The Liquidity Sentiment Profile (Auto-Anchored) Indicator for MetaTrader 5, developed by LuxAlgo, is an advanced analytical tool that automatically anchors volume profiles to key price swings or fixed ranges. It enables traders to see where buy-side and sell-side liquidity clusters form, revealing the hidden structure of institutional activity within the market.

Unlike traditional lagging indicators, this tool analyzes market microstructure, helping traders understand why price reacts at specific levels — not just where it moves. By combining volume distribution, sentiment profiling, and liquidity mapping, the indicator provides a clear visualization of where smart money is likely placing orders, defending zones, or absorbing liquidity.

Whether you trade Smart Money Concepts (SMC), order flow, or volume-driven setups, the Liquidity Sentiment Profile offers a data-driven edge for enhanced market timing and context.

The indicator automatically anchors the volume profile to:

Recent swing highs and lows

Defined fixed ranges

User-specified price structures

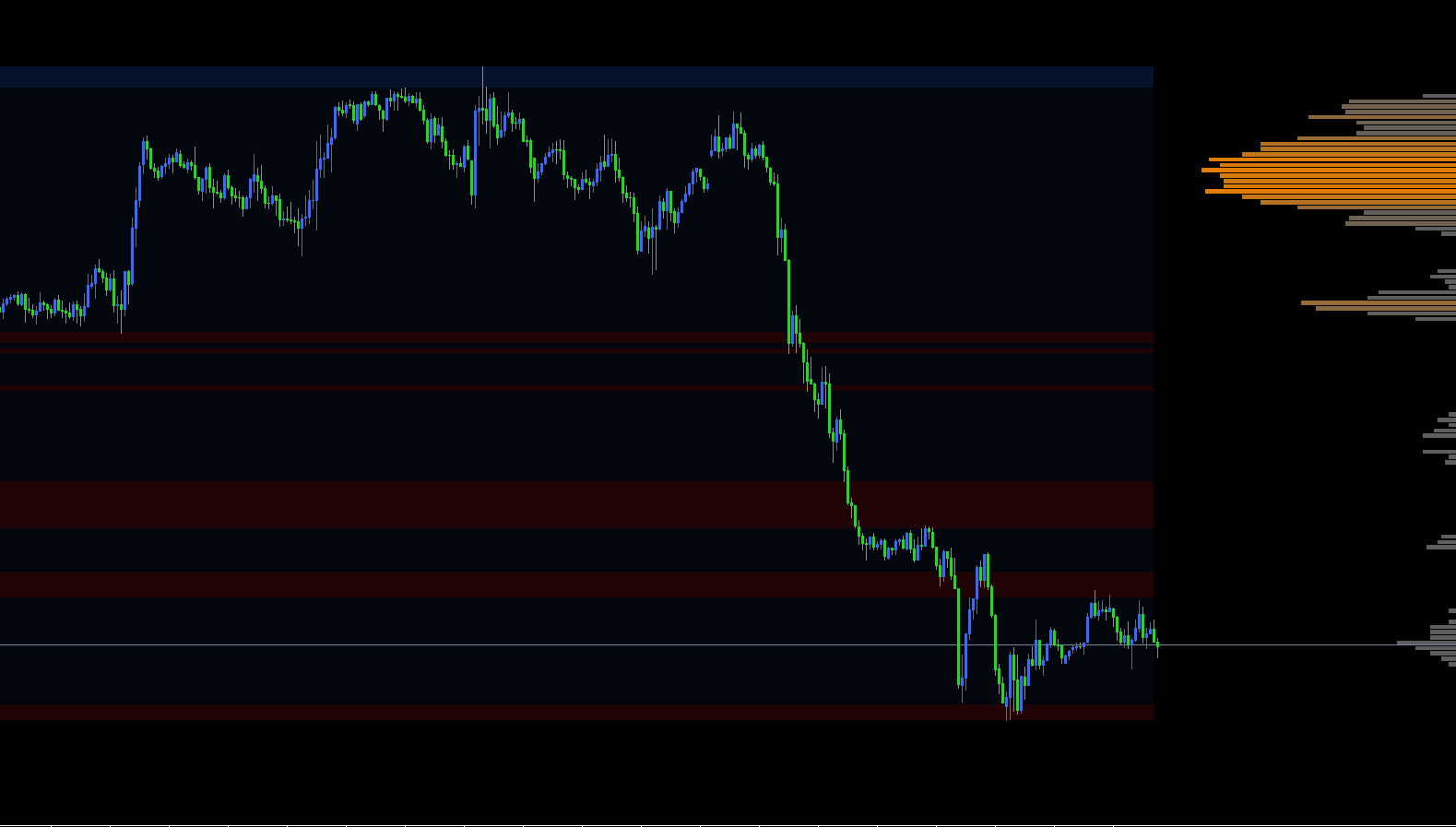

It then plots dynamic histograms that represent volume distribution within that range. Colored sentiment zones indicate whether liquidity and order flow are dominated by bullish (teal) or bearish (crimson) pressure.

This approach allows traders to see:

High-Traded Nodes (HVNs): Areas of high activity where price may consolidate or reverse.

Low-Volume Nodes (LVNs): Price gaps or “vacuum zones” where price can move quickly due to thin liquidity.

Liquidity Pools: Zones where stops or pending institutional orders are likely placed.

The auto-anchoring feature ensures that as market structure evolves, the indicator recalibrates the range automatically — keeping your volume analysis relevant to current conditions.

This indicator does not generate direct buy or sell signals. Instead, it highlights high-probability trading zones using volume clusters, sentiment imbalance, and liquidity distribution.

Price approaches a high-volume bullish node near a buy-side liquidity zone.

Volume shows strong absorption, suggesting accumulation.

Traders may look for reversal or continuation entries aligned with structure.

Price rises toward a high-volume bearish node near a sell-side liquidity pool.

Volume imbalance shows heavy selling pressure or rejection.

These zones can act as institutional resistance or distribution areas.

Price moves through a low-volume area (LVN) between two high-volume zones.

Indicates potential fast price movement due to lack of liquidity.

The sentiment overlay and shaded background help contextualize which side of the market is dominant, giving traders actionable insights to align with or fade institutional behavior.

Anchor the profile to recent swing highs/lows or a defined structure (range, breaker block, or order block).

Identify HVNs and LVNs: Mark where volume is dense (potential reversal) or sparse (potential breakout).

Assess sentiment: Observe whether the liquidity clusters show bullish or bearish dominance.

Align with structure: Confirm setups using SMC tools like fair value gaps, mitigation blocks, or market structure shifts.

Set entries and stops:

Stops beyond high-volume zones.

Targets near opposite liquidity nodes or low-volume gaps.

Institutional Insight: Visualizes where large players transact and defend positions.

Auto-Anchored Efficiency: No manual range selection — automatically adjusts to new market structure.

Volume + Sentiment Fusion: Combines quantitative volume data with sentiment cues for superior context.

Versatile Application: Works across Forex, indices, commodities, and crypto.

Ideal for SMC and Volume Traders: Perfect for identifying liquidity traps, stop hunts, and key mitigation zones.

The Liquidity Sentiment Profile (Auto-Anchored) Indicator for MT5 from LuxAlgo is an advanced visualization tool that unifies liquidity mapping, sentiment profiling, and volume analysis.

It helps traders pinpoint where institutions accumulate, distribute, or manipulate liquidity — offering a true window into market intent. Whether you’re scalping short-term imbalances or analyzing swing-level structures, this indicator delivers data-driven precision to your technical analysis.

Download the Liquidity Sentiment Profile (Auto-Anchored) for MT5 today at IndicatorForest.com and gain a clearer picture of how liquidity shapes every market move.

Published:

Nov 05, 2025 10:33 AM

Category: