The Pulse Fibonacci Pivot Indicator is a powerful technical analysis tool that helps traders identify key market levels based on Fibonacci pivot calculations. This indicator dynamically plots the central pivot point along with multiple support and resistance levels on a trading chart. These Fibonacci-based zones often serve as crucial turning points in price action, helping traders anticipate potential reversals or trend continuations.

Unlike traditional pivot point indicators, the Pulse Fibonacci Pivot Indicator leverages Fibonacci ratios—mathematical relationships widely used in trading—to deliver more precise and meaningful market insights. Whether you trade forex, stocks, or cryptocurrencies, this tool offers an advanced, data-driven way to enhance your analysis and execution.

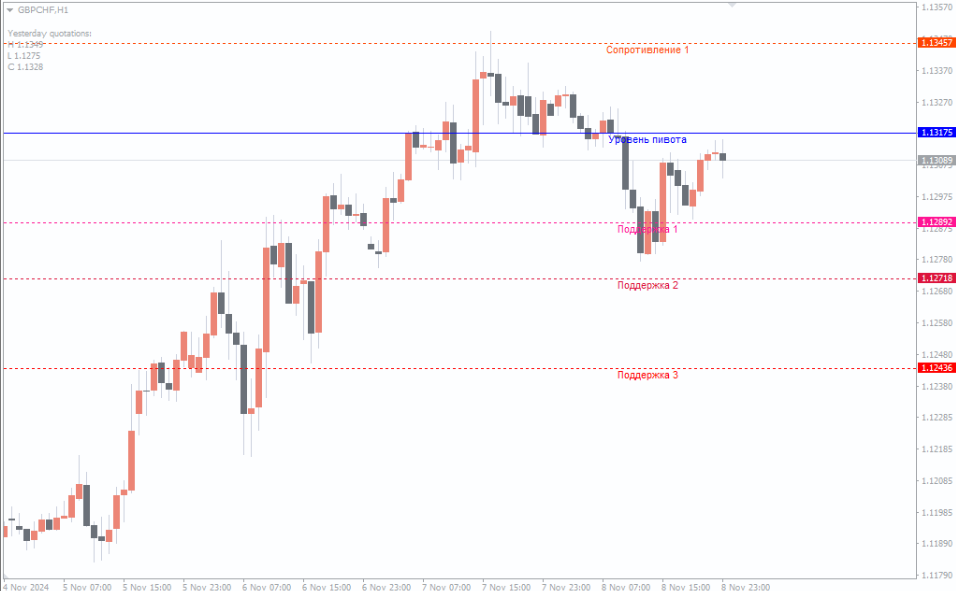

At its core, the Pulse Fibonacci Pivot Indicator calculates the central pivot level based on the previous day’s high, low, and close prices. From this reference point, it projects several support (S1–S3) and resistance (R1–R3) levels using Fibonacci-derived ratios.

Pivot Level

The pivot point acts as the balance or equilibrium level in the market.

When the price is above the pivot, market sentiment tends to be bullish.

When the price is below the pivot, the sentiment often turns bearish.

This makes the pivot point a valuable reference for identifying market bias and potential entry or exit zones.

Fibonacci Support Levels (S1, S2, S3)

These are potential buy zones where the price may find support or rebound.

Traders often watch these levels to plan long entries or stop-loss placements.

Each level is derived from a Fibonacci ratio, providing mathematically consistent spacing between price zones.

Fibonacci Resistance Levels (R1, R2, R3)

These are potential sell zones where the price may encounter resistance or profit-taking.

Traders can use these levels to identify short opportunities or take-profit targets.

By combining these levels with other indicators (like RSI or MACD), traders can validate momentum and reversal patterns.

The Pulse Fibonacci Pivot Indicator stands out for its accuracy, simplicity, and adaptability across markets. Here are some key benefits:

Mathematically Sound – Built on Fibonacci principles, it provides logical, structured price levels.

Dynamic and Automatic – Updates levels daily based on market data, removing guesswork.

Versatile Application – Works on forex, stocks, indices, and crypto charts.

Improved Risk Management – Clear levels help define entry, stop-loss, and target points.

Great for Both Beginners and Experts – Simple enough for new traders yet powerful for professionals who rely on precise levels.

To get the most out of the Pulse Fibonacci Pivot Indicator, traders can follow these practical steps:

Identify Market Bias – Use the central pivot to gauge whether the market is bullish or bearish.

Plan Entries and Exits – Watch how the price reacts at each support or resistance level.

Combine with Confirmation Tools – Add oscillators like RSI, MACD, or stochastic indicators for extra confirmation.

Adjust Timeframes – The indicator can be applied to daily, weekly, or intraday charts, depending on your strategy.

By combining Fibonacci-based pivots with broader technical signals, traders can develop a well-rounded and disciplined approach to market analysis.

The Pulse Fibonacci Pivot Indicator is a must-have for traders who value precision and structure. By blending traditional pivot analysis with Fibonacci mathematics, this tool reveals high-probability price zones that many overlook.

Ready to trade with better clarity and confidence?

👉 Download the Pulse Fibonacci Pivot Indicator today at IndicatorForest.com and elevate your trading strategy with Fibonacci-powered insights.

Published:

Oct 17, 2025 06:29 AM

Category: