The OSMA Indicator, or Moving Average of Oscillator, is a powerful technical analysis tool used to identify overbought and oversold conditions in financial markets. Available on most trading platforms, the OSMA builds a histogram showing the difference between an oscillator (MACD) and its signal line.

In essence, this indicator measures momentum by comparing a short-term and long-term moving average, helping traders forecast trend reversals with greater accuracy. At IndicatorForest.com, you’ll find detailed explanations and tools to use this indicator effectively in your trading strategy.

You can calculate the OSMA using the formula:

Moving Average of Oscillator (OSMA) = MACD – Signal Line

Here’s what each component means:

MACD (Moving Average Convergence Divergence): The difference between a 12-period EMA (fast) and a 26-period EMA (slow).

Signal Line: A 9-period SMA (Simple Moving Average) of the MACD values.

Subtracting the signal line from the MACD gives you the OSMA histogram, which shows whether market momentum is gaining or weakening.

The OSMA indicator is available in the Oscillators section of most trading platforms’ Navigator panel. Once applied, it appears as a histogram below the price chart.

Add the OSMA Indicator – From your platform’s indicator list, select “Moving Average of Oscillator.”

Interpret the Histogram – When the histogram is above the zero line, momentum is bullish; below zero indicates bearish momentum.

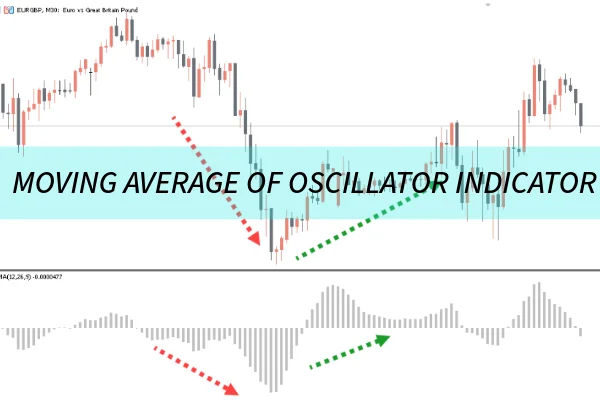

Look for Divergence – A divergence between price movement and OSMA values can signal a potential reversal.

For instance, if prices are rising but the OSMA histogram starts to decline, it indicates bearish divergence—a likely sign of an upcoming downtrend.

The divergence strategy is one of the simplest and most effective ways to use the OSMA indicator.

Wait until you notice a divergence between the price chart and the OSMA histogram.

As the bars get smaller and move toward the zero line, this suggests momentum weakening.

Enter a trade once the reversal is confirmed by a crossover or a price action signal.

Exit the trade when the histogram bars begin to shrink again or show a rollback from the previous candle.

By identifying momentum shifts early, the OSMA helps traders capitalize on trend reversals with precise entry and exit points.

Clear Visual Representation: The histogram offers an intuitive view of market momentum.

Early Reversal Signals: Detects potential reversals before they become obvious on price charts.

Works Across Markets: Suitable for Forex, stocks, and crypto trading.

Combines Well with Other Tools: Can be used with RSI, Stochastic, or Bollinger Bands for confirmation.

While the OSMA indicator is powerful, it’s not infallible. False signals can occur, especially during sideways markets. Always use risk management and confirm signals with other indicators before entering a trade.

The OSMA indicator—short for Moving Average of Oscillator—is a highly useful tool for identifying trend reversals and market extremes. Whether you’re trading Forex, stocks, or crypto, incorporating OSMA into your strategy can significantly improve your decision-making.

To learn more about the best trading indicators and strategies, visit IndicatorForest.com — your trusted resource for forex indicators, guides, and comparison tools.

Published:

Oct 11, 2025 04:46 AM

Category: