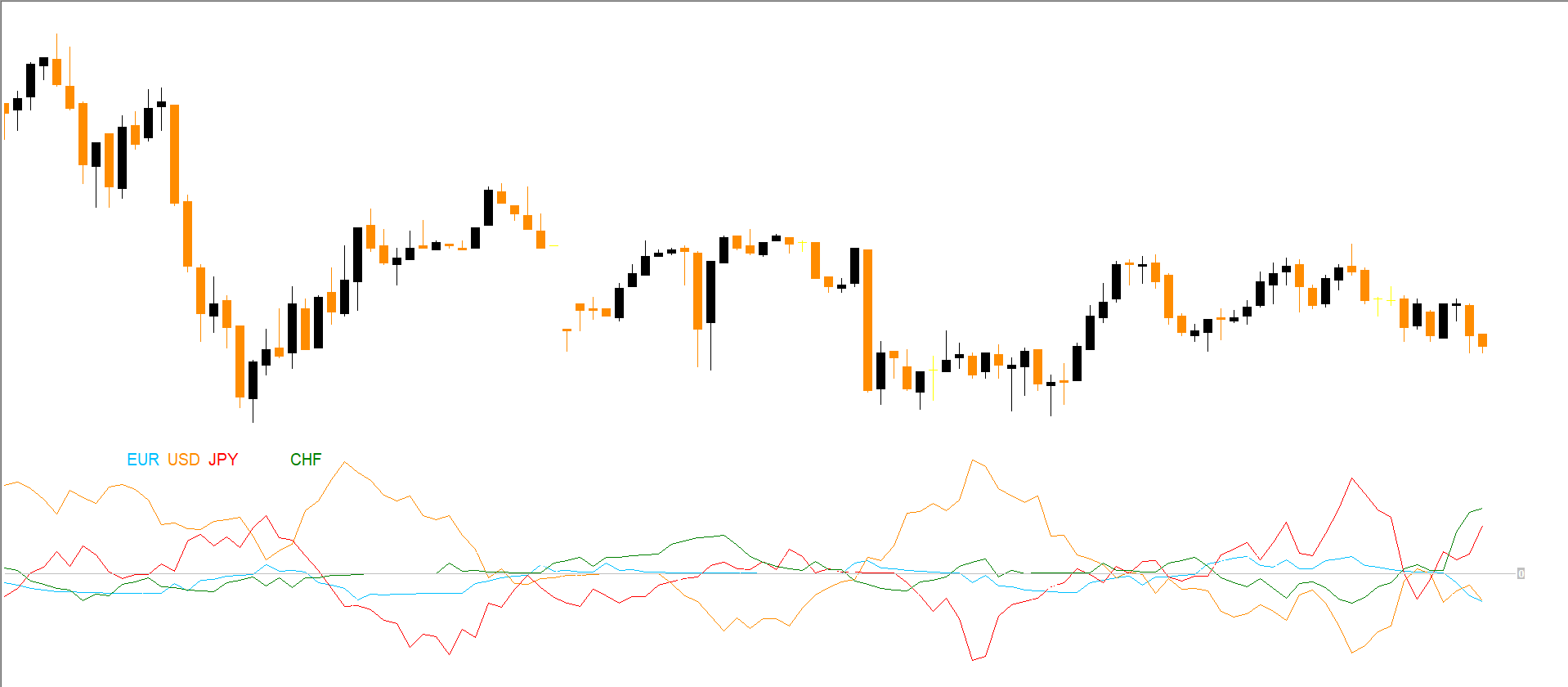

The ROC Multi Currency Indicator for MT4 is a unique tool that measures the rate of change of selected currencies, providing traders with a visual representation of currency strength and weakness. By comparing four currencies, traders can quickly identify which currencies are strong and which are weak, aiding in smarter trading decisions.

This indicator is particularly useful for traders who trade Forex pairs involving EUR, USD, JPY, and CHF. By observing the strength waves plotted by the indicator, you can anticipate market movements and make informed trading decisions.

The indicator displays four color-coded lines on the chart:

Green line: Represents the strongest currency.

Red line: Represents the weakest currency.

Blue line: Represents the second strongest currency.

Orange line: Represents the second weakest currency.

The lines move like waves, fluctuating based on the rate of change of each currency. This visualization helps traders see which currencies are dominating the market and which are lagging behind.

Although the ROC Multi Currency Indicator does not provide direct buy or sell signals, it is highly useful for analyzing currency strength before entering a trade. Traders can combine it with other indicators, such as RSI or Moving Averages, to determine entry and exit points.

Identify the strongest and weakest currencies for the pair.

Ensure the RSI is below 30, indicating oversold conditions.

Wait for price action to confirm upward movement.

Enter a long position.

Set a stop-loss below the recent swing low.

Exit when RSI rises above 70.

Identify the strongest and weakest currencies for the pair.

Ensure the RSI is above 70, indicating overbought conditions.

Wait for price action to confirm downward movement.

Enter a short position.

Set a stop-loss above the recent swing high.

Exit when RSI falls below 30.

Currency strength analysis: Quickly spot strongest and weakest currencies.

Visual representation: Easy-to-read color-coded waves.

Supports all timeframes: Works for intraday and long-term trading.

Versatile: Can be combined with RSI, Moving Averages, or other indicators for enhanced trading decisions.

Forex correlation insight: Helps understand how different currency pairs react to market changes.

The ROC Multi Currency Indicator is a powerful tool for Forex traders seeking insight into currency strength and weakness. While it doesn’t provide direct buy or sell signals, combining it with indicators like RSI or Moving Averages allows traders to develop a reliable trading strategy.

By using the ROC Multi Currency Indicator, you can make more informed decisions when trading pairs such as EUR/USD, GBP/JPY, or USD/CHF. Start analyzing currency strength today and enhance your Forex trading strategy. Download the ROC Multi Currency Indicator for MT4 from IndicatorForest.com for free.

Published:

Nov 17, 2025 22:59 PM

Category: