The Double Stochastic RSI Indicator MT5 brings together two of the most trusted technical oscillators—Stochastic and RSI—into one advanced, non-repainting momentum tool. Both indicators are known for identifying overbought and oversold zones, but each measures momentum differently. RSI is smoother and less reactive, while Stochastic is more sensitive to price fluctuations. Many traders often debate which is better, but with the Double Stochastic RSI indicator, you don’t have to choose; it allows you to use both simultaneously to generate more reliable reversal signals.

This indicator automatically analyzes price movements, highlighting strong momentum shifts, trend exhaustion, and potential reversal zones. Whether you trade forex, crypto, indices, or equities, the Double Stochastic RSI indicator is versatile and effective across all assets and timeframes on MT5.

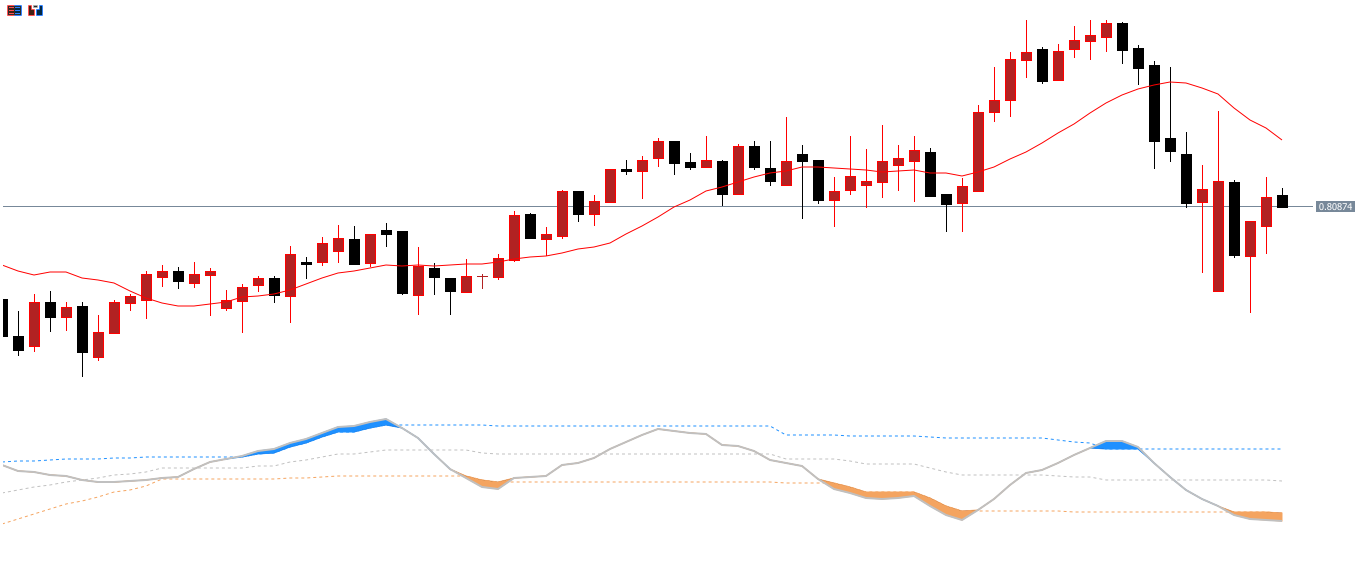

The indicator is composed of:

A main dynamic line – fluctuating between 0 and 100

Customizable overbought and oversold zones

Automatic color changes to highlight bullish or bearish pressure

When the line moves above the overbought threshold, it turns blue, signaling high prices or a continuation of a strong uptrend. When it falls below oversold levels, it turns orange, signaling low prices or bearish continuation.

This color-changing feature makes momentum shifts easy to see even at a glance, helping traders catch early reversal setups.

When the main line moves above the overbought zone and turns blue, it can mean:

The market is overstretched to the upside

A bullish run may soon weaken

A potential reversal could form if price confirms

When the line drops below the oversold zone and turns orange:

Prices may be excessively low

Bears may be losing strength

A bullish reversal becomes likely if confirmed by additional analysis

This indicator excels in momentum reversal trading, where traders look for normalization after an extreme price move.

The Double Stochastic RSI is not a magical arrow indicator, nor does it guarantee perfect signals. Like all oscillators, it can produce false alerts—especially in trending conditions. Traders looking for a guaranteed 5:1 reward ratio will be disappointed.

However, when paired with support and resistance, moving averages, or price action, the indicator becomes far more accurate and reliable.

A BUY signal forms when:

The indicator’s main line moves out of oversold territory

Price retests a former resistance level, which now acts as support

This combination creates a strong reversal setup.

For example, if price breaks above a resistance level and later returns to test it, the Double Stochastic RSI crossing upward reinforces a bullish entry.

Entry rules:

Enter long at the open of the next candle after the signal

Place stop loss below the previous swing low

Take profit when a counter signal appears or based on risk–reward targets

A SELL signal forms when:

The main line moves out of the overbought zone

The moving average or overall trend shows bearish direction

Entry rules:

Enter short once the indicator turns downward

Place stop loss above the last swing high

Exit on an opposite signal or your preferred TP method

Identifies reversal entry points

Works across forex, stocks, crypto, indices

Highly customizable levels

Suitable for intraday and long-term traders

Non-repainting

No built-in alerts

Generates false signals in strong trends

Requires additional confirmation (candle patterns, S/R, volume, MA)

To increase accuracy, combine this tool with volume analysis, moving averages, or price action methods.

The Double Stochastic RSI Indicator MT5 offers traders a powerful blend of RSI stability and Stochastic sensitivity, making it ideal for detecting reversal zones and overextended price conditions. While it delivers reliable momentum analysis, it's not a standalone indicator. The best results come from combining it with support/resistance, trend confirmation, and candle patterns.

Published:

Nov 25, 2025 09:34 AM

Category: