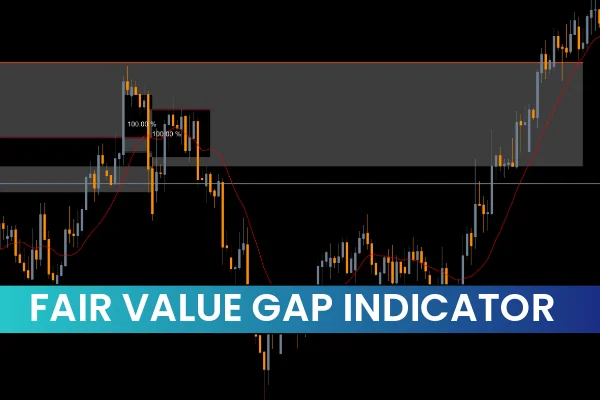

The Fair Value Gap (FVG) Indicator for MT5 is a specialized market structure tool designed to help traders identify price inefficiencies left behind by sharp market movements. These inefficiencies, often referred to as imbalances or liquidity voids, represent areas where price may return before continuing the prevailing trend.

Widely used in ICT (Inner Circle Trader) strategies, the FVG Indicator provides a visual representation of unfilled gaps, allowing traders to spot potential retracements or continuation zones. Its flexible settings, clear graphical display, and color-coded zones make it a valuable tool for traders focused on smart money concepts, order blocks, and institutional trading models.

At IndicatorForest.com, you can download the Fair Value Gap Indicator for MT5 for free and start improving your market timing and trade entries today.

The FVG Indicator identifies gaps created by rapid price movements where the wicks of consecutive candles do not overlap. These gaps often signal:

Potential liquidity areas: Where stop orders or unfilled market orders may exist.

Retracement opportunities: Price may revisit these zones before continuing the trend.

Support and resistance points: Depending on whether the gap is bullish or bearish.

The indicator highlights gaps visually with colored zones:

Bullish gaps: Usually displayed in one color (e.g., green) to indicate potential buying zones.

Bearish gaps: Typically shown in another color (e.g., red) for potential selling zones.

When a gap is fully mitigated by price, the indicator updates the zone, giving traders confirmation that the market has restored efficiency.

1. Spotting Imbalances:

Look for FVG zones after strong impulsive moves.

Identify whether the gap is bullish or bearish based on candle orientation.

2. Trading Retracements:

Enter trades when price revisits the FVG zone.

Bullish gaps provide potential buy opportunities, while bearish gaps suggest sell entries.

3. Confirmation:

Wait for price action to partially or fully interact with the gap.

Consider other tools such as order blocks, support/resistance, or trend analysis to improve trade accuracy.

4. Mitigation Check:

The indicator shows when a gap is fully covered by subsequent candles.

Mitigated gaps often signal that the market has absorbed the imbalance, allowing traders to focus on fresh opportunities.

By integrating FVG with a broader market structure framework, traders can anticipate retracements, improve entry timing, and align trades with institutional flow.

Clearly visualizes market inefficiencies and gaps.

Works on any timeframe and instrument in MT5.

Highlights bullish and bearish zones for easy identification.

Supports ICT strategies, smart money concepts, and institutional trading.

Provides mitigation confirmation to indicate market efficiency restoration.

Considerations:

Best used alongside other technical and market structure tools.

Not a standalone trading system; always confirm with price action and volume analysis.

The Fair Value Gap Indicator for MT5 is a must-have tool for traders seeking to understand and trade market imbalances. By displaying both open and mitigated gaps, it provides a visual edge that enhances timing for entries and exits.

Whether you’re following ICT strategies or simply looking for retracement opportunities in trending markets, the FVG Indicator helps you spot institutional inefficiencies and make more informed trading decisions.

You can download the Fair Value Gap Indicator for MT5 for free at IndicatorForest.com and start tracking price imbalances like a professional trader today.

For additional insights on market structure tools, see our guide on Best Market Structure Indicators for MT5.

Published:

Nov 11, 2025 22:43 PM

Category: