The FTLM STLM Indicator for MT4 is a momentum-based trading tool designed to provide traders with deep insights into market direction. Using two smoothed oscillators, it helps identify potential reversals and continuation patterns before price action confirms them. Whether you’re a scalper, day trader, or swing trader, this indicator can significantly improve your market timing and decision-making.

At IndicatorForest.com, you can download and explore this indicator along with other professional trading tools that simplify technical analysis and boost trading performance.

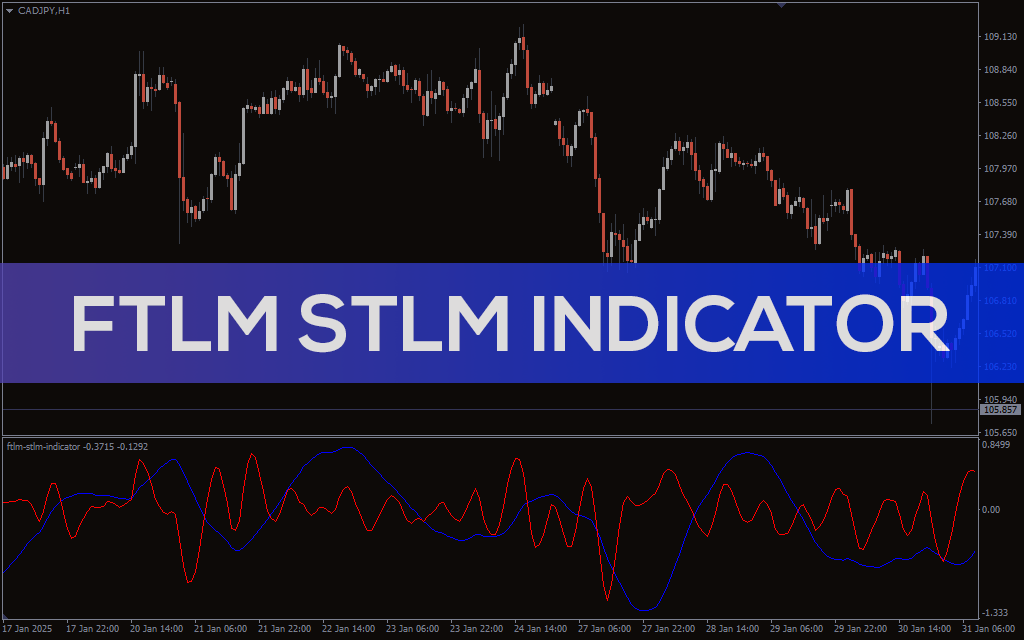

The FTLM STLM Indicator stands for Fast Trend Line Momentum and Slow Trend Line Momentum. It’s a dual-oscillator system that measures the strength and direction of market momentum.

FTLM (Fast Line) reacts quickly to price changes, signaling short-term momentum shifts.

STLM (Slow Line) moves more gradually, filtering noise and confirming broader trend direction.

When used together, these two lines form a reliable framework for detecting market turns and gauging overall trend health.

H3: Crossovers and Momentum Signals

The core of this indicator lies in the interaction between the two lines:

When the FTLM (blue) crosses above the STLM (red), it suggests increasing bullish momentum — a potential buy signal.

When the FTLM crosses below the STLM, it indicates weakening momentum — a potential sell signal.

These crossover points often appear before major price shifts, giving traders an edge in timing their entries and exits.

H3: Divergences and Reversal Detection

In addition to crossovers, traders can watch for divergences between price action and the FTLM/STLM lines.

Bullish divergence: Price makes a lower low while the indicator forms a higher low — signaling a possible upward reversal.

Bearish divergence: Price makes a higher high while the indicator forms a lower high — suggesting potential weakness.

These divergences help anticipate turning points, allowing traders to prepare before momentum shifts fully unfold.

For optimal results, traders can use the FTLM STLM Indicator alongside other technical analysis tools, such as:

Support and resistance levels to confirm breakout strength.

Moving averages for trend confirmation.

Trend lines to identify potential continuation zones.

This multi-layered approach helps reduce false signals and improves overall accuracy, making your trading strategy more robust and data-driven.

Early trend detection – Identify shifts in market momentum before the price reacts.

Versatility – Works across forex, stocks, commodities, and indices.

Enhanced confidence – Provides clear, visual signals for both bullish and bearish conditions.

Customizable settings – Adapt the sensitivity of the lines to match your trading style.

Ease of use – Simple graphical representation that’s ideal for both beginners and professionals.

Imagine trading EUR/USD on the 1-hour chart. The FTLM line crosses above the STLM while the pair approaches a strong support level. This crossover, confirmed by a rising MACD and bullish candlestick pattern, offers a high-probability long setup.

Conversely, when the FTLM crosses below the STLM after a strong rally, it signals momentum exhaustion, suggesting it may be time to take profits or prepare for a short position.

The FTLM STLM Indicator for MT4 is a powerful addition to any trader’s toolkit. By analyzing the interaction between its two lines, traders can identify trend shifts, reversals, and continuation patterns with precision.

If you’re serious about improving your market timing and decision-making, visit IndicatorForest.com today to download the FTLM STLM Indicator and explore more premium trading tools.

Published:

Oct 04, 2025 00:34 AM

Category: