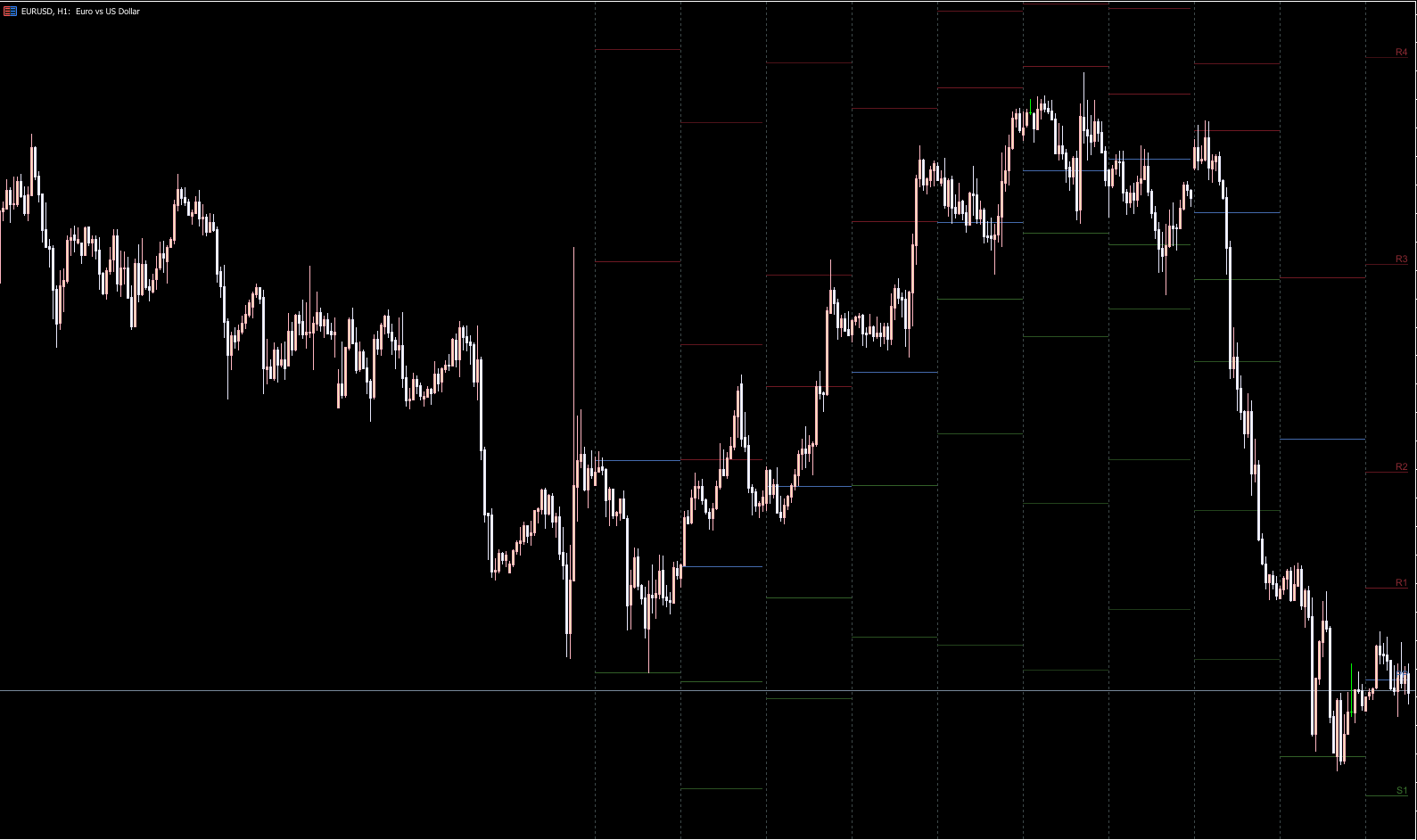

The Pivot Points.All-In-One indicator for MetaTrader 5 is a versatile tool that automatically plots support and resistance levels using all major pivot-calculation methods. These levels help traders identify potential reversal zones, plan entry/exit points, and manage stop loss/take profit placements.

This indicator is valuable because MT5 does not include a built-in pivot indicator, and this version combines multiple strategies into one tool.

The indicator supports the five main pivot-point calculation methods, each used for different trading styles and market conditions:

The most widely used method.

Based on the previous session’s high, low, and close.

Frequently watched by traders → often highly respected by price.

Gives greater weight to the previous close, making it useful for traders looking for precise reversal areas.

Helpful when seeking the most probable turning point.

Based on Fibonacci ratios.

Used to identify the end of retracements and the resumption of the main trend.

Ideal for swing or trend traders.

Produces very tight support/resistance levels close to the pivot.

Favored by intraday traders and scalpers because price interacts with levels frequently.

Displays only three levels: main pivot, upper CPR, lower CPR.

Excellent for identifying the market trend:

Price above CPR → uptrend

Price below CPR → downtrend or weakening uptrend

Best used on M30 and higher timeframes.

Pivot levels often act as strong turning zones.

However, signals should be confirmed using:

price action,

candlestick patterns,

another indicator,

or your main trading system.

The Fibonacci method is especially useful for spotting potential pullback completions.

Example:

Price corrects downward into a Fib pivot like S2.

Candlestick rejection + slowing momentum → possible long entry.

Classic pivot levels are excellent for risk management.

Example:

Price bounces repeatedly from S1, making it a reliable support.

→ Stop loss can be placed just below S1.

If highs become lower near R2, indicating weakening buying pressure:

→ Take partial profit at R1 and final at R2.

Method

Best for

Notes

Classic

Most traders

High interaction with price

Woody

Precision reversal spotting

Weighted on close

Fibonacci

Trend & pullback traders

Great for corrections

Camarilla

Scalpers & intraday traders

Tight levels, frequent trades

CPR

Trend identification

Highly reliable on M30+

The Pivot Points.All-In-One indicator is a powerful tool because it consolidates multiple pivot-calculation techniques into one package. It does not replace a full trading system, but significantly enhances:

trend identification,

entries after retracements,

stop loss / take profit placement,

probability-based trading decisions.

Use pivot-point signals with confirmation from price action or other indicators for the best results.

Published:

Nov 25, 2025 21:51 PM

Category: