The Swami Aroon Indicator for MT5 is a powerful oscillator designed to identify overbought and oversold conditions in the forex market. Like many other oscillators, it fluctuates between 0 and 100, helping traders determine when the market is likely to reverse or continue in its current trend.

When the Swami Aroon shows readings above 80, it signals that the market may be overbought, suggesting a potential selling opportunity. Conversely, when values drop below 20, it indicates oversold conditions and a possible buying opportunity.

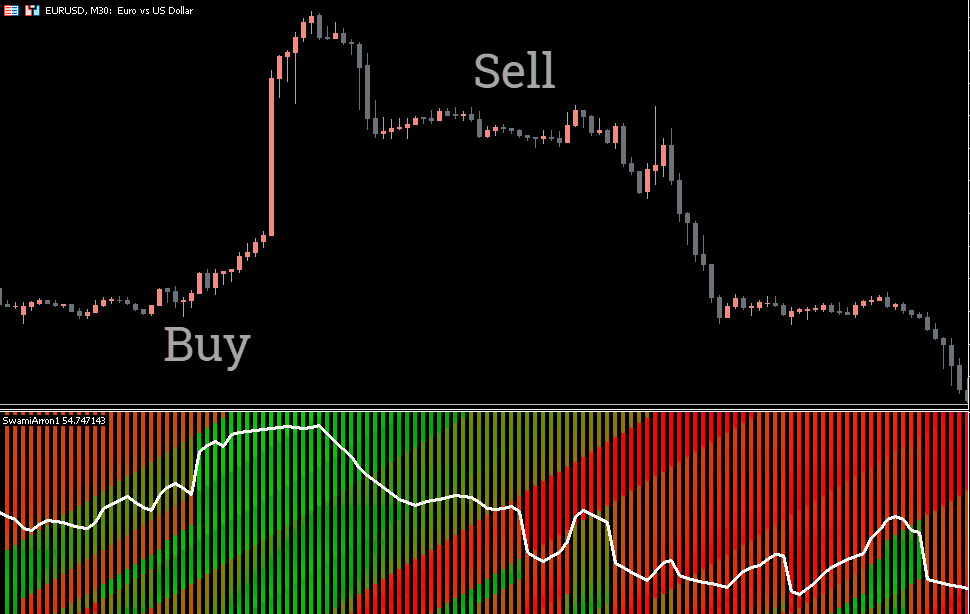

One of the key advantages of this indicator is its color-coded visualization. The Swami Aroon displays bars concentrated on the recent portion of the chart—green bars represent a bullish market, while bright red bars indicate bearish conditions. As the oscillator moves upward, the colors shift toward green, signaling growing bullish momentum. When it starts to decline, the bars gradually turn red, showing increasing bearish pressure.

When using the Swami Aroon MT5 indicator, traders should look for bright red bars, which represent a downtrend. When the oscillator moves into the oversold region (below 20), it may be a signal to enter a buy position. As the indicator climbs and approaches the overbought area, traders can prepare to close their buy trades for potential profit.

For sell positions, traders should watch for green bars, which indicate bullish momentum. When the oscillator reaches the overbought zone (above 80), it often means the market is due for a reversal. This can be a good time to open a sell trade and hold it until the indicator drops into the oversold area.

While the Swami Aroon works well as a standalone tool, combining it with other technical indicators like Moving Averages, RSI, or MACD can enhance accuracy. Using confluence from multiple tools helps confirm signals and reduces false entries.

Easy to Read: The color-coded bars make it simple to identify the current market trend at a glance.

Versatile Application: Works effectively in forex, stocks, and commodities markets.

Trend and Momentum Analysis: Provides insight into both the direction and strength of market movements.

Improves Timing: Helps traders determine optimal entry and exit points based on overbought and oversold conditions.

Whether you’re a beginner or an experienced trader, the Swami Aroon Indicator for MT5 can add clarity to your technical analysis, helping you make more informed decisions.

Use the H1 or H4 timeframes for more reliable signals.

Always confirm oscillator signals with price action or support/resistance levels.

Avoid trading solely based on the overbought or oversold zones—wait for confirmation signals.

Keep your risk management plan consistent to minimize potential losses.

The Swami Aroon Indicator for MT5 is a valuable tool that simplifies the process of identifying overbought and oversold market conditions. Its color-coded bars and straightforward interpretation allow traders to quickly recognize market sentiment and take timely trading decisions.

For a smoother trading experience and access to more powerful tools, visit IndicatorForest.com to explore our collection of professional MT4 and MT5 indicators designed to enhance your trading strategy.

Published:

Oct 30, 2025 06:06 AM

Category: