The MTF MACD Bars Indicator MT4 is a powerful upgrade to the classic MACD indicator. It allows forex traders to view MACD values from a higher or lower timeframe directly on their current chart. This multi-timeframe capability gives both beginners and experienced traders a clearer view of trend strength, momentum changes, and reversal opportunities. By combining traditional MACD signals with higher-timeframe confirmation, the indicator offers more reliable trade setups and reduces false entries.

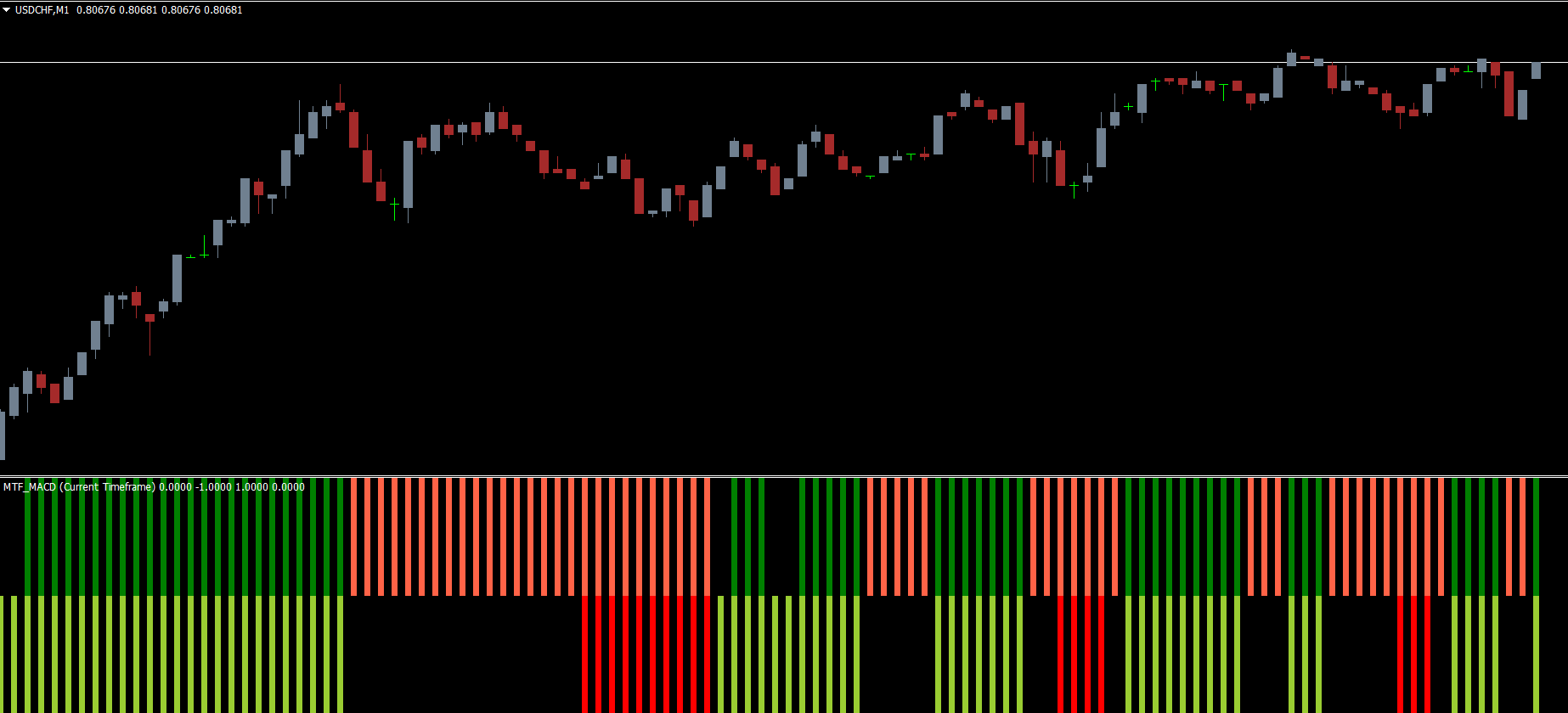

The indicator plots two segments of colored bars inside the indicator window:

Upper segment: displays higher-timeframe MACD data (HTF)

Lower segment: displays current timeframe MACD data (CTF)

This structure allows traders to compare market momentum across multiple timeframes instantly.

Common bar colors include:

YellowGreen / Green → Bullish momentum

TomatoRed / Red → Bearish momentum

This color-coded visualization helps traders assess market direction at a glance.

The upper bar section shows the dominant trend from a higher timeframe such as H4 or Daily.

Green/YellowGreen = strong bullish momentum

Red/TomatoRed = strong bearish momentum

The lower bar section reflects MACD strength in the active chart timeframe.

Green/YellowGreen bars provide BUY opportunities

Red/TomatoRed bars provide SELL opportunities

When both segments align with the same color, the setup is considered a high-probability trade.

A BUY trade is valid when:

The lower bars switch to YellowGreen or Green, signaling current timeframe bullish momentum

The upper bars confirm with matching bullish colors, indicating higher-timeframe trend support

This combination means the lower timeframe aligns with the dominant market direction.

Exit Strategy:

Close the BUY position when the bars shift from Green/YellowGreen to Red.

A SELL trade is confirmed when:

The top bars turn TomatoRed or Red, showing higher-timeframe bearish sentiment

The lower bars match with bearish colors, signaling a strong downward move

Exit Strategy:

Exit when the lower bars shift to YellowGreen or Green.

Use the upper segment to assess the major market bias.

Bullish HTF = preference for long entries

Bearish HTF = preference for short entries

Entries must align with the current timeframe’s MACD bars. This ensures timing accuracy and helps avoid premature trades.

Strong setups occur when HTF and CTF colors match. This alignment reflects synchronized momentum, offering the highest probability of trend continuation.

Combine MACD signals with major support/resistance levels to filter out low-quality entries.

MACD signals work best in trending or moderately volatile markets. Avoid trading during low-volatility consolidation.

Price action, trendlines, and moving averages help validate MACD-based entries.

Visual multi-timeframe trend confirmation

Reduced false signals

Clear bullish and bearish transitions

Suitable for intraday and swing trading

Compatible with automated trading systems

Both beginners and advanced traders benefit from its simple, effective, and visually intuitive interface.

The MTF MACD Bars Indicator MT4 provides a significant advantage by displaying MACD momentum across multiple timeframes in one window. This helps traders make more accurate decisions, avoid weak signals, and stay aligned with the dominant market trend. To download more powerful MT4 and MT5 tools, visit IndicatorForest.com and enhance your forex trading strategy today.

Published:

Nov 19, 2025 22:42 PM

Category: