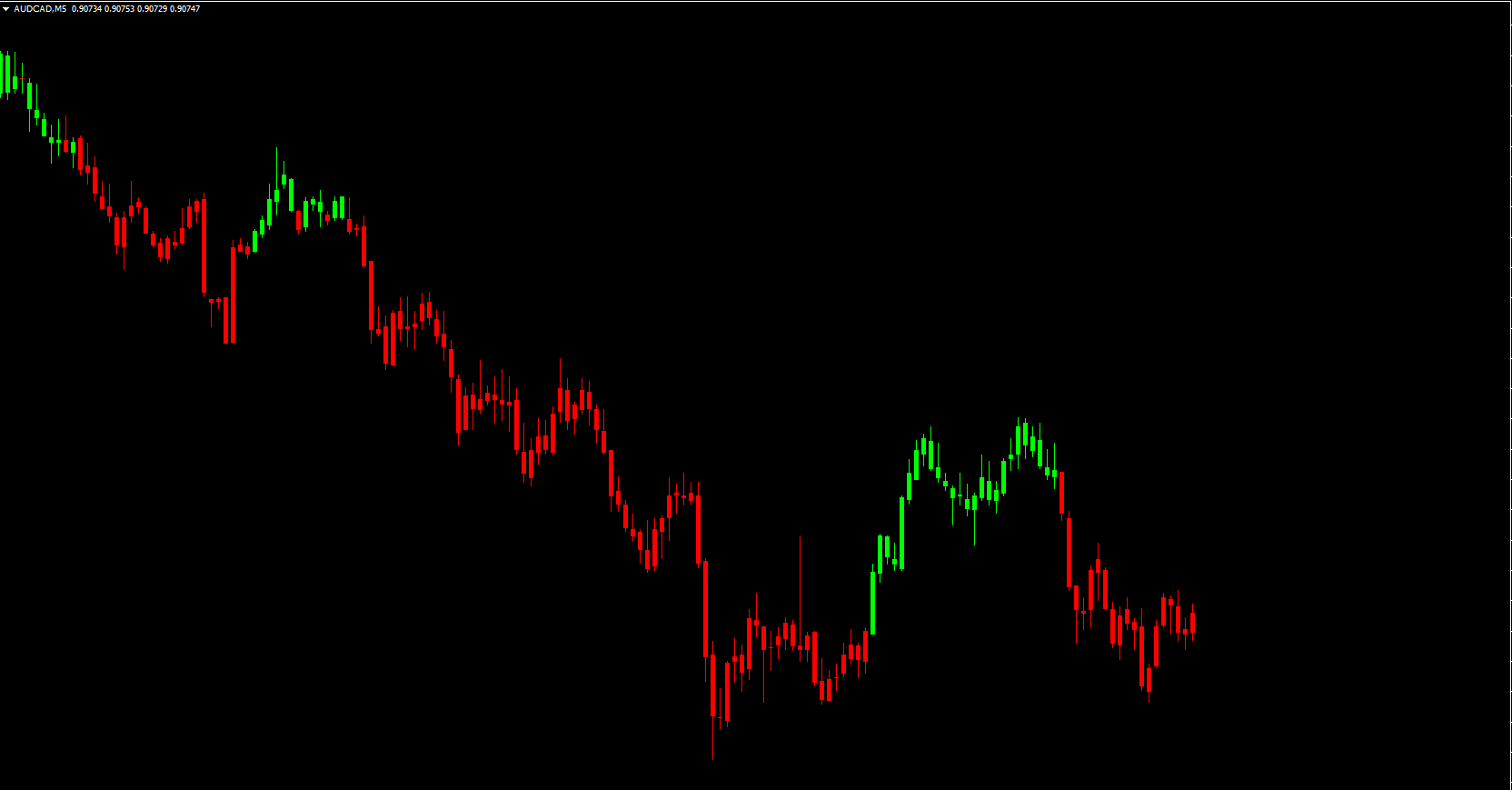

The RSI Candles Indicator operates around the 50.00 RSI level, which acts as the threshold between bullish and bearish trends:

RSI > 50.00 → bullish sentiment → candlestick turns lime green

RSI < 50.00 → bearish sentiment → candlestick turns red

This method allows traders to quickly identify the market trend at a glance.

Observe the color of each candlestick:

Lime green → price momentum is bullish

Red → price momentum is bearish

Identify trend continuity by monitoring consecutive candlesticks of the same color.

Combine with support/resistance levels, price action patterns, or other indicators like moving averages to improve signal accuracy.

When candlesticks turn lime green and stay above the 50.00 RSI level.

Confirm with price action or other technical indicators.

Enter long positions when momentum is sustained and supported by market structure.

When candlesticks turn red and RSI stays below 50.00.

Use price action confirmations such as bearish engulfing patterns or resistance rejection.

Open short positions during a confirmed downtrend.

On a EUR/USD H1 chart, the RSI Candles indicator clearly displays trend sentiment:

Continuous red candles below the 50.00 level signal a strong bearish trend.

Traders can use this to identify selling opportunities while confirming with price action or trend oscillators.

This visual approach eliminates the need to constantly reference an RSI window, allowing faster and more intuitive trade decisions.

Best used as a trend confirmation tool, not a stand-alone entry/exit indicator.

Combine with support/resistance levels, moving averages, or MACD for higher accuracy.

Works effectively on lower and mid-range timeframes (M5, M15, H1).

Ideal for Forex, indices, and commodities with clear trend structures.

The RSI Candles Indicator for MT4 is a practical tool for traders who want a clear visual representation of bullish and bearish market sentiment. By directly coloring candlesticks based on RSI values, it allows quick trend analysis and improves trading efficiency. For better results, always combine it with other technical tools such as price action or trend oscillators.

Discover more advanced MT4 indicators and trading strategies at IndicatorForest.com to enhance your Forex and intraday trading performance.

Published:

Nov 19, 2025 04:38 AM

Category: