The Ehlers Cyber Cycle Indicator for MT5 is a powerful supertrend oscillator designed to help traders evaluate market trends and forecast future price movements. By blending trend-following and momentum analysis, this indicator simplifies identifying trend direction, entry/exit zones, and overbought or oversold market conditions.

Whether you are a beginner or a professional trader, the Cyber Cycle Indicator offers clear and easy-to-understand trading signals that work across all timeframes and trading instruments, including forex, stocks, commodities, indices, and cryptocurrencies.

Developed by John Ehlers, the Cyber Cycle Indicator applies digital signal processing techniques to market data. It smooths price movements and minimizes lag, providing more accurate and responsive trend detection than traditional oscillators.

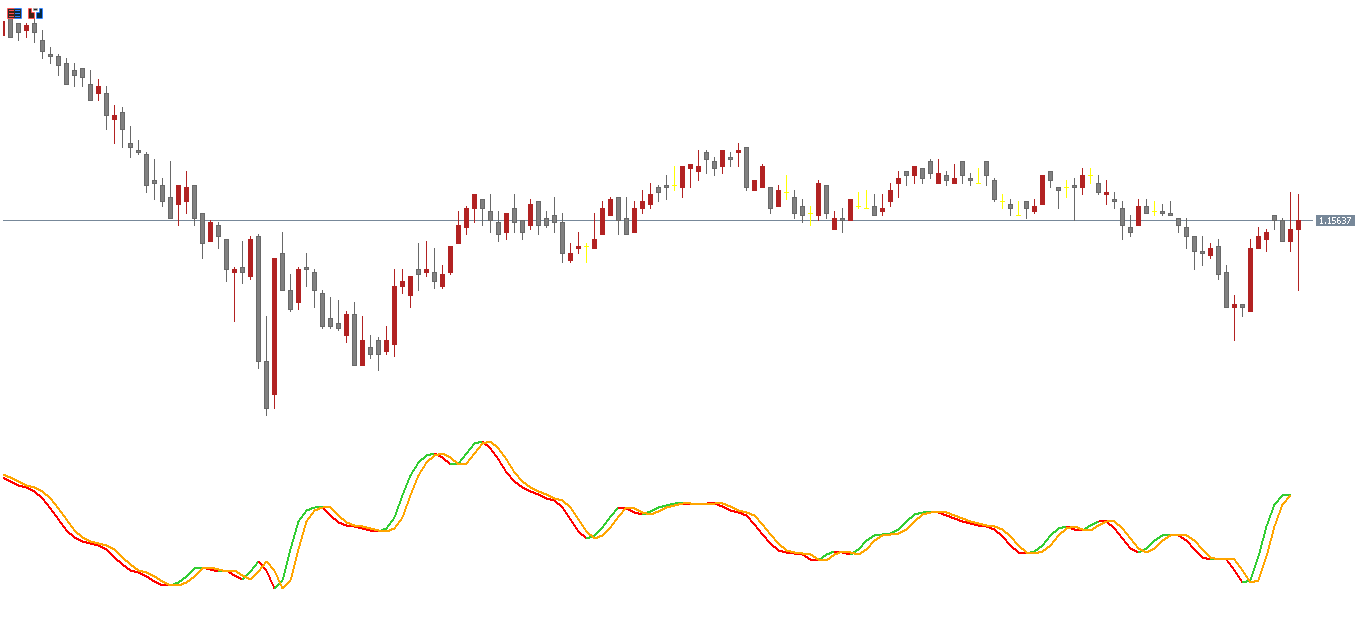

The indicator consists of:

Trigger Line (Green/Red): Shows short-term momentum changes.

Signal Line (Orange): Represents the smoothed trend direction.

Zero Level Line: Acts as a neutral zone that separates bullish and bearish trends.

When the trigger line crosses above or below the signal line, it indicates potential buy or sell opportunities.

When the signal line moves above zero, it suggests that the market is bullish.

When the signal line drops below zero, it indicates a bearish market condition.

During bullish phases, traders should look for buy entries when the trigger line moves above the signal line. Conversely, during bearish phases, a sell entry is valid when the trigger line crosses below the signal line.

A trigger line above the signal line after a downtrend indicates an oversold market—potentially signaling a buying opportunity.

A trigger line below the signal line after an uptrend shows an overbought market, warning that a bearish reversal might occur.

Avoid trading when the indicator hovers near the zero line since this represents a sideways or consolidating market.

For better accuracy, combine Cyber Cycle readings with candlestick patterns or support/resistance zones.

Example: A bullish pin bar forming while the signal line is above zero strengthens a buy setup.

Example: A bearish engulfing candle appearing while the signal line is below zero confirms a sell setup.

Buy Setup:

Signal line above zero (bullish trend).

Trigger line crosses above signal line.

Confirm with bullish price action or trend continuation pattern.

Place a stop-loss below the recent swing low and target the next resistance level.

Sell Setup:

Signal line below zero (bearish trend).

Trigger line crosses below signal line.

Confirm with bearish reversal candle or trend breakdown.

Set stop-loss above the recent swing high and aim for the next support zone.

Accurately detects trend direction and momentum shifts.

Helps identify reversal zones and entry/exit levels.

Reduces lag compared to traditional oscillators.

Works across all timeframes and trading instruments.

Enhances confidence when combined with other technical indicators.

The Ehlers Cyber Cycle Indicator for MT5 is an advanced trend oscillator that helps traders analyze market momentum and forecast reversals with precision. By identifying overbought and oversold conditions, traders can use it for both trend-following and swing trading strategies.

When combined with price action and support/resistance analysis, this indicator becomes a highly effective trading tool for all types of market conditions.

Published:

Nov 09, 2025 01:30 AM

Category: