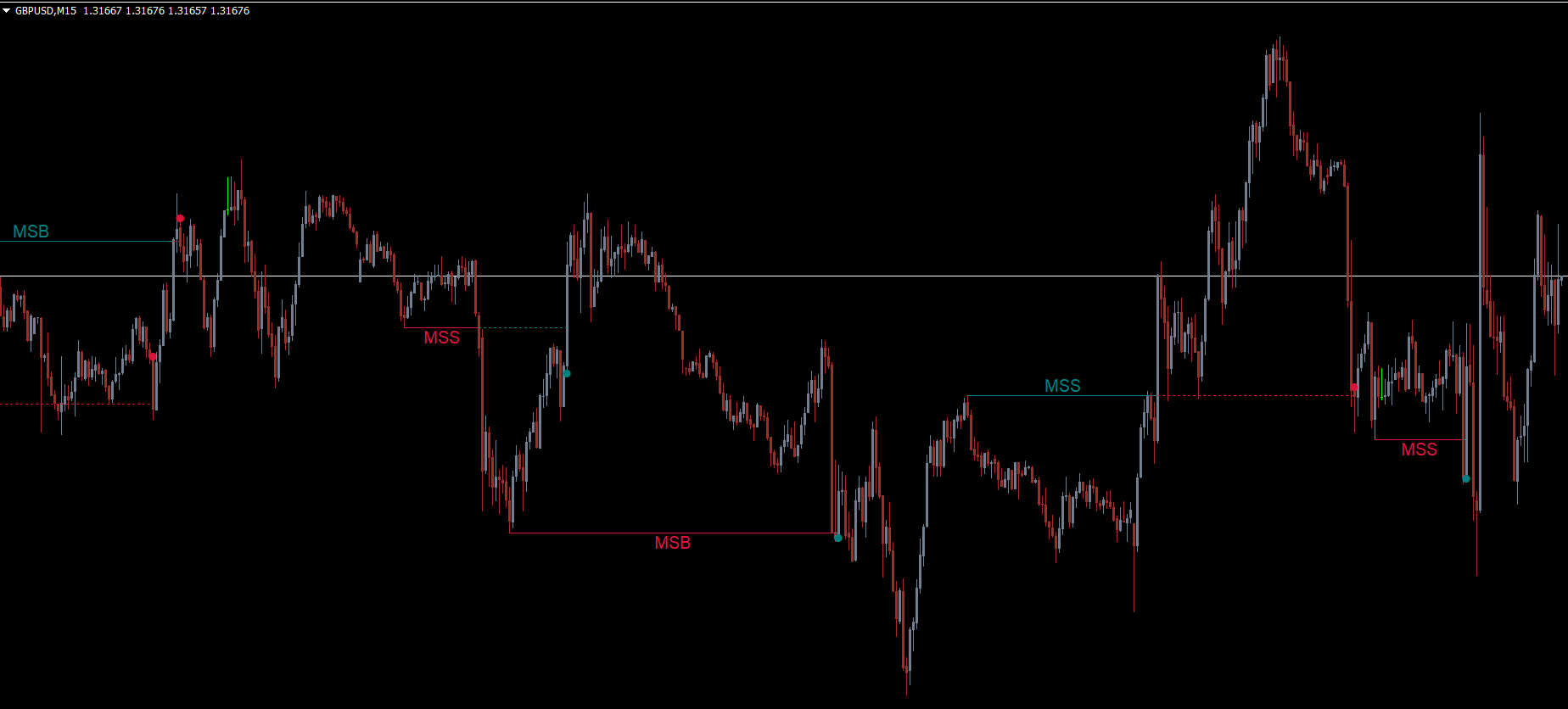

The Market Structure (Breakers) Indicator by LuxAlgo provides traders with an advanced and reliable way to detect real-time structural changes in price action. Built around smart money concepts (SMC) and ICT-style market logic, the indicator automatically identifies when price shifts direction by plotting Market Structure Shifts (MSS) and Market Structure Breaks (MSB) directly on the chart.

Market structure is considered the backbone of institutional trading strategies. By analyzing swing highs and swing lows, traders can determine whether the market is trending, accumulating, or distributing. This indicator simplifies the process by visually marking these structural behaviors, allowing traders to quickly build directional bias and make informed trade decisions.

The indicator continuously monitors price action to detect key turning points. It highlights:

An MSS appears when price shows signs of reversing from the current trend.

In a bullish market, a bearish MSS indicates the first potential sign of downward reversal.

In a bearish market, a bullish MSS suggests buyers may be returning.

An MSS does not confirm a trend reversal on its own, but it is a reliable early warning signal for possible market direction change.

An MSB is confirmed when price breaks above or below the previous major swing that defined the trend.

In a bearish market, a break above a previous structure level is marked as MSB.

In a bullish market, a break below a previous structure level signals MSB.

MSB confirmation helps traders validate that the structure has officially changed, reducing false reversal assumptions.

The indicator displays clear visual labels on the chart:

“MSS” marks the potential start of a reversal

“MSB” confirms the structural break

These signals allow traders to:

Identify shifts between bullish and bearish structure

Spot potential reversal zones

Confirm breakout entries

Validate trend continuation setups

Align trades with institutional order flow

Many traders wait for MSS to anticipate a turning point, then use MSB for execution confirmation to enter the market with greater accuracy and reduced risk.

Identify a bullish MSS after a bearish trend.

Wait for confirmation through a bullish MSB breaking above a previous swing high.

Enter long on MSB confirmation or retest.

Stop-loss below the shift point or last swing low.

Take profits at the next structure point or supply area.

Spot a bearish MSS during a bullish trend.

Confirm with a bearish MSB breaking below a previous swing low.

Enter short on MSB confirmation or retest.

Place stop-loss above the MSS level.

Target the next demand zone or structure low.

This structured approach aligns well with smart money concepts and ICT-style trading.

Automatically detects institutional structure shifts

Helps avoid emotional or subjective market analysis

Perfect for SMC, ICT, Wyckoff, and price-action traders

Works on all timeframes and all trading instruments

Clear, uncluttered visual labels for easy interpretation

Whether you are a beginner studying price action or an experienced trader using advanced SMC rules, the indicator helps simplify the process of reading market structure.

The Market Structure (Breakers) Indicator by LuxAlgo is a valuable tool for traders who rely on structure-based analysis. By highlighting both Market Structure Shifts (MSS) and Market Structure Breaks (MSB), it clarifies potential reversals, trend shifts, and breakout opportunities.

Its real-time structure identification enables traders to stay aligned with market direction and make more confident trading decisions. Download the indicator today and incorporate it into your smart money trading strategy for improved accuracy and clarity.

Published:

Nov 14, 2025 09:33 AM

Category: