The Next Line Regression Indicator for MT5 is a powerful forex trading tool that predicts future price movements of currency pairs using statistical modeling. Unlike traditional moving averages, this indicator adapts more quickly to price changes, offering accurate bullish, bearish, and neutral trend signals.

Whether you’re a beginner or a seasoned trader, the Next Line Regression Indicator is easy to use and works effectively across all timeframes—from 1-minute intraday charts to long-term weekly and monthly setups. This makes it ideal for scalping, swing trading, and long-term forex strategies.

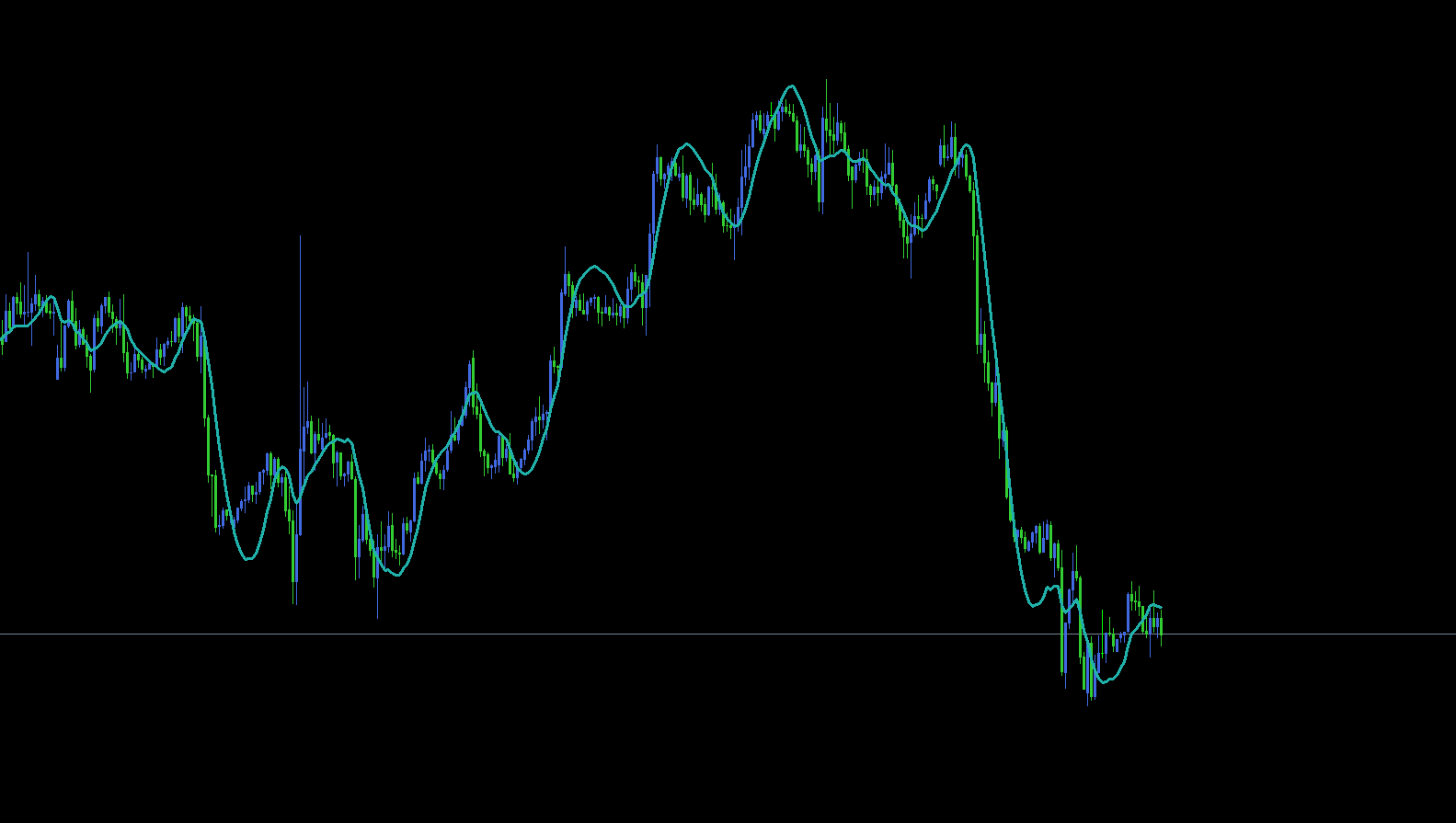

The indicator displays a sea-green regression line directly on your MT5 chart.

Upward slope (bullish trend): suggests buying opportunities.

Downward slope (bearish trend): signals potential sell trades.

Yellow color (neutral trend): indicates sideways or uncertain price action.

By analyzing these signals, traders can make data-driven decisions and anticipate potential price reversals more effectively than when using standard moving averages.

Bullish Trading Setup

When the regression line starts moving upward, it indicates growing buying pressure. Traders can open buy positions once the price crosses above the regression line. To manage risk effectively, place a stop-loss just below the previous swing low.

Bearish Trading Setup

If the regression line points downward, it’s a sign of a bearish market. Consider sell trades when price action crosses below the regression line. Traders should remember that prices tend to revert toward the regression line—a concept known as mean reversion—which often provides an optimal entry point.

Neutral Market Conditions

When the regression line turns yellow, it signifies a neutral or consolidating market. In such conditions, traders should stay on the sidelines until a clear trend direction emerges.

While moving averages are useful, they lag behind actual price movements. The Next Line Regression Indicator offers:

Faster reaction to price changes.

Higher accuracy in trend identification.

Early detection of reversals.

Reduced false signals in volatile markets.

This makes it an excellent alternative to the classic moving average indicator, helping traders capture profitable trends sooner.

The indicator performs consistently across multiple instruments—major, minor, and exotic forex pairs. It also works effectively on commodities, indices, and cryptocurrencies traded on MT5. For optimal results:

Use M15–H1 charts for short-term trading.

Apply H4–D1 charts for swing or position trading.

In conclusion, the Next Line Regression Indicator for MT5 is a superior analytical tool that provides clear visual cues for trend direction and reversals. Its responsive algorithm makes it an essential part of any trader’s toolbox—whether you’re trading short-term scalps or long-term positions.

Ready to upgrade your trading strategy? Download the Next Line Regression Indicator for MT5 now at IndicatorForest.com and experience more accurate forex trend forecasting.

Published:

Oct 31, 2025 03:43 AM

Category: