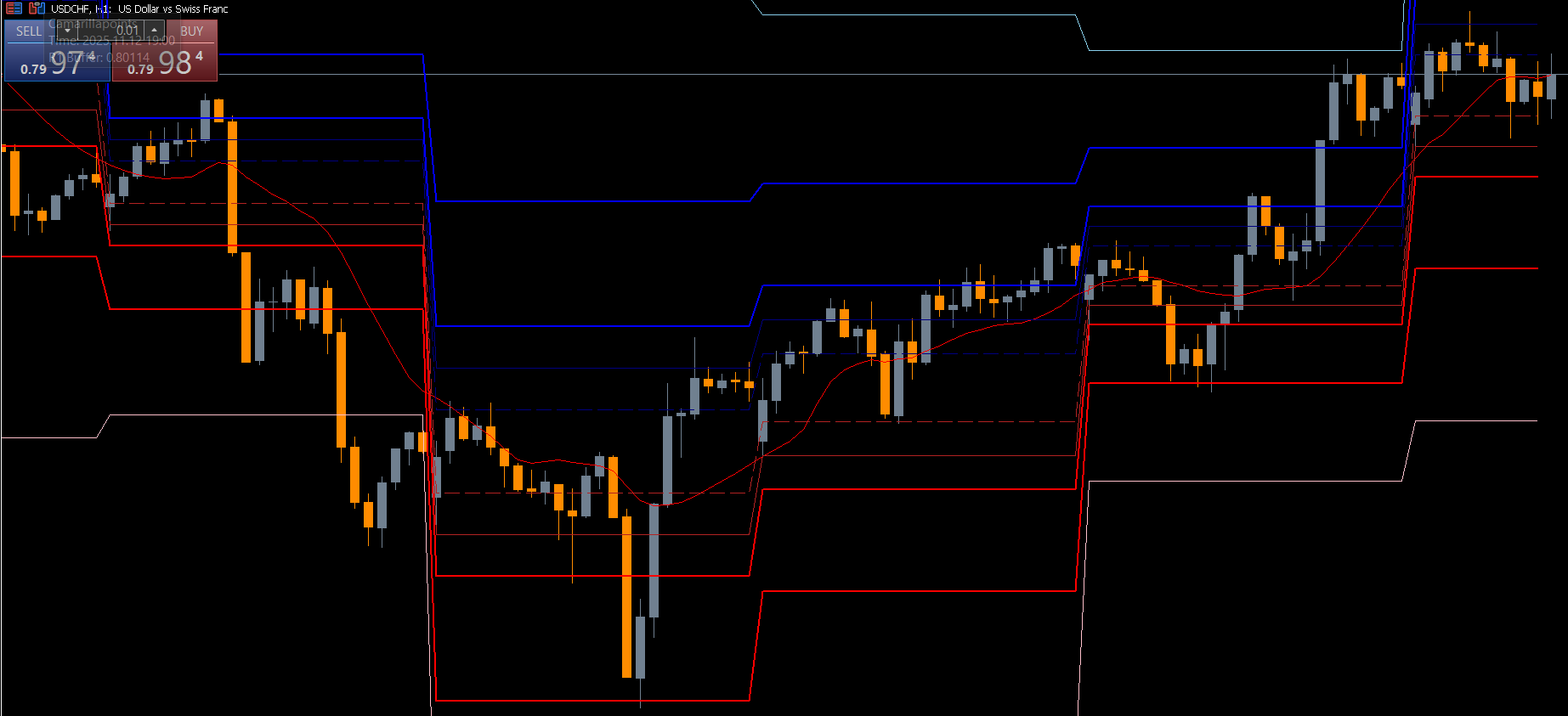

The Camarilla Points Indicator for MT5 is a powerful support and resistance tool that helps traders identify key market turning points with remarkable accuracy. Derived from the classic Camarilla Equation developed by Nick Scott, this indicator uses the previous day’s high, low, and close to calculate support and resistance zones. However, the MT5 version enhances the traditional formula by including 10 distinct levels, many of which are based on Fibonacci ratios, making it more precise than standard pivot point systems.

Traders use the Camarilla Points Indicator to detect potential breakout areas, trend continuation points, and reversal zones. Whether you are a swing trader, intraday trader, or price action enthusiast, this indicator provides a clear structure for understanding market behavior. For more high-quality tools, visit IndicatorForest.com.

The Camarilla Points Indicator is an upgraded version of classic pivot levels. Instead of offering only a few key levels, it provides a complete structure of 10 support and resistance lines—five above price and five below it. These levels represent:

Resistance Lines (H1–H5)

Support Lines (L1–L5)

Central pivot levels for equilibrium

The top levels act as resistance zones where price may reverse, while the bottom levels serve as support where new bullish opportunities may emerge.

Many traders prefer the Camarilla system because its use of Fibonacci calculations creates natural levels that align with market psychology. These levels:

Identify where traders take profit

Highlight zones of reversal

Help traders anticipate breakout momentum

When the price breaks above the top Fibonacci resistance level, it suggests a strong downtrend is forming, as sellers may re-enter the market. Conversely, when price breaks below the lower Fibonacci support line, it suggests a strong uptrend is developing.

Although the indicator functions on all timeframes, it performs best on:

H1

H4

Daily (D1)

Lower timeframes such as M1 or M5 tend to create frequent false signals due to noise and intraday volatility. Higher timeframes provide cleaner, more reliable Camarilla levels.

The USD/JPY M15 chart in the example highlights how the indicator generates BUY and SELL signals. Understanding how to trade these levels is essential for maximizing your strategy.

A BUY trade is considered when:

Price approaches or touches the lower Camarilla support line (L3–L5)

The market shows signs of bullish rejection or reversal patterns

Price fails to close below the support zone

Traders place BUY orders above support with stop-losses below the lower Camarilla line.

A SELL trade becomes possible when:

Price reaches the upper Camarilla resistance lines (H3–H5)

A reversal candle forms near the resistance zone

Momentum weakens as price struggles to break the upper levels

Sell orders are placed below resistance with stop-losses above the highest Camarilla level.

Although the indicator offers clear levels, it is wise to wait for:

Bullish/bearish engulfing patterns

Pin bars

Double tops or double bottoms

This prevents entering too early on weak signals.

To improve accuracy, combine Camarilla Points with:

RSI – to identify overbought/oversold conditions

MACD – to confirm trend direction

ADX – to detect strength of a breakout

Camarilla levels are more accurate when the market has enough momentum, such as during:

London session

New York session

Major news events

The Camarilla Points Indicator for MT5 is a highly effective analytical tool for identifying support, resistance, breakout zones, and reversal signals. Its Fibonacci-based structure offers traders a unique advantage, helping them interpret price movements more precisely. Whether used for breakout strategies or trend reversals, the Camarilla system is a reliable addition to any trader’s toolkit.

Download the Camarilla Points Indicator and explore more high-quality MT4 and MT5 tools at IndicatorForest.com.

Published:

Nov 19, 2025 03:39 AM

Category: