The Heiken Ashi Smoothed indicator for MT4 is an improved version of the classic Heiken Ashi tool, designed to offer clearer and more stable trend signals. By incorporating a moving average into its calculation, the indicator filters out noisy market fluctuations and produces smoother candles. This makes it a powerful tool for trend traders who prefer a cleaner chart structure and more accurate trend-following signals.

Whether you are a new trader or an experienced forex analyst, the Heiken Ashi Smoothed indicator provides a simplified yet effective way to read price action. It works seamlessly on intraday timeframes such as M5, M15, and H1, as well as higher timeframes like H4 and Daily. Many automated trading strategies also rely on the smoothing effect of this indicator to deliver more consistent entries.

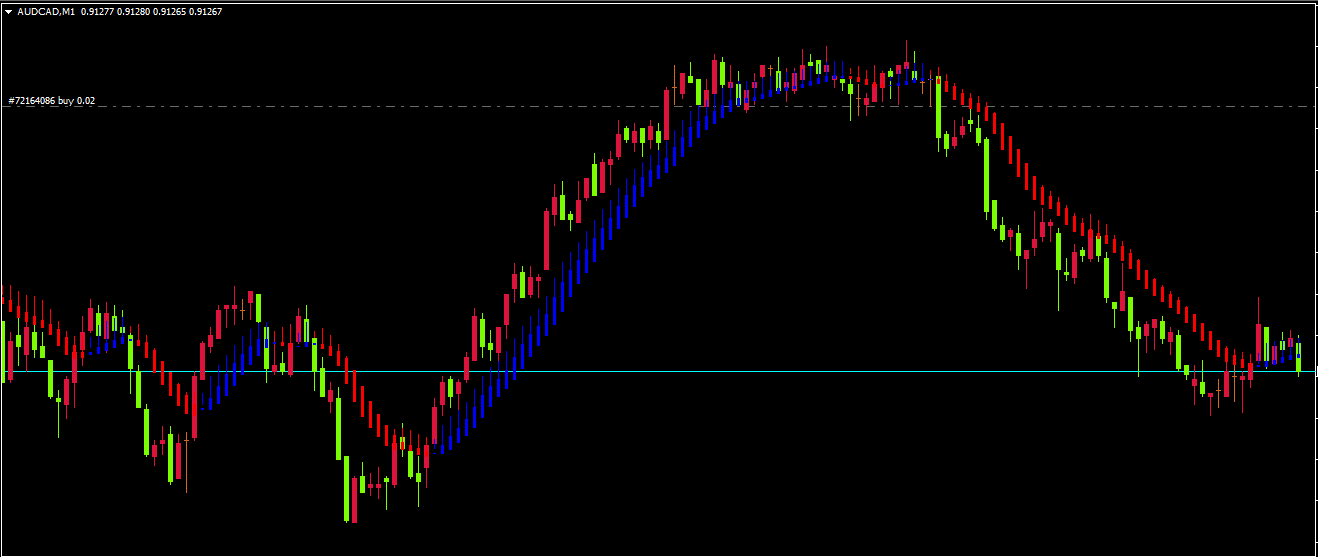

The indicator replaces standard candlesticks with smoothed Heiken Ashi bars. Instead of showing raw price fluctuations, it plots colored bars that reflect generalized market movement:

Blue bars indicate bullish momentum

Red bars indicate bearish momentum

Because the indicator incorporates moving averages, it reduces the impact of market noise, consolidations, and fakeouts. This helps traders focus on the overall direction rather than minor pullbacks.

A buy signal occurs when the indicator transitions from red to blue Heiken Ashi Smoothed candles.

To trade this setup:

Enter a long position when the first blue candle forms

Place a stop loss below the previous swing low

Use trend-following exits such as waiting for the next opposite color or using trailing stops

Trading in the direction of the higher timeframe trend—such as H4 or Daily—significantly increases reliability.

A sell signal is triggered when candles shift from blue to red Heiken Ashi Smoothed bars.

Trading steps:

Open a short trade at the first red candle

Set a stop loss above the recent swing high

Take profits when a blue candle emerges or when price meets your risk-reward target

This method is especially powerful when the market is clearly trending, as the smoothing mechanics help filter countertrend noise.

To increase accuracy, combine the Heiken Ashi Smoothed indicator with a higher timeframe trend check:

Identify the overall trend using H4 or Daily

Enter trades on M15–H1 when colors match the higher timeframe direction

Use standard technical tools like support/resistance or market structure for better entries

This approach helps avoid false entries and ensures greater alignment with market momentum.

The smoothing effect makes it incredibly easy to differentiate between strong trends and ranging periods.

Scalpers, day traders, and swing traders all benefit from its clarity.

Because of its stable output, it integrates well into expert advisors and algorithmic systems.

Perfect for traders who prefer clean charts instead of the choppy nature of normal candles.

Like all moving-average-based indicators, the Heiken Ashi Smoothed may lag slightly. This means signals appear a bit later compared to classic Heiken Ashi. However, this tradeoff results in more reliable and stable signals during trending markets.

The Heiken Ashi Smoothed indicator for MT4 is a powerful and beginner-friendly tool for identifying clean trend directions. Its smoothed calculation provides enhanced clarity, making it ideal for traders who want to follow medium- and long-term trends. While the slight lag may delay entries, it significantly reduces false signals and helps create a more disciplined trading strategy.

For a free download and more high-quality indicators, visit IndicatorForest.com today.

Published:

Nov 17, 2025 13:20 PM

Category: