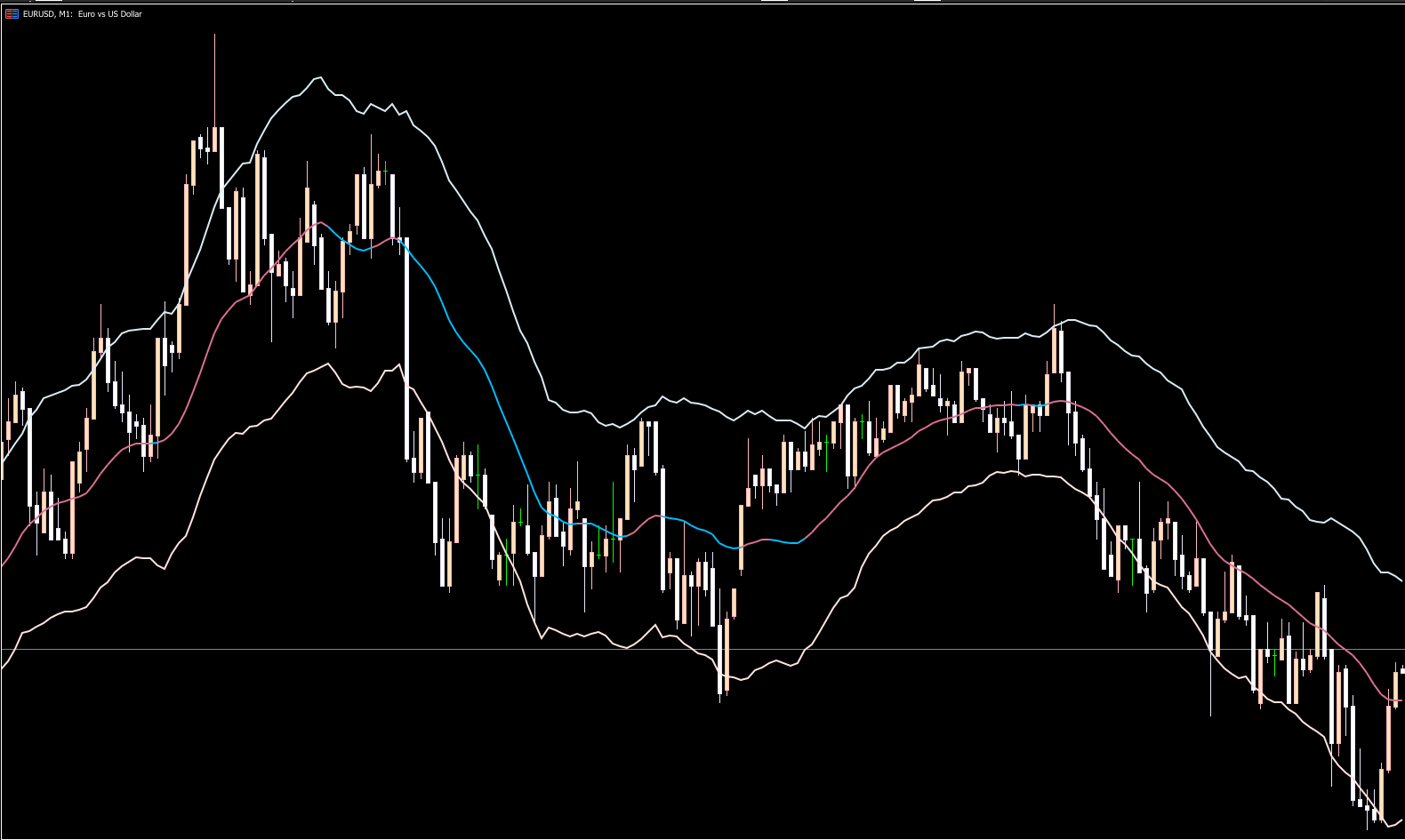

If you’ve ever struggled to determine whether the market is trending up or down, you’re not alone. Many traders hear the advice “always trade with the trend”, yet still find it difficult to identify real market direction. The Keltner Channel (KC) Indicator for MT5 solves this problem by giving a clear, visual representation of trend direction, volatility, and potential breakout opportunities.

The Keltner Channel is a volatility-based trading indicator composed of three bands:

Upper Band

Lower Band

Middle Band (the EMA line)

These bands expand and contract based on volatility and typically contain most price movement within them.

Traders use the Keltner Channel to:

Identify market trends

Detect trend reversals

Spot breakout opportunities

Determine market volatility

Unlike Bollinger Bands—one of its closest rivals—the Keltner Channel reacts smoother and produces fewer false breakout signals, thanks to its special calculation formula.

When the entire channel tilts upward, the market is in an uptrend.

When the channel tilts downward, it signals a downtrend.

This makes it extremely beginner-friendly for identifying market direction.

Because the channel envelopes price action, breaks outside the bands can signal an early shift in momentum—ideal for reversal traders.

The Keltner Channel uses ATR-based volatility rather than standard deviation (like Bollinger Bands).

This makes it less sensitive to random price spikes and more resistant to false trading signals.

You can fine-tune how aggressively the channel reacts to the market by adjusting:

EMA period

ATR period

Multiplier

This allows trend traders, scalpers, swing traders, and breakout traders to customize the indicator to their style.

The KC indicator uses EMA (Exponential Moving Average) and ATR (Average True Range) to calculate its bands:

Upper Band = EMA + (Multiplier × ATR)

Lower Band = EMA – (Multiplier × ATR)

Middle Band = EMA

EMA Period: 20

ATR Period: 10

Multiplier: 2

A higher EMA makes the channel slower and smoother. A lower EMA makes it react more quickly.

A higher multiplier widens the bands; a lower multiplier narrows them.

The Keltner Channel is excellent for breakout trades.

Buy Signal: Price closes above the upper band

Sell Signal: Price closes below the lower band

Once the breakout occurs, traders enter in the direction of the break and hold until the opposite signal appears.

To protect against false breakouts:

Buy Trades: Place SL below the previous swing low

Sell Trades: Place SL above the previous swing high

This keeps stop-loss placement aligned with real price structure.

The Keltner Channel is great for:

Beginner traders struggling to identify trends

Trend-followers who want clean signals

Trend reversal traders spotting early shifts

Breakout traders using volatility expansion

Swing and intraday traders who rely on dynamic support & resistance

Its simple visual layout makes it one of the best MT5 indicators for learning market structure.

The Keltner Channel Indicator for MT5 is a powerful, easy-to-use tool that helps traders identify trends, breakouts, and potential reversals. Its EMA- and ATR-based formula makes it smoother, more stable, and more reliable than many alternative indicators. Whether you're a beginner learning market structure or an advanced trader fine-tuning your strategy, the Keltner Channel is a must-have tool in your MT5 toolbox.

Published:

Nov 29, 2025 23:50 PM

Category: