The Alligator indicator is a powerful trend-following tool widely used in forex and stock day trading. By combining three smoothed moving averages, the Alligator indicator helps traders identify trend direction, filter market noise, and detect potential reversals. Using the Alligator indicator on MT5 provides a structured way to interpret price action, especially during volatile market conditions.

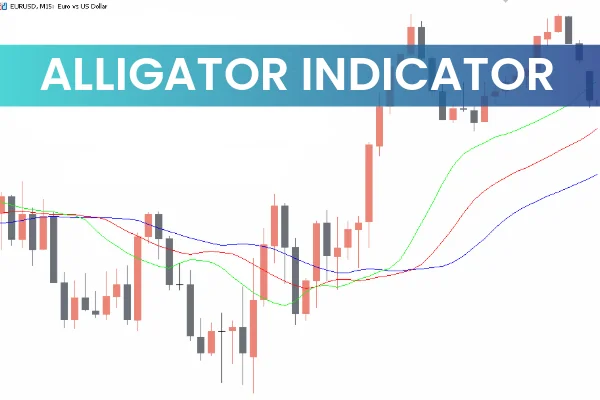

Developed by Bill Williams, the Alligator indicator includes three smoothed moving averages that work together to show market trends and the likelihood of trend reversals. These lines—called Lips, Teeth, and Jaws—intersect during shifting market conditions and create visual cues to buy or sell.

Lips (Green Line) – 5-period smoothed MA

Teeth (Red Line) – 8-period smoothed MA

Jaws (Blue Line) – 13-period smoothed MA

The Jaws line works as a dynamic support or resistance zone. The Lips and Teeth react faster, making them useful for identifying early shifts in market momentum.

The Alligator indicator signals depend on the positioning and separation of the three moving averages. These signals help day traders determine the best moments to enter or exit trades.

A bullish crossover forms when:

Lips move above the Teeth

Teeth remain above the Jaws

All lines begin spreading apart

This scenario is often referred to as the Alligator opening its mouth, indicating that an uptrend is likely forming. Traders may enter buy trades when momentum aligns with the expanding Alligator pattern.

A bearish signal appears when:

Lips move below the Teeth

Teeth remain below the Jaws

The lines diverge downward

This pattern means the Alligator has closed its mouth, suggesting that bearish momentum is strengthening.

Day traders in forex and stocks often face unpredictable price swings, especially on lower timeframes. The Alligator indicator helps filter false reversals and displays clearer trend direction.

Buy trades: enter during an upward crossover and exit either at your target zone or when the Alligator closes its mouth.

Sell trades: enter during a downward crossover and exit when the Alligator opens its mouth again.

For advanced trade management, many traders use trailing stops based on the Jaws line (13-period MA). This helps secure profits during prolonged trend movements.

The spacing between the three lines helps determine strength or weakness in ongoing trends:

Wide separation = strong trend

Tight or squeezed lines = consolidation or sideways market ahead

This insight helps traders avoid low-probability setups, especially during choppy markets.

Helps identify reliable trend-following setups

Reduces false reversal entries

Works in combination with classic tools like RSI or moving average strategies

Ideal for beginners and experienced technical traders

For more indicators and trading strategies, explore IndicatorForest.com for free tools, guides, and advanced signals.

Published:

Nov 20, 2025 22:48 PM

Category: