The Fractal Adaptive Moving Average (FRAMA) Indicator for MT5 is a powerful trend-following forex tool designed to adapt dynamically to price changes. Based on fractal mathematics developed by John Ehlers, this indicator adjusts its smoothing factor according to market volatility—becoming more sensitive during strong trends and flattening during sideways markets.

Unlike traditional moving averages, the FRAMA indicator intelligently differentiates between trending and ranging conditions, allowing traders to capture major moves while avoiding false signals during consolidation. It’s ideal for scalpers, day traders, and swing traders seeking accurate trend confirmation with minimal lag.

The FRAMA indicator analyzes fractal geometry within price movements to determine the level of market efficiency. When price volatility increases, it becomes more responsive, and when the market consolidates, it smooths out—staying relatively flat.

This behavior makes FRAMA a self-adjusting moving average, able to reflect market structure changes without requiring manual parameter tuning.

Dynamic Adaptation: Becomes highly responsive in trending markets and stable in ranging conditions.

Fractal Efficiency Calculation: Uses price fractal dimensions to measure the level of market noise.

Lag Reduction: Smooths price data while keeping the indicator line closely aligned with real-time market movements.

Before placing any trade, determine whether the market is trending or sideways.

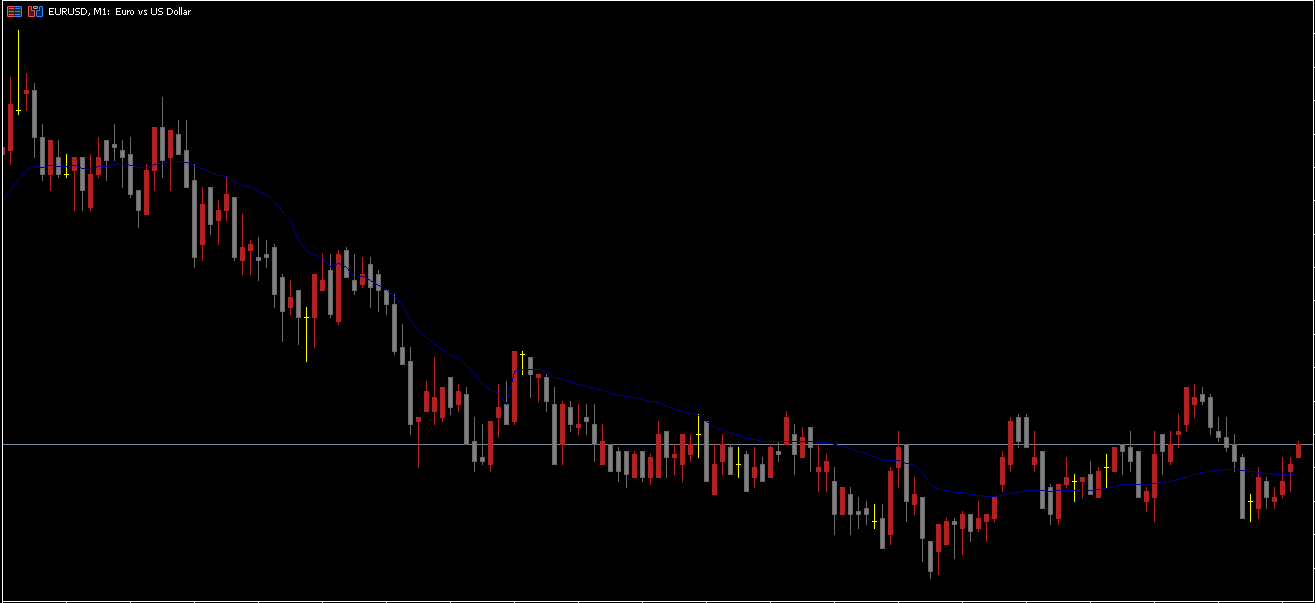

When the FRAMA line slopes upward, it signals a bullish trend.

When the FRAMA line slopes downward, it indicates a bearish trend.

A flat FRAMA line means the market is consolidating—a signal to wait.

A BUY signal occurs when the price breaks above the FRAMA line, confirming bullish momentum.

Wait for the price to retest the FRAMA line after the breakout.

Look for a bullish reversal candlestick (such as a bullish engulfing pattern) near the FRAMA line.

Enter a BUY trade once confirmation appears.

Set the stop loss just below the last swing low for protection.

This setup is particularly effective when the FRAMA line acts as dynamic support, suggesting strength in the underlying trend.

A SELL signal appears when the price closes below the FRAMA line in a downtrend.

Wait for a retest of the FRAMA line to confirm resistance.

Enter a SELL trade after a bearish reversal pattern (e.g., bearish engulfing) forms near the line.

Place the stop loss above the recent swing high.

The FRAMA line serves as dynamic resistance, offering ideal re-entry opportunities during retracements.

For greater accuracy, combine the FRAMA Indicator for MT5 with:

MACD – to confirm trend strength.

RSI – to identify overbought or oversold levels.

Price Action Patterns – to validate FRAMA-based entries.

This multi-confirmation approach enhances reliability and reduces false signals.

Adapts to Market Volatility: Reacts quickly during strong trends and filters out noise during consolidations.

Ideal for All Strategies: Effective for scalping, day trading, and swing trading.

Virtually Lag-Free: Offers near real-time trend following.

Easy to Use: Suitable for both novice and professional traders.

Dynamic Support & Resistance: Helps identify pullbacks and reversals with precision.

By understanding its fractal-based logic, traders can align their strategies with the true market rhythm, improving entry timing and trade management.

In conclusion, the FRAMA Indicator for MT5 offers traders an advanced, adaptive moving average that intelligently adjusts to market conditions. Its ability to reduce lag while remaining responsive makes it one of the most efficient tools for identifying trends and reversals.

Whether you’re a beginner looking for clarity or an experienced trader seeking confirmation, the Fractal Adaptive Moving Average can enhance your decision-making and trading precision.

Download the FRAMA Indicator for MT5 now at IndicatorForest.com and experience the power of adaptive trend trading.

Published:

Nov 04, 2025 14:13 PM

Category: