The VWAP Plus Indicator for MT4 is a volume-weighted trading tool that uses the Volume Weighted Average Price (VWAP) as its core signal. Unlike standard moving averages, the VWAP incorporates traded volume, giving traders a more accurate and meaningful view of price equilibrium.

Beyond the core VWAP line, the indicator also plots dynamic support and resistance zones—a major advantage for intraday traders looking to capture precise reversals and trend shifts.

If you prefer alternative VWAP-based tools, we also recommend exploring the VWAP Bands Indicator and the New VWAP Indicator, which offer different approaches to volume-weighted analysis.

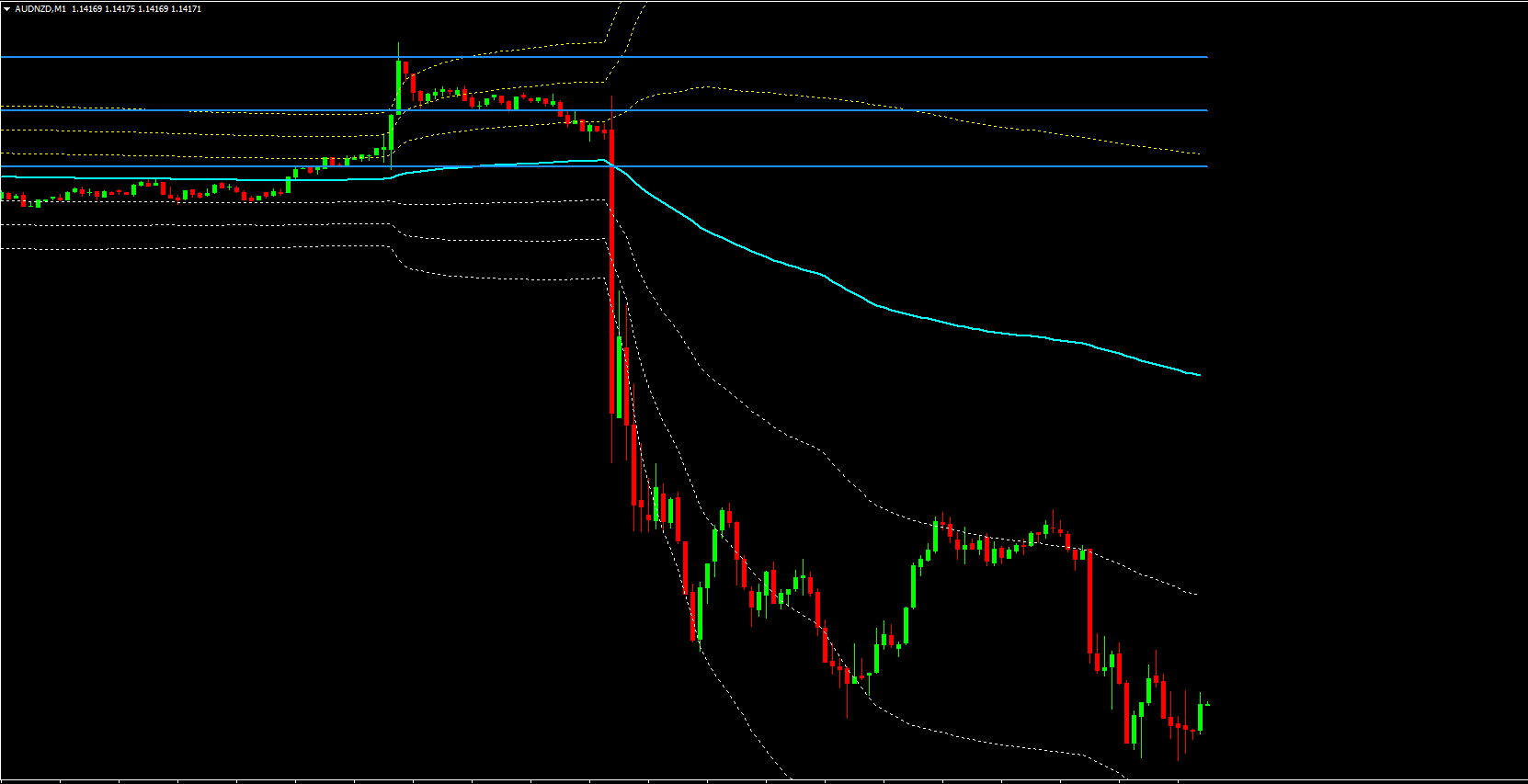

One standout feature is the AQUA-colored VWAP line, which visually separates itself from price action without cluttering the chart. Price closing above the VWAP gives an immediate bullish bias, while closing below it signals bearish conditions.

In my own trading, the dynamic support and resistance zones proved extremely reliable, especially on M5 and M15 charts. Combining VWAP rejections with candlestick confirmation helped me avoid multiple false entries during choppy sessions.

The indicator is suitable for:

New traders using VWAP for simple trend identification

Advanced traders combining VWAP with price action or volume analysis

Intraday, swing, and even long-term traders (M5 → Monthly charts)

Its strongest performance occurs on lower timeframes, where VWAP reacts quickly to changing market conditions.

The EUR/USD H1 chart example shows the indicator in action:

The AQUA line represents VWAP

YELLOW lines act as resistance

WHITE lines act as support

A bullish signal occurs when price crosses above and closes above the AQUA VWAP line.

Stop Loss: previous swing low

Take Profit: yellow resistance lines

A bearish signal appears when price crosses below the VWAP line.

Stop Loss: previous swing high

Take Profit: white support lines

Traders can combine these signals with candlestick patterns for added confluence.

The EUR/JPY M5 chart example shows how VWAP-derived dynamic zones work. These BLUE horizontal lines mark key reaction points where price often reverses.

If price touches a BLUE support line and forms a rejection pattern, it indicates a bullish reversal.

Stop Loss: previous swing low

If price reacts negatively to a resistance line, it signals a bearish entry.

Stop Loss: previous swing high

These levels perform exceptionally well on M5–M15 during active market hours.

Clear volume-weighted trend signals

High-probability dynamic S/R zones

Beginner-friendly color coding

Excellent for intraday and scalping strategies

Effective across forex, indices, stocks, crypto

Can produce false signals during highly volatile news events

Requires confirmation with price action or momentum tools

Less reactive on higher timeframes (Weekly/Monthly)

The VWAP Plus Indicator for MT4 delivers robust volume-weighted trading signals through its VWAP core line and dynamic support/resistance zones. It is suitable for traders of all skill levels but works best when combined with price action confirmation.

From my experience, this indicator becomes even more powerful when paired with volatility-based tools. To explore this further, check out our guide: How to Use Bollinger Bands in Forex Trading.

The indicator is free, simple to install, and a valuable addition to any MT4 trading system.

Published:

Nov 25, 2025 21:27 PM

Category: