The Ferru MTF ATR trading indicator for MT4 is a powerful forex analysis tool that automatically calculates and displays the Average True Range (ATR) across multiple timeframes. Whether you trade intraday, daily, or long-term charts, this indicator provides a complete overview of market volatility in one convenient window.

The indicator plots ATR values from M1 (1-minute) up to Monthly charts, allowing traders to observe volatility trends without switching between timeframes. It’s especially useful for identifying potential breakout zones and adjusting trading strategies based on market conditions.

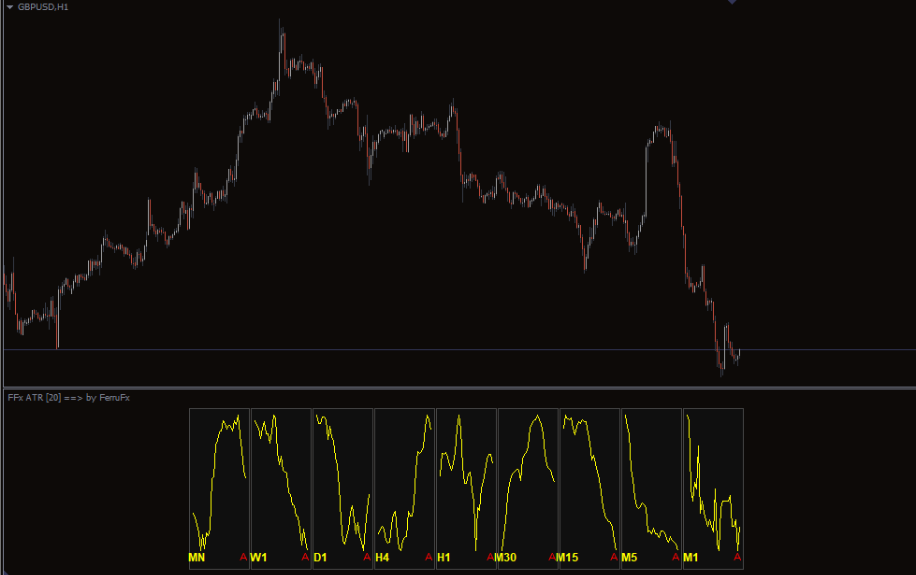

Once installed on your MetaTrader 4 (MT4) platform, the Ferru MTF ATR indicator automatically calculates ATR values for selected timeframes. These are displayed as yellow line charts in a separate indicator window.

Traders can customize the timeframes they wish to analyze—whether it’s only the M5, M15, H1, or Daily charts. This flexibility makes it a versatile tool for both scalpers and swing traders who rely on accurate volatility readings.

The Average True Range (ATR) measures the degree of price movement over a given period, serving as a key indicator of market volatility. A higher ATR suggests increased volatility, while a lower ATR reflects quieter market conditions.

Incorporating ATR into your strategy can help:

Identify potential breakouts or trend reversals.

Set more accurate stop-loss and take-profit levels.

Adjust position sizing based on volatility risk.

The Ferru MTF ATR trading indicator for MT4 simplifies this process by displaying all ATR readings across multiple timeframes at once—saving time and improving accuracy.

To get the most out of the Ferru MTF ATR trading indicator, combine it with support and resistance levels or other technical indicators like moving averages or RSI. Here’s how:

Use the ATR values to place stop-loss orders just below the current ATR reading. This minimizes the chance of being stopped out by market noise. For take-profit targets, aim for values within or slightly above the ATR range, where the price has a higher probability of reaching.

When ATR readings start increasing across multiple timeframes, it often signals the beginning of a breakout or strong trend. Monitoring these shifts can give traders an early entry advantage.

The multi-timeframe (MTF) feature enables traders to monitor market conditions from different perspectives—short-term trends on the M15 chart and long-term trends on the Daily or Weekly charts. This provides a holistic view for more confident trade execution.

Both beginner and experienced traders benefit from:

All-in-one volatility monitoring (from M1 to Monthly charts).

User-friendly interface for easy interpretation.

Customizable settings to match any trading style.

Accurate, real-time ATR calculations for better decision-making.

In short, the Ferru MTF ATR trading indicator for MT4 helps traders stay one step ahead of the market by revealing volatility shifts across all relevant timeframes.

The Ferru MTF ATR trading indicator for MT4 is an indispensable tool for traders who value precision, efficiency, and insight into market volatility. By combining this indicator with solid technical strategies, you can significantly enhance your trade timing, stop-loss placement, and profit management.

👉 Start exploring the power of multi-timeframe ATR analysis today at IndicatorForest.com and download this advanced trading indicator to elevate your forex trading performance.

Published:

Oct 15, 2025 07:04 AM

Category: