The RSI Bands Indicator for MetaTrader 5 is a powerful, customizable trading tool that helps traders identify overbought and oversold market zones while providing potential buy and sell entries. Unlike the standard RSI indicator on MT5, which only signals extreme price conditions, the RSI Bands indicator offers enhanced visualization with dynamic bands, making it easier to anticipate reversals and trend continuation points.

The indicator uses colored bands above and below the price chart, which can also act as dynamic support and resistance zones. By combining RSI readings with price action, traders gain more confidence in timing entries and exits.

The traditional RSI indicator signals overbought conditions when the value reaches 70 or higher and oversold conditions at 30 or lower.

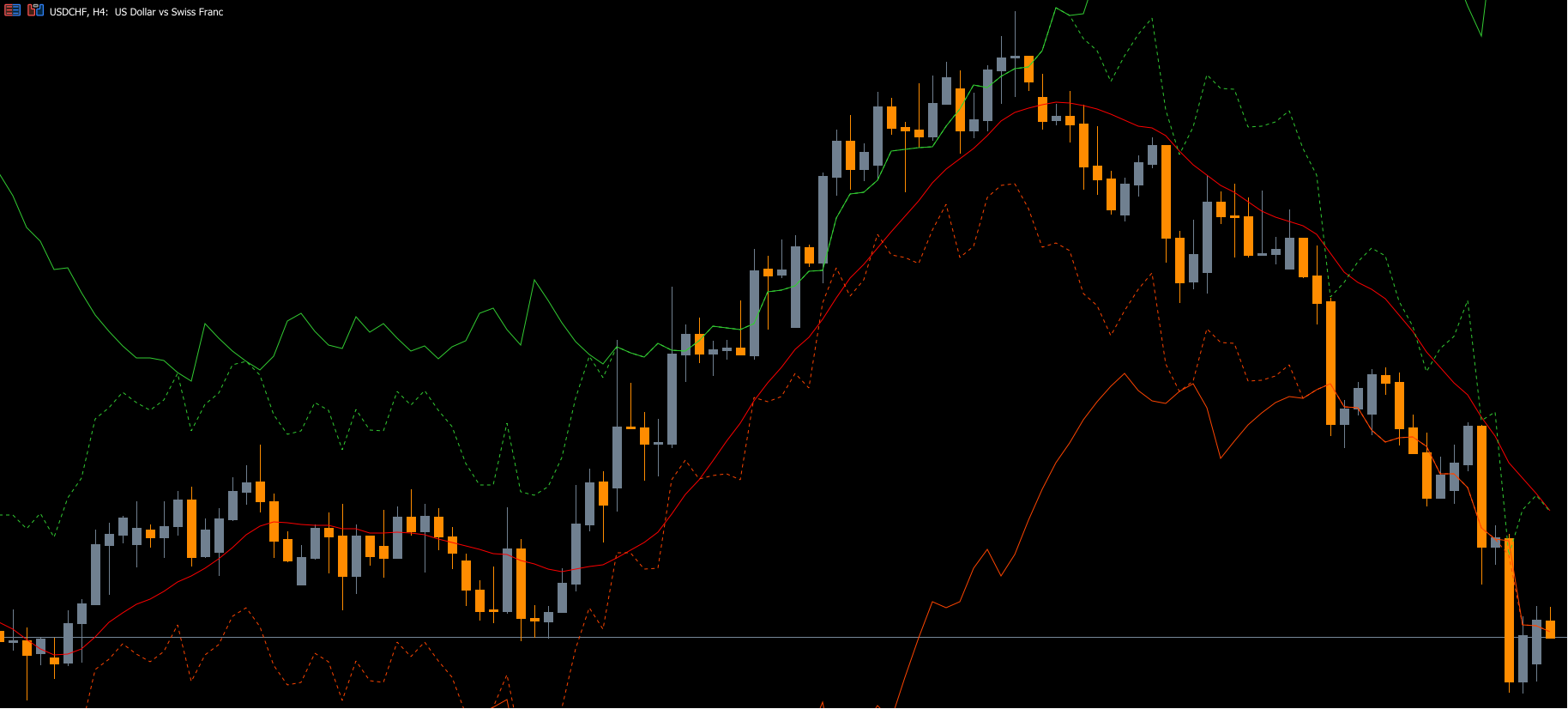

The RSI Bands Indicator extends this functionality by drawing two green lines and two red lines above and below the price chart:

Solid lines track standard RSI levels

Dotted lines represent damped values that fluctuate with price movement

When the price touches or crosses these bands:

Overbought signals appear when the price reaches the upper red bands

Oversold signals appear when the price touches the lower green bands

These bands can also function as dynamic support/resistance levels

Traders are recommended to use the RSI Bands indicator alongside price action, candlestick patterns, or other technical indicators to confirm trade setups.

Price crosses above the upper red band, signaling overbought conditions

Price closes back below the band, confirming a potential reversal

Check for supply zones or resistance levels to validate the entry

Enter a sell trade once the bearish candle closes below the supply zone

Price touches the lower green band, indicating oversold conditions

Price closes above the band, suggesting upward momentum

Confirm with demand zones or support levels

Enter a buy trade after a bullish candle closes above the demand zone

Place stop loss a few pips beyond the band or nearest swing high/low

Take profit based on risk/reward ratio or nearby support/resistance

Avoid trading during sideways or low-volatility conditions

On the EUR/USD M30 chart, the RSI Bands indicator successfully identified an overbought condition:

Price crossed above the red band

A bearish candle closed below the band, confirming a trend reversal

Price retested the supply zone, providing a high-probability sell entry

This example demonstrates how combining RSI Bands with price action enhances accuracy in detecting market extremes and trend reversals.

Identifies overbought and oversold market conditions with precision

Provides dynamic support and resistance levels for entry/exit decisions

Works for scalpers, intraday traders, and swing traders

Enhances standard RSI functionality with visual bands

Compatible with other technical analysis tools to improve trade confirmation

By integrating the RSI Bands indicator into your trading routine, you gain a better visual representation of market extremes, helping reduce false signals and improving trade timing.

The RSI Bands Indicator for MT5 is a dynamic and versatile Forex trading tool that detects extreme market conditions and provides actionable buy/sell signals. It is suitable for scalping, intraday, and swing trading, making it an essential addition to your MT5 toolkit.

The indicator is free to download and easy to install on MetaTrader 5. For more MT5 trading tools and free indicators, visit IndicatorForest.com.

Published:

Nov 13, 2025 22:03 PM

Category: