The Liquidity Sweeps Indicator for MetaTrader 5 by LuxAlgo is an advanced smart-money concept (SMC) tool that highlights hidden liquidity areas missed by traditional indicators. It detects aggressive stop-hunts, false breakouts, and institutional liquidity grabs by analyzing wick behavior, swing highs, and swing lows.

This indicator provides traders with a clear visual representation of where large market participants—such as institutions and algorithms—collect liquidity before major moves. Whether you trade reversals, breakouts, or trend continuations, the Liquidity Sweeps Indicator helps you identify where price is likely to react next.

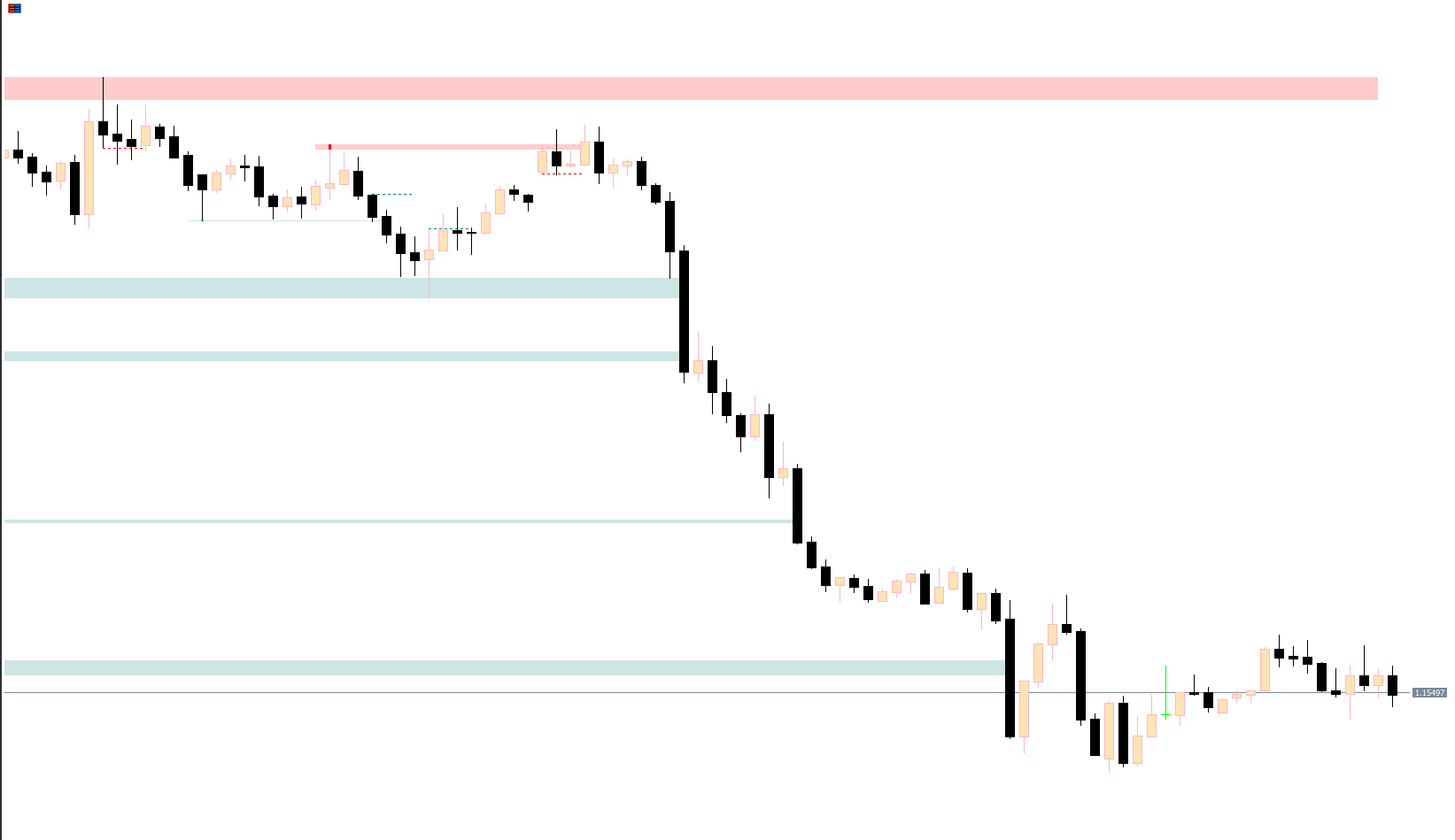

The indicator studies wick extremes and swing points to determine whether the market is accumulating or releasing liquidity. Each sweep is visually represented using distinct colors and markers, allowing traders to instantly spot potential reversal points and manipulation zones.

A teal dot below a swing low marks where sell-side liquidity has just been taken.

This indicates that traders’ stop-losses below the previous low were triggered.

After liquidity collection, price may reverse upward, creating a strong bullish move.

A red dot above a swing high shows where buy-side liquidity was targeted.

The market may have cleared long positions before reversing downward.

This setup is often followed by a bearish continuation or sharp pullback.

Beyond simple dots, the indicator extends horizontal shaded regions from each liquidity sweep wick. These shaded zones represent liquidity pools—areas that often act as support or resistance in future price action.

When multiple sweeps occur in close proximity, it signals high liquidity concentration. These zones are critical for traders seeking high-probability entries or exit targets.

The indicator’s swing-based logic also filters out noise by ignoring minor deviations, ensuring only significant liquidity events are displayed. This helps traders avoid false breakouts and stay aligned with the institutional order flow.

Identify the Sweep: Wait for a teal (bullish) or red (bearish) marker to appear.

Confirm Rejection: Look for price rejection, wick re-tests, or confluence with volume spikes.

Enter the Trade:

Enter long after a bullish sweep when price reclaims the swept low.

Enter short after a bearish sweep when price rejects the swept high.

Use Liquidity Zones: Set stop-losses beyond the zone and take profits near opposing liquidity areas.

For the best results, combine the Liquidity Sweeps Indicator with other smart-money indicators such as Fair Value Gaps, Order Blocks, or Volume Profiles to confirm institutional trading intent.

The Liquidity Sweeps Indicator for MT5 from LuxAlgo is an essential tool for traders embracing Smart Money Concepts (SMC) and ICT-style analysis. It visually maps where liquidity is gathered and where potential reversals may begin, giving you insight into the true intent behind market moves.

By identifying hidden liquidity zones, this indicator helps you trade confidently around manipulation points and optimize your entries and exits. Download the Liquidity Sweeps Indicator for MT5 today from IndicatorForest.com and uncover the market’s hidden footprints

Published:

Nov 12, 2025 23:25 PM

Category: