The KAMA indicator for MT5 is a dynamic and adaptive moving average tool designed to adjust itself based on market volatility. KAMA stands for Kaufman Adaptive Moving Average, created by Perry Kaufman. Unlike typical moving averages that often lag behind price, the KAMA indicator reacts quickly during slow markets and smooths out during trending phases.

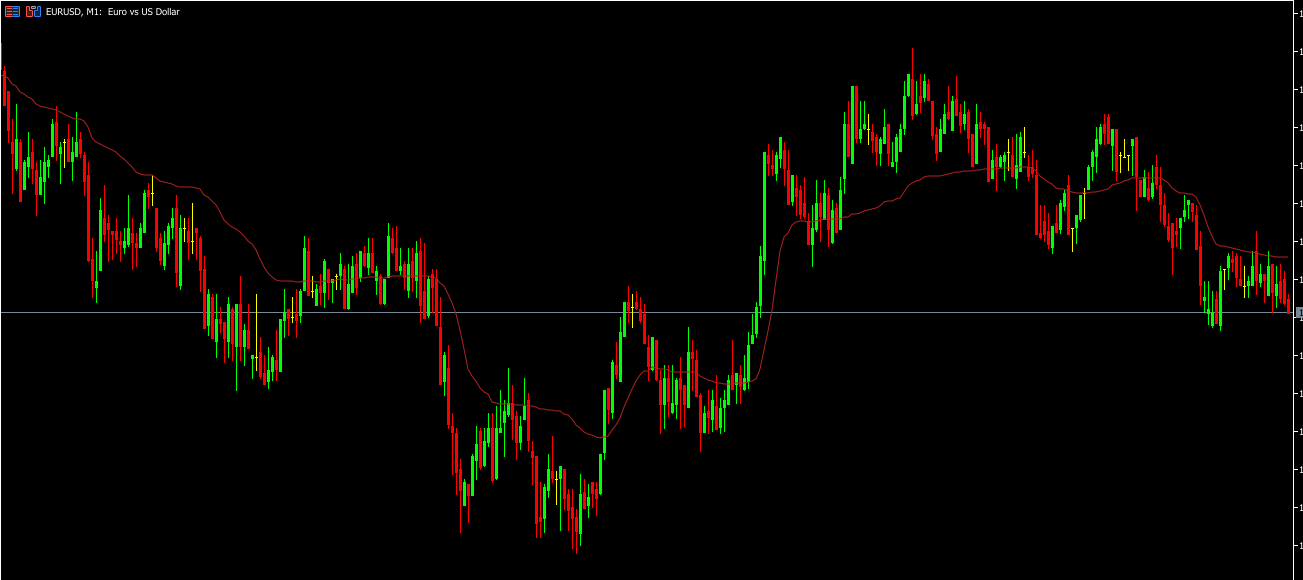

When the market is ranging, the KAMA hugs the price closely. But during strong trends, it maintains a significant distance from the price. This adaptive behavior helps traders easily distinguish between trending and sideways markets, improving their decision-making and timing.

The indicator is suitable for beginners and advanced traders, works on all timeframes (M1 to Monthly), and is completely free to download.

Slow/flat market: KAMA stays close to the price → signals consolidation.

Strong trend: KAMA pulls away from the price → confirms directional strength.

Instead of calculating a simple average, KAMA uses market efficiency ratios to decide how fast or slow it should react. This makes it more responsive than traditional moving averages like SMA or EMA.

Below is how traders typically use the Kaufman Adaptive Moving Average:

If the price closes above the KAMA line:

Market may be shifting bullish.

Enter buy trades.

Place stop-loss below previous swing low.

If the price closes below the KAMA line:

Indicates bearish pressure.

Enter sell trades.

Place stop-loss above previous swing high.

When the KAMA line is flat:

Market is ranging.

Best to avoid entries to prevent false signals.

Upward-sloping KAMA: Only look for buy opportunities.

Downward-sloping KAMA: Only consider sell opportunities.

Combine with price action, support/resistance, or trendlines

Use KAMA on higher timeframes for trend direction, then enter on lower timeframes

Ignore signals that move against the main KAMA trend direction

Avoid using double-KAMA crossovers – they lag and produce delayed signals

The KAMA Indicator for MT5 is an excellent tool for identifying trend direction and filtering out choppy market noise. Its adaptive nature makes it more responsive compared to traditional moving averages. However, because it can still produce false signals in highly volatile markets, traders should combine it with other tools like price action or structure analysis for better accuracy.

It is free, easy to install, beginner-friendly, and powerful enough for advanced traders—making it a valuable addition to any MT5 trading strategy.

Published:

Nov 17, 2025 13:12 PM

Category: