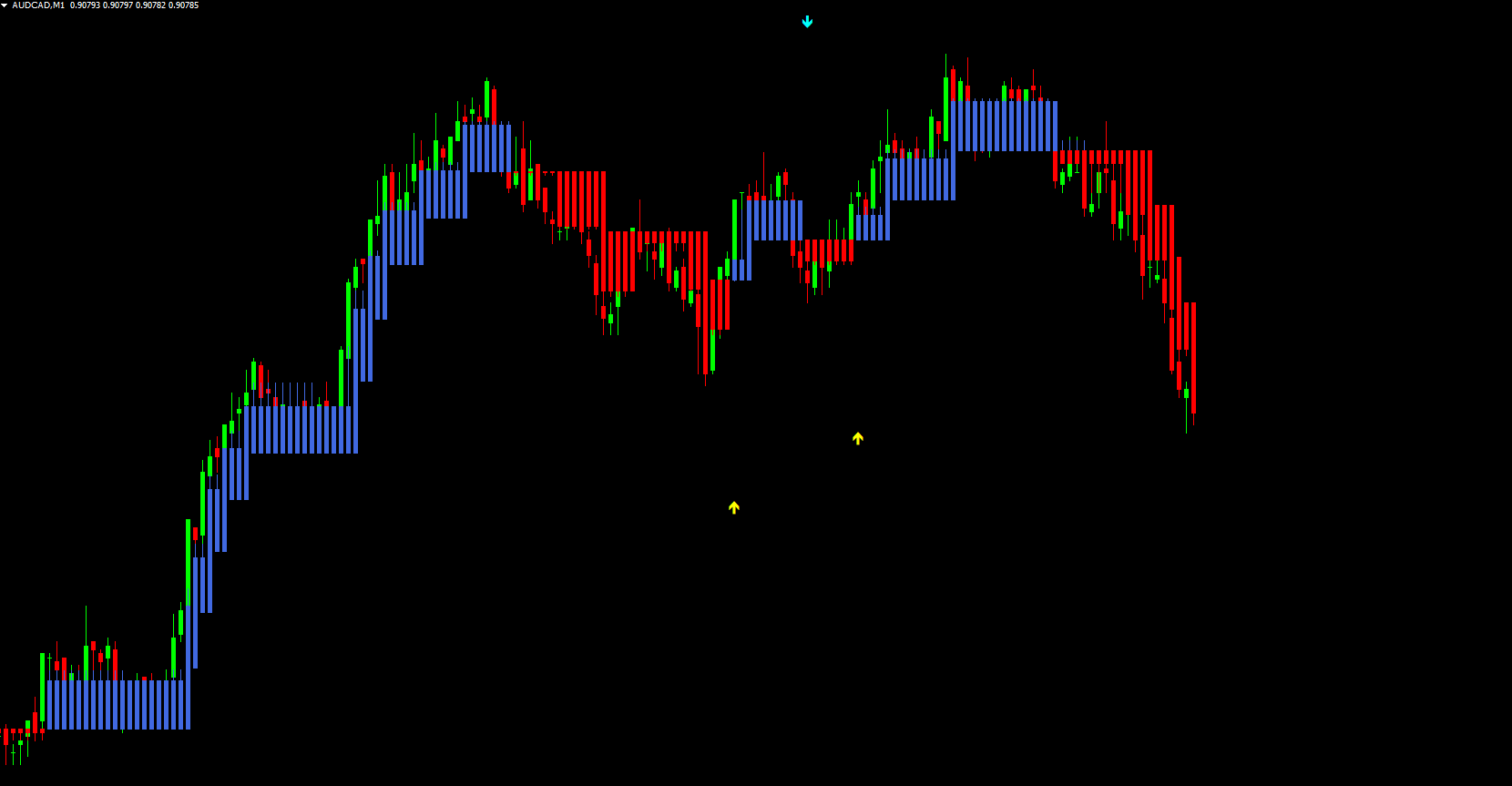

The Heiken Ashi MA T3 Indicator for MT4 is a trend-following trading tool designed to simplify market analysis by overlaying Heiken Ashi–based candles on top of standard candlesticks. Instead of traditional Heiken Ashi colors, the indicator uses blue and red candles that behave like a smoothed moving average, giving traders a clearer view of trend direction and momentum.

In addition to these candles, the indicator also plots trend arrows—yellow arrows for potential uptrends and aqua arrows for potential downtrends. When used together, these two components help forex traders identify trend continuation setups and catch early reversals with improved precision.

Because the indicator smooths out short-term noise, it is suitable for traders of all experience levels who want more structured and visually clear signals.

This indicator combines:

T3 moving average smoothing

Heiken Ashi candle construction

Automatic trend arrows

The T3 smoothing method reduces noise and produces elegantly flowing Heiken Ashi candles.

Here is how the visual components function:

Indicate bullish momentum

Show that price is closing higher consistently

Suggest continuation during uptrends

Indicate bearish momentum

Show that price is closing lower

Signal downtrend pressure

Yellow arrows → Uptrend potential / BUY signal

Aqua arrows → Downtrend potential / SELL signal

These arrows appear frequently, which makes them useful—but also requires filtering using overall market context.

Although the indicator works effectively on all timeframes, the best trading results often come from higher timeframes (H1, H4, Daily). Higher timeframes:

Reduce market noise

Provide stronger, more reliable signals

Help avoid false reversals

Scalpers can still use M15 or M30, but swing and intraday traders will benefit the most from H1 and above.

A valid BUY setup occurs when:

Heiken Ashi MA T3 candles turn blue, indicating bullish momentum.

A yellow uptrend arrow appears below price.

Price aligns with the overall trend direction.

You can enter long once both conditions appear near the same zone.

For confirmation, check for:

Higher highs and higher lows

Support bounces

Price above 200 MA (optional filter)

Stop-loss:

Below the most recent swing low

Or below the latest red candle cluster

Take-profit:

Previous resistance zone

Or a 1:2–1:3 risk-to-reward ratio

A valid SELL setup occurs when:

Heiken Ashi MA T3 candles turn red (bearish momentum).

An aqua downtrend arrow appears above price.

The overall trend supports the short entry.

This combination signals early bearish pressure, providing a clear opportunity to enter a short position.

Stop-loss:

Above the latest swing high

Or above recent blue candles

Take-profit suggestions:

Next support level

Or a 1:2–1:3 R:R ratio

To reduce false signals:

Avoid taking trades against the primary trend

Use arrows only when candle color agrees

Confirm entries using price action patterns

Combine with indicators like RSI or MACD for further validation

Since arrows can appear frequently, trend filtering is essential for consistent performance.

The Heiken Ashi MA T3 Indicator for MT4 offers a clean and powerful way to track market momentum using smoothed Heiken Ashi candles paired with automated trend arrows. By combining candle color and arrow direction, traders can easily identify BUY/SELL opportunities with improved clarity.

Because this tool is available for free on our website, you can download it and start testing your trend strategy immediately. It is especially effective on higher timeframes where market noise is minimal, making it an excellent addition to any trader’s MT4 toolkit.

Published:

Nov 19, 2025 03:12 AM

Category: